Orange California Debt Settlement Offer in Response to Creditor's Proposal is a legal process wherein debtors in Orange, California, negotiate with their creditors to reach a mutually beneficial agreement regarding their outstanding debts. This offer is made in response to a proposal put forth by the creditor, outlining terms for debt repayment or resolution. Debt settlement offers in Orange California typically involve negotiating with creditors to reduce the total amount owed, waive accrued interest, and establish a feasible repayment plan. These settlement offers can vary depending on the individual's financial situation and their creditor's policies. Different types of Orange California Debt Settlement Offers in Response to Creditor's Proposal may include: 1. Lump Sum Settlement: This type of settlement offer involves offering a one-time payment to the creditor in a significantly reduced amount compared to the original debt. Debtors often negotiate to pay a percentage of the total debt balance upfront as a complete resolution. 2. Installment Plan: With this type of settlement offer, debtors propose a structured repayment plan with fixed monthly payments. These payments are often reduced from the original debt amount, and the agreement is reached depending on the debtor's financial capabilities and the creditor's willingness to accommodate such terms. 3. Debt Consolidation: In certain cases, debtors consolidate multiple debts into a single loan or payment plan. Often, they negotiate with creditors to combine debts and agree on a new repayment schedule with more favorable terms, such as reduced interest rates or extended repayment periods. 4. Partial Debt Forgiveness: Some creditors may agree to forgive a portion of the debt as a settlement offer. Debtors and creditors negotiate the amount to be forgiven in exchange for a partial repayment, typically through a lump sum or installment plan. 5. Debt Management Program: Debtors can also propose a debt management program where professional credit counselors or agencies step in to negotiate with creditors on their behalf. These programs aim to lower interest rates, reduce or eliminate late fees, and establish a manageable repayment schedule. It is important to note that debt settlement offers should be approached with caution as they can have long-term effects on credit scores and financial stability. Seeking guidance from financial advisors, credit counseling agencies, or legal professionals is advisable before entering into any debt settlement agreement.

Orange California Debt Settlement Offer in Response to Creditor's Proposal

Description

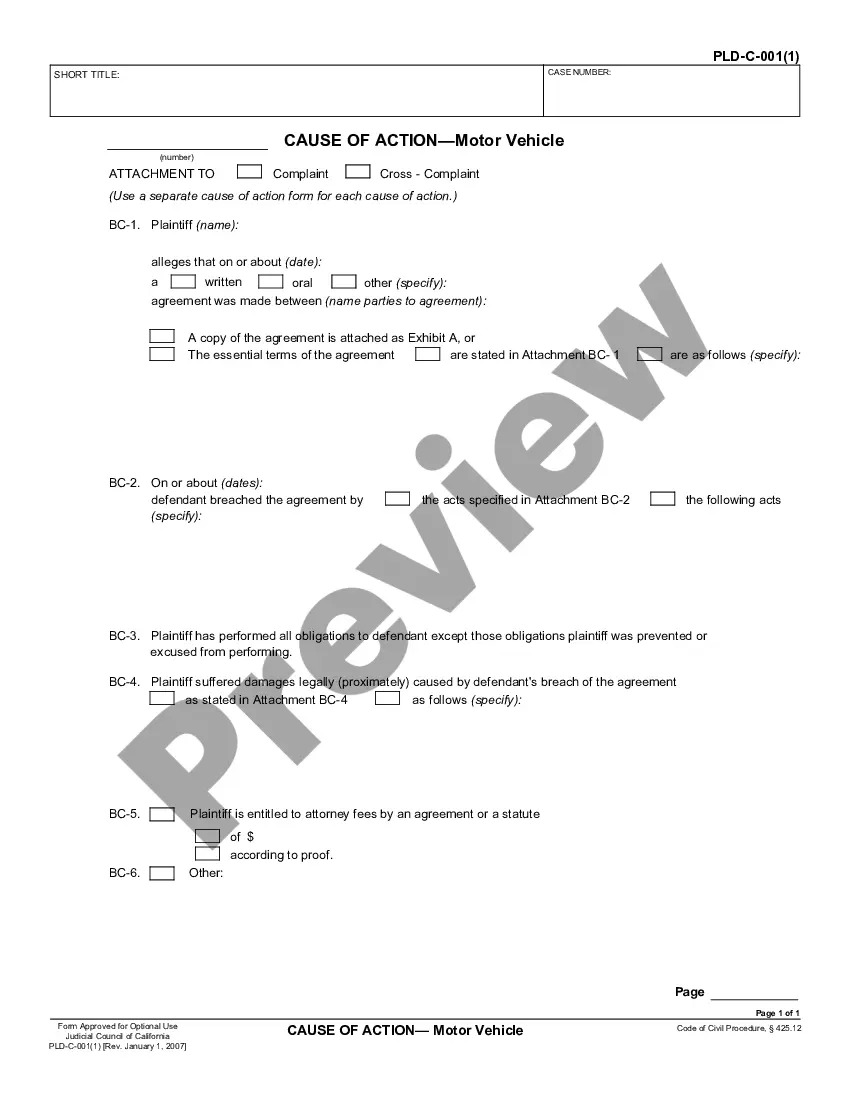

How to fill out Orange California Debt Settlement Offer In Response To Creditor's Proposal?

