Franklin Ohio is a city located in Warren County, in the southwestern part of the state. It is a suburb of Cincinnati and offers a small-town atmosphere while still providing easy access to urban amenities. A Franklin Ohio letter to creditor requesting a temporary payment reduction is a formal document written by a debtor to their creditor, seeking a temporary relief from their regular payment obligations for a specific period. This type of letter is typically sent when the debtor is facing financial difficulties and is unable to meet their payment obligations due to unforeseen circumstances such as job loss, medical emergencies, or other financial hardships. The key objective of the letter is to explain the debtor's current financial situation and demonstrate their willingness to fulfill their debt obligations. The letter should be concise, yet comprehensive, providing all necessary details and supporting documentation to support the request for a temporary payment reduction. Some relevant keywords for a Franklin Ohio letter to creditor requesting a temporary payment reduction could include: 1. Franklin Ohio: Referring to the specific location where the debtor resides or where the letter is being sent from. 2. Letter to creditor: Indicating that the letter is addressed to the creditor, the entity to whom the debtor owes a debt. 3. Requesting: Highlighting the purpose of the letter, which is to formally request a temporary payment reduction. 4. Temporary payment reduction: Emphasizing that the debtor is seeking a temporary relief from their regular payment obligations. 5. Financial difficulties: Describing the debtor's current financial situation, implying the reasons behind the request for temporary payment reduction. 6. Unforeseen circumstances: Explaining the unexpected events or emergencies that have led to the debtor's financial hardships. 7. Job loss: Mentioning one possible reason for the financial difficulties, if applicable. 8. Medical emergencies: Pointing out another possible cause for the financial difficulties, specifically related to healthcare expenses. 9. Financial hardships: Expressing the overall difficulties faced by the debtor in meeting their financial obligations. 10. Supporting documentation: Indicating that the letter should include any necessary documents, such as bank statements, medical bills, or termination letters, to support the request. Different types of Franklin Ohio letters to creditor requesting a temporary payment reduction could include variations based on the reasons for the financial difficulties, the specific documentation provided, or other additional factors unique to the debtor's situation. However, the basic structure and content of the letter would remain relatively consistent.

