Suffolk New York Debt Settlement Offer in Response to Creditor's Proposal When faced with overwhelming debt, individuals residing in Suffolk, New York often consider a debt settlement offer in response to a creditor's proposal. A debt settlement offer is a negotiation between the debtor and creditor, aiming to reach a mutually beneficial agreement that allows the debtor to settle their outstanding debts for a reduced amount. There are various types of Suffolk New York debt settlement offers in response to a creditor's proposal, each with its unique features. Let's explore the different options: 1. Lump Sum Settlement: This type of settlement involves offering a one-time payment to the creditor in exchange for a significant reduction in the total debt owed. Debtors who have access to a lump sum of money may choose this option to quickly resolve their debts. 2. Installment Settlement: In an installment settlement, debtors propose to make regular and manageable monthly payments to the creditor over an agreed-upon period. This option can be suitable for individuals who are unable to make a lump sum payment but are committed to repaying their debts gradually. 3. Structured Settlement: A structured settlement offer involves proposing a combination of upfront payments and subsequent regular installments to settle the debt. This option provides some flexibility to debtors by allowing them to pay a portion of the debt initially and make smaller payments over time. 4. Hardship Settlement: Individuals experiencing extreme financial hardship may opt for a hardship settlement. In this case, debtors provide evidence of their challenging circumstances, such as unemployment or severe medical expenses, and propose a reduced payment plan that aligns with their financial capabilities. 5. Full and Final Settlement: Debtors can also propose a full and final settlement where they offer to pay a specific percentage of the total debt, usually between 40% to 60%, and consider the remaining balance as forgiven. This option can provide debtors with significant relief by eliminating a substantial portion of their debt. It's crucial to note that debt settlement offers will depend on the debtor's unique financial situation and the creditor's willingness to negotiate. Seeking the guidance of a reputable debt settlement company or professional in Suffolk, New York can greatly assist in formulating a compelling offer and negotiating with creditors. Successfully settling debts through a creditor's proposal can alleviate financial burdens, provide peace of mind, and allow individuals in Suffolk, New York, to regain control over their financial future. However, it is essential to carefully consider the terms and potential implications before accepting any settlement offer.

Suffolk New York Debt Settlement Offer in Response to Creditor's Proposal

Description

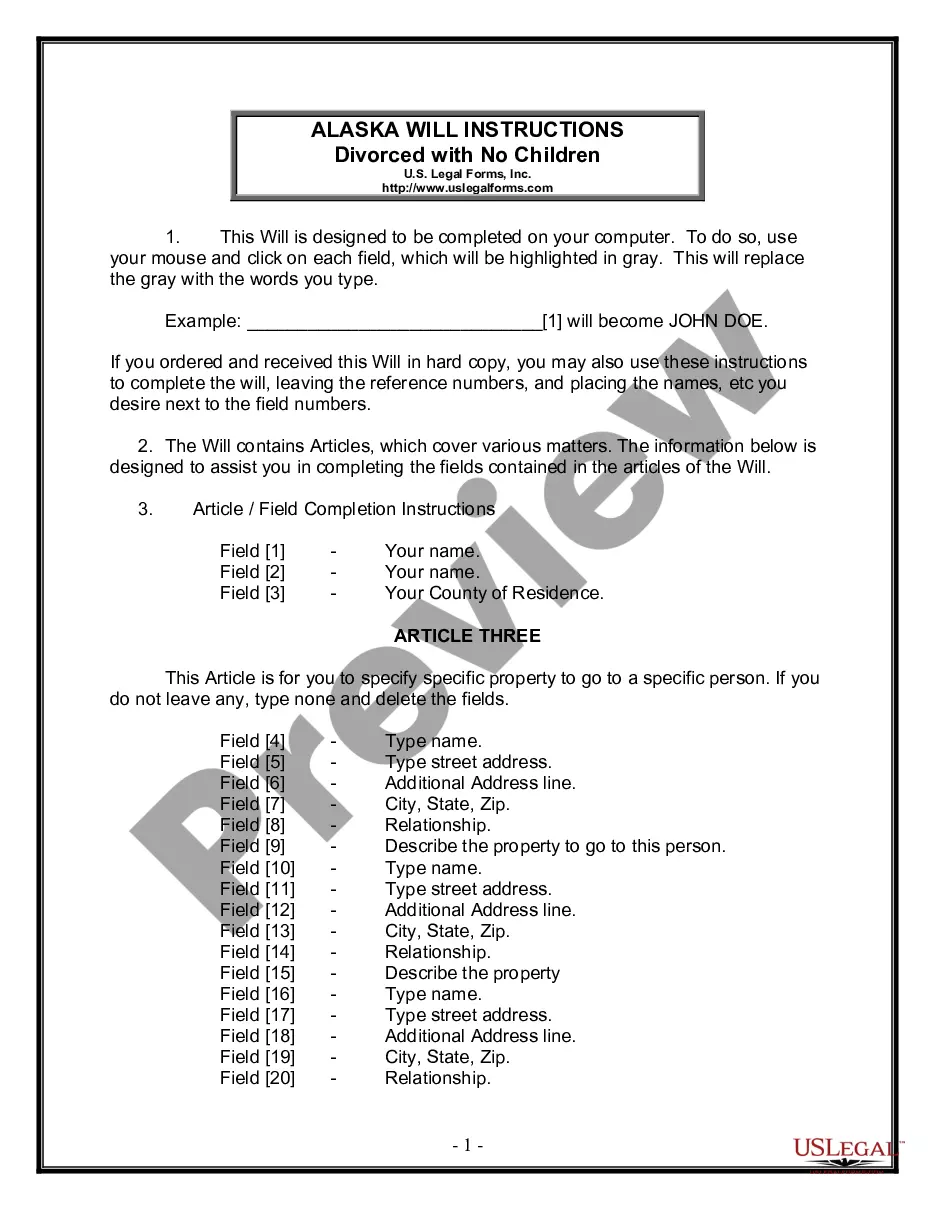

How to fill out Suffolk New York Debt Settlement Offer In Response To Creditor's Proposal?

Whether you plan to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business case. All files are collected by state and area of use, so opting for a copy like Suffolk Debt Settlement Offer in Response to Creditor's Proposal is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to get the Suffolk Debt Settlement Offer in Response to Creditor's Proposal. Adhere to the instructions below:

- Make certain the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the sample when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Debt Settlement Offer in Response to Creditor's Proposal in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!