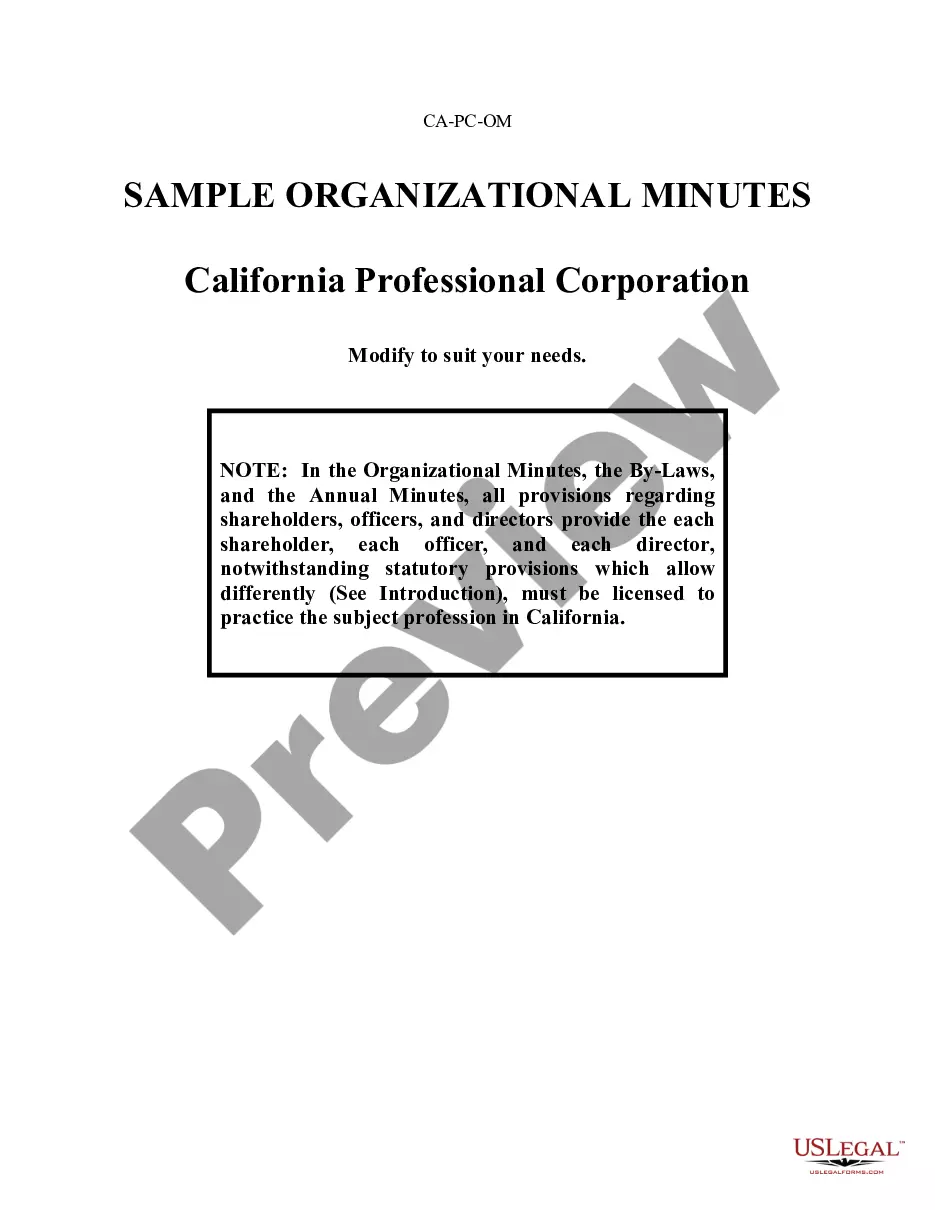

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from the ground up, including Orange Debt Settlement Offer in Response to Creditor's Proposal, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different types ranging from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find detailed resources and tutorials on the website to make any tasks associated with paperwork completion straightforward.

Here's how to find and download Orange Debt Settlement Offer in Response to Creditor's Proposal.

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can impact the legality of some records.

- Check the related forms or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and purchase Orange Debt Settlement Offer in Response to Creditor's Proposal.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Orange Debt Settlement Offer in Response to Creditor's Proposal, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer completely. If you have to deal with an exceptionally challenging case, we advise getting a lawyer to review your document before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Become one of them today and get your state-specific paperwork effortlessly!