San Antonio Texas Debt Settlement Offer in Response to Creditor's Proposal refers to the negotiation process between a debtor and creditor to resolve outstanding debts. Debt settlement offers are common in situations where a debtor cannot repay their debts in full and seeks an alternative solution. These offers aim to achieve a mutually agreed-upon settlement amount that the debtor can afford to pay while satisfying the creditor's requirements. In San Antonio, Texas, individuals facing financial difficulties may explore debt settlement as an option to resolve their debt issues. Debt settlement offers encompass various types tailored to different situations. Some common types of San Antonio Texas Debt Settlement Offers in Response to Creditor's Proposal include: 1. Lump-sum Settlement Offer: This involves offering a one-time payment to the creditor, usually at a reduced amount, in exchange for the debt being considered fully settled. 2. Installment Settlement Offer: With this type of offer, the debtor proposes to repay the debt in multiple installments over an agreed-upon period. Payments can be structured monthly, quarterly, or according to a schedule that aligns with the debtor's financial capacity. 3. Percentage-Based Settlement Offer: In this scenario, the debtor proposes a settlement amount based on a percentage of the total outstanding debt. For example, the debtor might offer to pay 50% of the debt as a lump sum or over a specific period. 4. Hardship Settlement Offer: This type of offer is specifically tailored to debtors experiencing significant financial hardship. Debtors provide evidence of their financial distress, such as unemployment, medical bills, or other uncontrollable circumstances. The debtor then proposes a settlement amount based on their current financial situation. 5. Cease and Desist Settlement Offer: In some cases, debtors may offer to settle the debt on the condition that the creditor stops all collection efforts and ceases any further contact. This offer is usually pursued when debtors feel harassed or overwhelmed by frequent communication from creditors. When considering a San Antonio Texas Debt Settlement Offer in Response to Creditor's Proposal, it is crucial for debtors to seek professional advice from debt settlement agencies or attorneys experienced in debt negotiations. These professionals can guide debtors through the complexities of the settlement process, ensuring a fair and reasonable agreement is reached. Overall, a San Antonio Texas Debt Settlement Offer in Response to Creditor's Proposal provides debtors with an opportunity to alleviate their financial burden by negotiating an achievable resolution with creditors. By exploring different types of settlement offers, debtors can determine the most suitable approach to resolve their debts effectively.

San Antonio Texas Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out San Antonio Texas Debt Settlement Offer In Response To Creditor's Proposal?

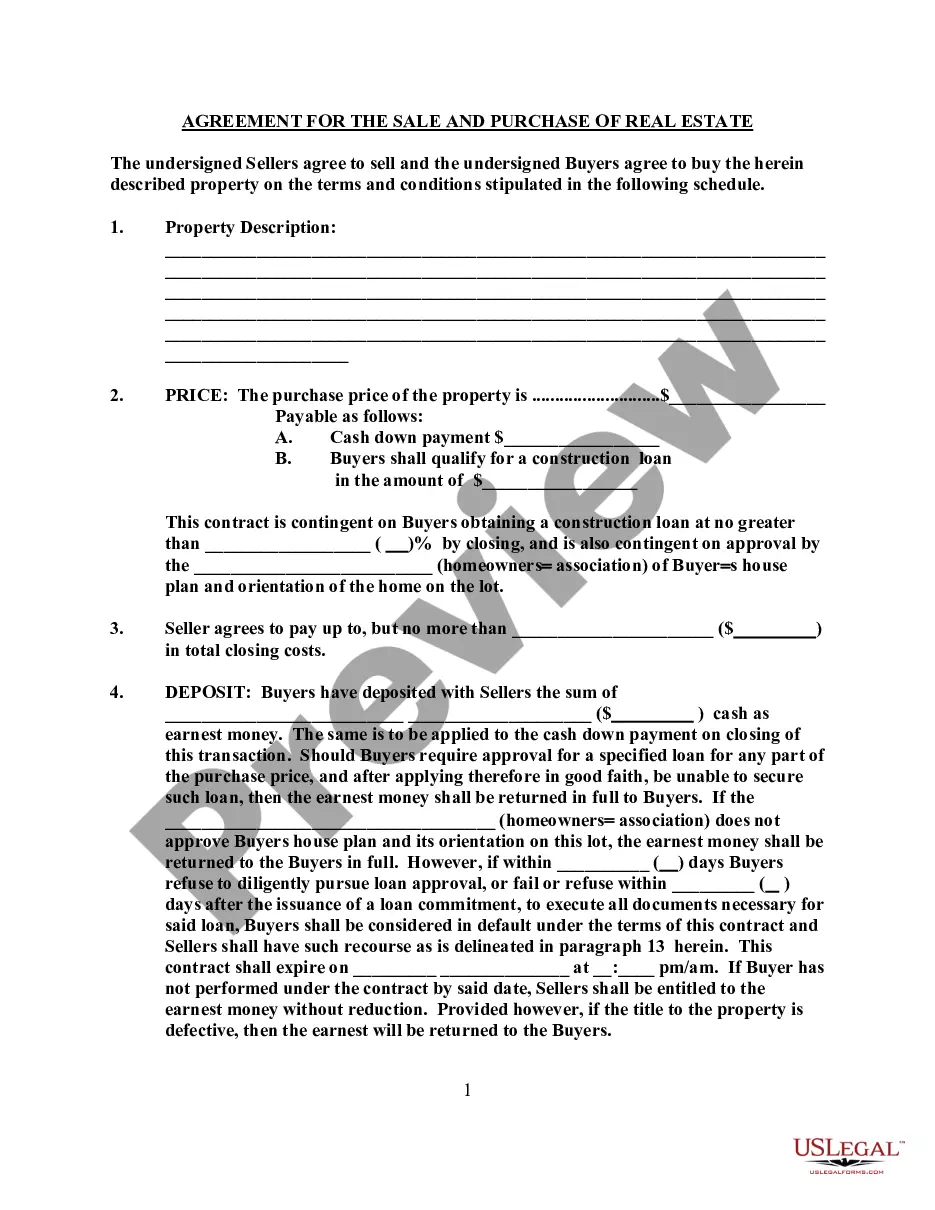

Are you looking to quickly draft a legally-binding San Antonio Debt Settlement Offer in Response to Creditor's Proposal or maybe any other document to take control of your personal or business matters? You can select one of the two options: contact a professional to write a valid paper for you or draft it entirely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive professionally written legal documents without having to pay unreasonable fees for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-compliant document templates, including San Antonio Debt Settlement Offer in Response to Creditor's Proposal and form packages. We provide documents for a myriad of use cases: from divorce papers to real estate documents. We've been out there for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra troubles.

- First and foremost, double-check if the San Antonio Debt Settlement Offer in Response to Creditor's Proposal is adapted to your state's or county's regulations.

- If the form has a desciption, make sure to check what it's intended for.

- Start the searching process over if the form isn’t what you were seeking by using the search bar in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the San Antonio Debt Settlement Offer in Response to Creditor's Proposal template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the templates we offer are updated by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!