Travis Texas is a prime location offering various debt settlement offers in response to creditor's proposals. Debt settlement is an effective solution for individuals struggling with overwhelming financial obligations. It involves negotiating with creditors to settle debts for less than the full amount owed, relieving the burden on debtors and allowing them to regain financial stability. One type of Travis Texas debt settlement offer in response to a creditor's proposal is a lump-sum settlement. With this option, debtors offer a single, larger payment to the creditor in exchange for the forgiveness of a significant portion of their debt. This typically requires debtors to have a substantial amount of money available to make the payment all at once. Another type of debt settlement offer is a structured settlement. This involves negotiating with creditors to establish a payment plan based on the debtor's financial capabilities. Debtors make regular monthly payments over an agreed-upon period, allowing them to gradually pay off their debt while still benefiting from reduced overall amounts owed. Travis Texas debt settlement offers typically aim to secure a reduced debt balance, lower interest rates, or both. Creditors may be willing to negotiate in order to recoup as much of the owed amount as possible, considering the likelihood of being repaid in full. Debt settlement companies in Travis Texas work closely with clients, evaluating their financial situation, and assisting in developing personalized settlement proposals. When responding to creditor's proposals, Travis Texas debt settlement offers are tailored to address the unique circumstances of each client. These offers are designed to reflect the debtor's financial capabilities and maximize the chances of reaching a favorable agreement. By presenting a well-prepared offer, debtors increase their likelihood of obtaining a mutually beneficial settlement with their creditors. In summary, Travis Texas offers various types of debt settlement offers in response to creditor's proposals, such as lump-sum or structured settlements. These settlement options allow debtors to negotiate reduced debt balances or lower interest rates, providing a pathway towards financial relief and stability. It is crucial for individuals in debt to seek professional assistance and explore the best debt settlement option suited to their specific needs and circumstances.

Travis Texas Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Travis Texas Debt Settlement Offer In Response To Creditor's Proposal?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life situation, finding a Travis Debt Settlement Offer in Response to Creditor's Proposal suiting all local requirements can be stressful, and ordering it from a professional attorney is often costly. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. In addition to the Travis Debt Settlement Offer in Response to Creditor's Proposal, here you can get any specific form to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Travis Debt Settlement Offer in Response to Creditor's Proposal:

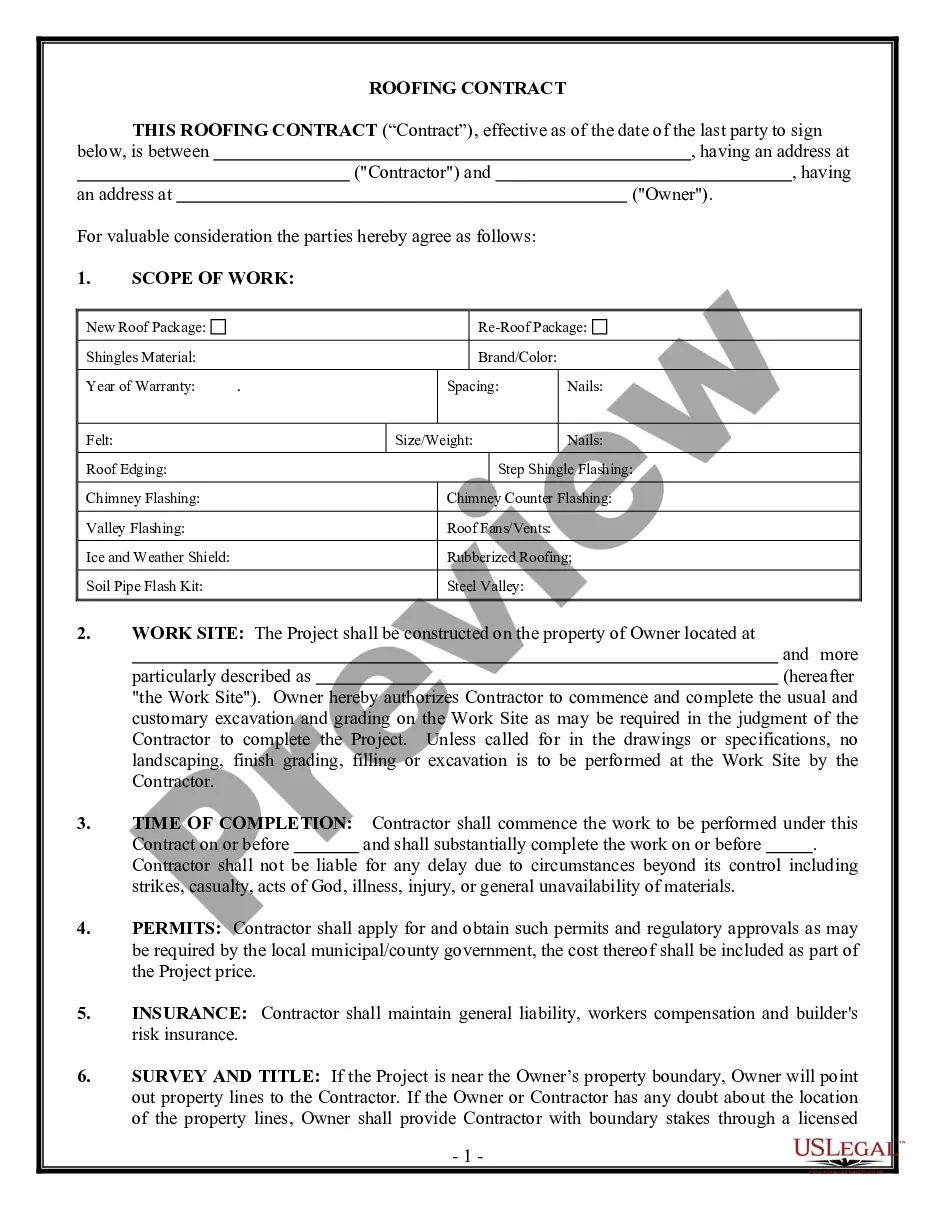

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Travis Debt Settlement Offer in Response to Creditor's Proposal.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!