Franklin Ohio Letter to Creditor Requesting a Temporary Payment Reduction

Description

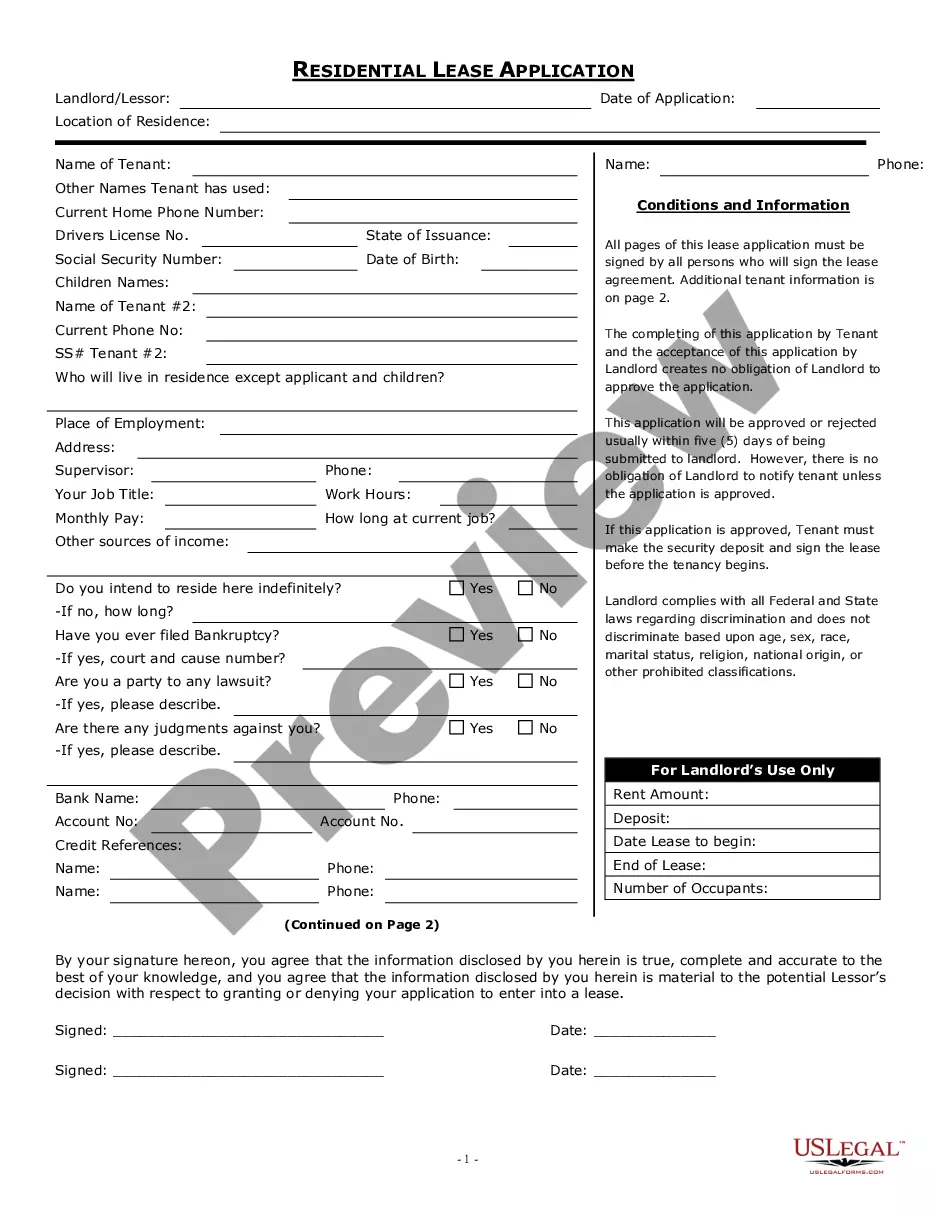

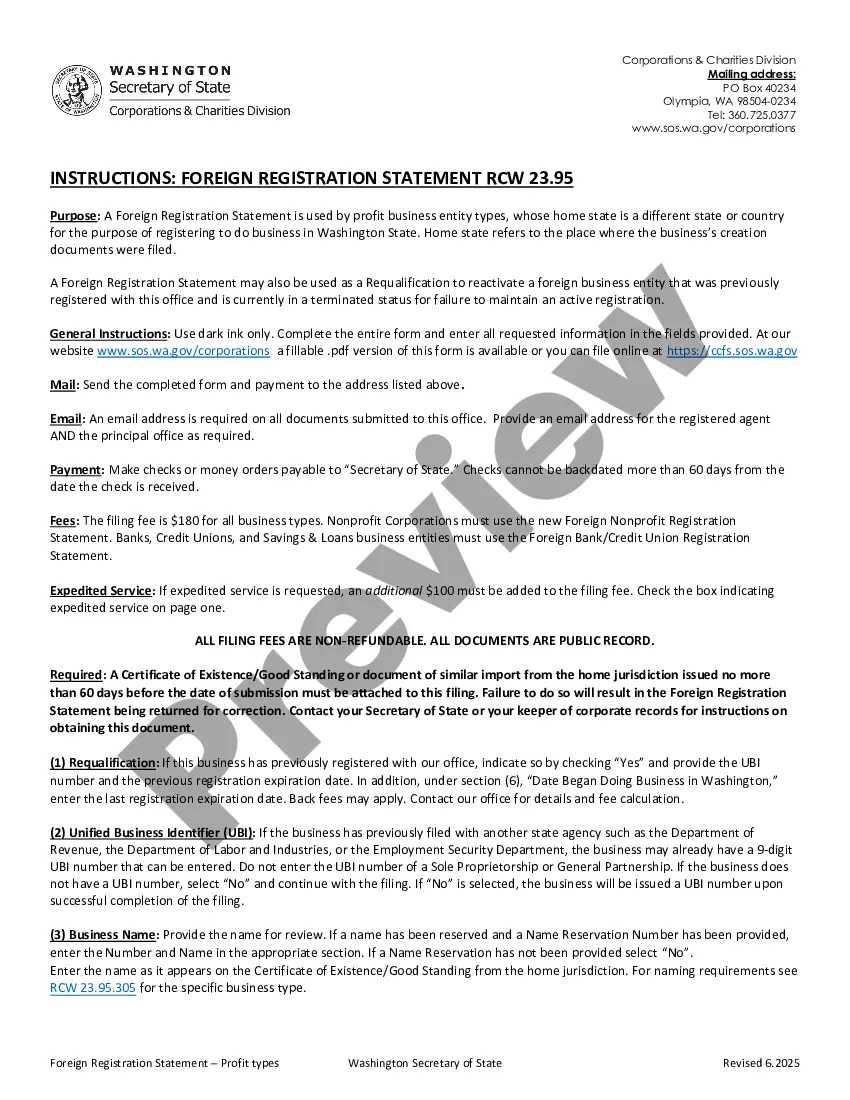

How to fill out Franklin Ohio Letter To Creditor Requesting A Temporary Payment Reduction?

