Palm Beach, Florida is a vibrant city known for its luxurious lifestyle and beautiful beaches. However, like many other cities, residents in Palm Beach may find themselves overwhelmed by debt at times. When faced with mounting debts and a proposal from a creditor, residents have the option to consider a Palm Beach Florida debt settlement offer in response to a creditor's proposal. Debt settlement is a negotiation process aimed at reaching an agreement between the debtor and creditor, which allows the debtor to settle their debts for less than the full amount owed. This approach can be a viable alternative to bankruptcy or continued financial strain. There are several types of Palm Beach Florida debt settlement offers that individuals can consider in response to a creditor's proposal: 1. Lump-sum Payment: This type of debt settlement offer involves negotiating a reduced total payment to the creditor in a single, upfront payment. This option offers the advantage of resolving the debt quickly, but it requires having a significant amount of money available. 2. Installment Plan: In this type of settlement offer, the debtor proposes a structured payment plan to the creditor, outlining how they will pay off their debts over a specific period. The client and creditor negotiate the amount and duration of the installments. This option allows debtors to manage their debts while adhering to a realistic payment plan. 3. Debt Consolidation: Debt consolidation involves combining multiple debts into one, usually through a loan or line of credit, to streamline the payment process and potentially reduce interest rates. The debtor can then propose a settlement offer to the creditor based on the new consolidated debt amount. 4. Professional Debt Settlement Services: Individuals in Palm Beach, Florida, can seek the assistance of professional debt settlement companies. These companies have experience in negotiating with creditors and can handle the entire settlement process on behalf of the debtor. They will review the creditor's proposal and work to negotiate the best settlement terms that align with the debtor's financial situation. When considering a Palm Beach Florida debt settlement offer in response to a creditor's proposal, it is crucial to assess personal financial circumstances and consult with a qualified professional if needed. Understanding the different types of settlement offers empowers debtors to make informed decisions and negotiate favorable terms in order to regain control over their financial future.

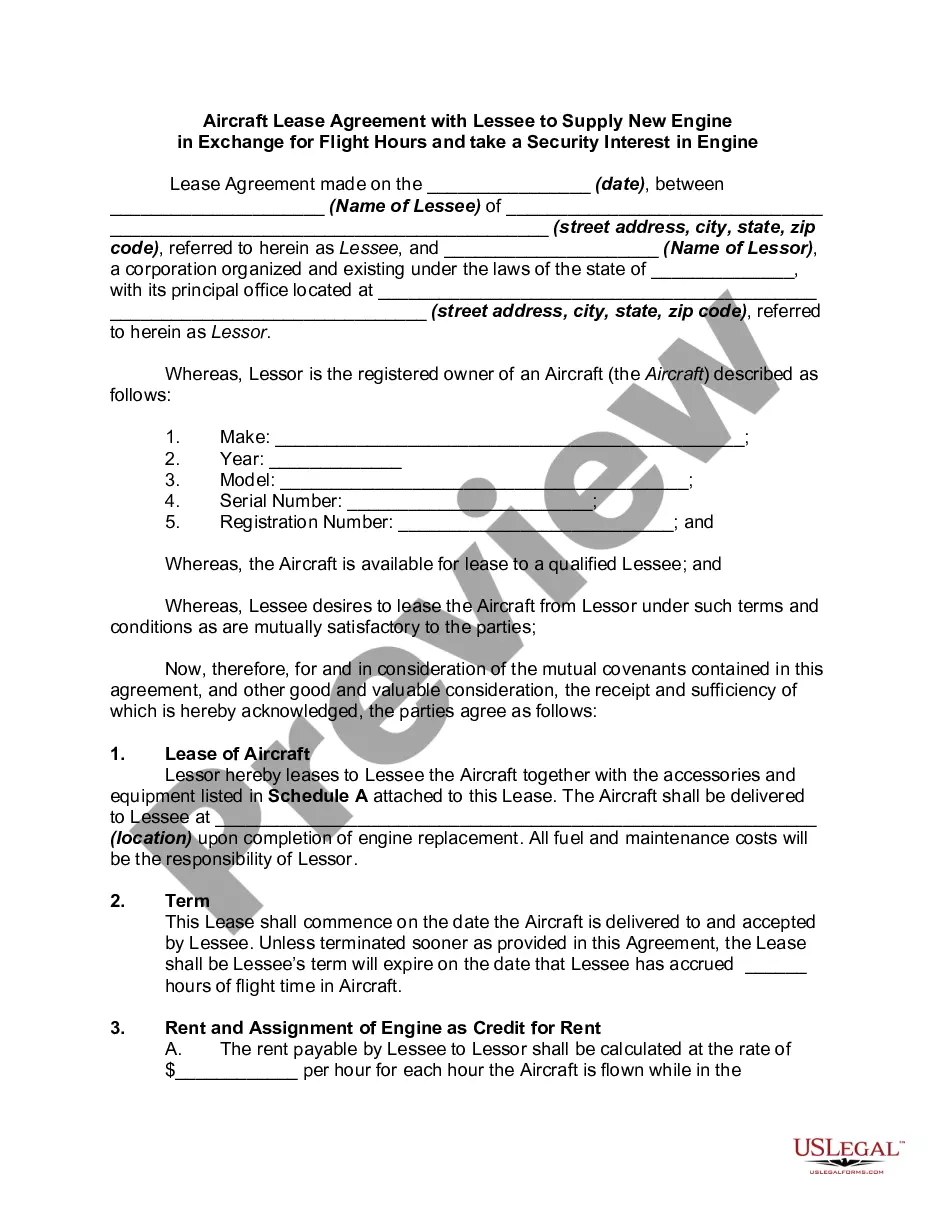

Palm Beach Florida Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Palm Beach Florida Debt Settlement Offer In Response To Creditor's Proposal?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from the ground up, including Palm Beach Debt Settlement Offer in Response to Creditor's Proposal, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different types ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find detailed resources and tutorials on the website to make any tasks associated with paperwork execution straightforward.

Here's how you can find and download Palm Beach Debt Settlement Offer in Response to Creditor's Proposal.

- Go over the document's preview and description (if provided) to get a basic idea of what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Examine the similar document templates or start the search over to find the appropriate file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and purchase Palm Beach Debt Settlement Offer in Response to Creditor's Proposal.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Palm Beach Debt Settlement Offer in Response to Creditor's Proposal, log in to your account, and download it. Of course, our website can’t replace a legal professional entirely. If you need to deal with an exceptionally difficult case, we advise getting an attorney to check your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Join them today and purchase your state-specific documents with ease!