If you need to find a trustworthy legal paperwork supplier to get the Franklin Letter to Creditor Requesting a Temporary Payment Reduction, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of learning resources, and dedicated support make it easy to get and execute different papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply type to search or browse Franklin Letter to Creditor Requesting a Temporary Payment Reduction, either by a keyword or by the state/county the document is intended for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Franklin Letter to Creditor Requesting a Temporary Payment Reduction template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and select a subscription option. The template will be instantly available for download once the payment is processed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less costly and more reasonably priced. Create your first company, arrange your advance care planning, create a real estate agreement, or execute the Franklin Letter to Creditor Requesting a Temporary Payment Reduction - all from the comfort of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

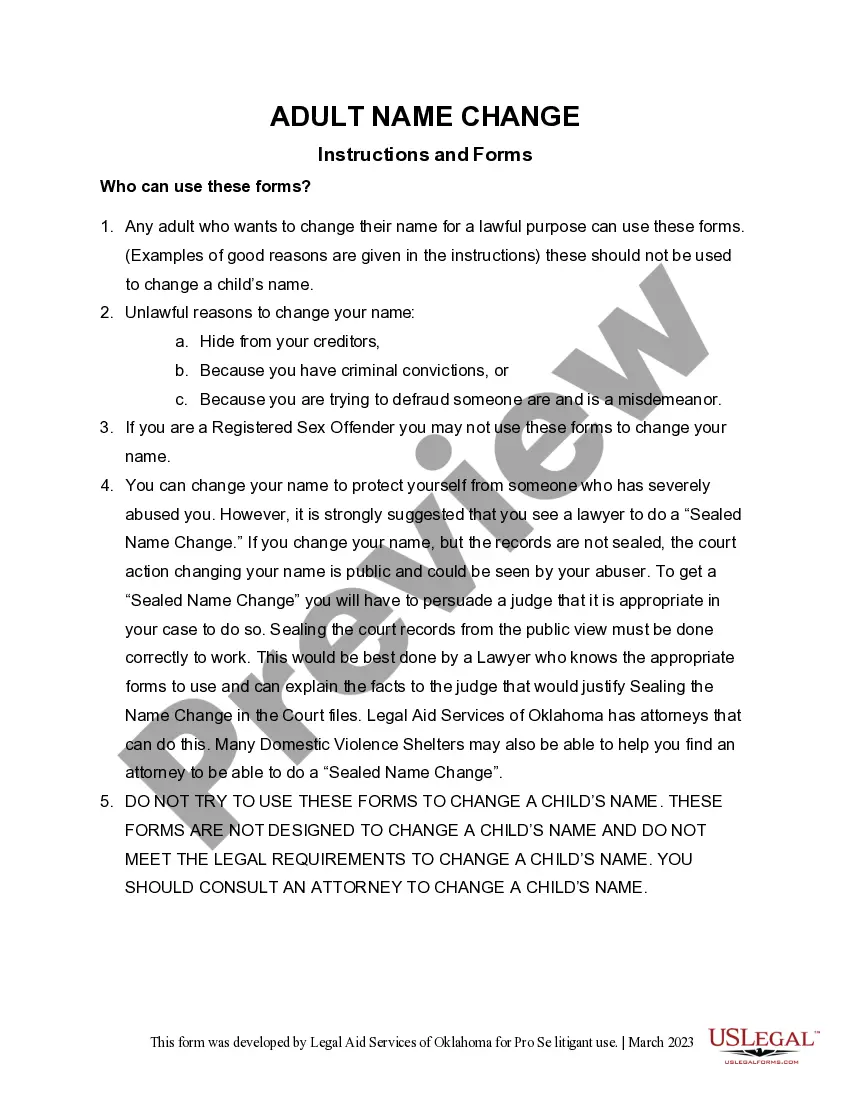

A debt collection letter should include the following information: The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or longer. Instructions on how to pay the debt.

I'm contacting all of my creditors to explain my situation and to ask for a reduced payment until my situation improves. I would like to offer a reduced payment of $ per month. This is the most that I can pay regularly at this time.

- Stay calm. Explain your financial situation and how much of the bill you are able to pay, according to your repayment plan. - Dispute debts in writing. If you believe you don't owe the amount claimed or otherwise disagree, make your reasons known promptly in writing to both the creditor and the collection agency.

I am writing to inform you that my current income from CPP, OAS, Disability Pension, Government Assistance, etc is not enough for me to be able to make any payments towards my alleged debt at this time. I respectfully request that you contact me by letter only going forward; please do not contact me by telephone.

Explain the reasons for your hardship clearly and concisely. Include any supporting documentation that you have (e.g., copy of your unemployment awards letter). Be specific about the remedy you are seeking, and don't promise to send more money than you can reasonably afford.

Dear Creditor: Due to a layoff, I am temporarily out of work and am experiencing financial difficulty. Due to my financial hardship and in order to meet necessary household expenses plus credit payments, I am asking each creditor to accept a reduced payment for the next (#) months on my debt.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Tips for Writing a Hardship Letter Keep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

I respectfully request that you forgive my alleged debt, as my condition precludes any employment, and my current and future income does not support any debt repayment. Please respond to my request in writing to the address below at your earliest convenience. Thank you in advance for your understanding of my situation.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and other information. If you're still uncertain about the debt you're being asked to pay, you can send the debt collector a debt verification letter requesting more information.