Title: San Diego California Letter to Creditor Requesting a Temporary Payment Reduction: Complete Guide with Helpful Tips Introduction: In the vibrant city of San Diego, California, individuals may occasionally face financial hardships requiring temporary payment reductions from their creditors. To navigate this situation, a well-crafted letter to the creditor becomes crucial. This article serves as a comprehensive guide addressing various types of San Diego California Letters to Creditors Requesting Temporary Payment Reduction, providing valuable tips to help you draft a successful request. 1. General Overview of San Diego, California: — Get to know the beautiful city of San Diego, home to stunning beaches, delightful weather, and a booming economy. — Explore top attractions like Balboa Park, San Diego Zoo, SeaWorld, and the renowned Gas lamp Quarter. — Discover the diverse art and culture scene, bustling nightlife, and the city's rich history. 2. Understanding the Need for a Letter to Creditor: — Examine the reasons why someone in San Diego might require a temporary payment reduction, such as job loss, medical emergencies, or unforeseen personal circumstances. — Highlight the importance of maintaining open communication with creditors to ensure a smoother financial recovery. 3. Components of a San Diego California Letter to Creditor Requesting a Temporary Payment Reduction: — Addressing the letter correctly, including the creditor's name, contact information, and your own personal details. — Stating the purpose of the letter and providing a brief explanation for the temporary payment reduction request. — Clearly outlining the need for financial assistance due to specific circumstances. — Presenting accurate financial information, including income, expenses, and any supporting documentation if applicable. — Proposing a feasible temporary payment reduction plan that is reasonable and sustainable. — Expressing gratitude for the creditor's consideration and willingness to work together toward a mutually beneficial solution. 4. Tips for Drafting an Effective Letter: — Maintain a polite and respectful tone throughout the letter. — Use clear and concise language to avoid any misunderstandings. — Support your request with relevant evidence if available, such as medical documents, termination letters, or bank statements. — Offer a specific and realistic payment reduction proposal that suits your financial capabilities without overly burdening the creditor. — Follow a professional letter format, including a proper greeting and closing signature. Additional Types of San Diego California Letters to Creditors Requesting Temporary Payment Reduction may include: — San Diego California Letter to Mortgage Lender Requesting Temporary Payment Reduction — San Diego California Letter to Credit Card Company Requesting Temporary Payment Reduction — San Diego California Letter to Auto Lender Requesting Temporary Payment Reduction — San Diego California Letter to Student Loan Service Requesting Temporary Payment Reduction Conclusion: When seeking a temporary payment reduction from your creditor in San Diego, California, constructing a well-crafted and professional letter is crucial. Understanding the specific components and utilizing effective tips will increase the chance of a successful negotiation. By maintaining open communication and discussing your unique circumstances, you can work towards a sustainable solution that helps relieve your financial pressure while maintaining a positive relationship with your creditor.

San Diego California Letter to Creditor Requesting a Temporary Payment Reduction

Description

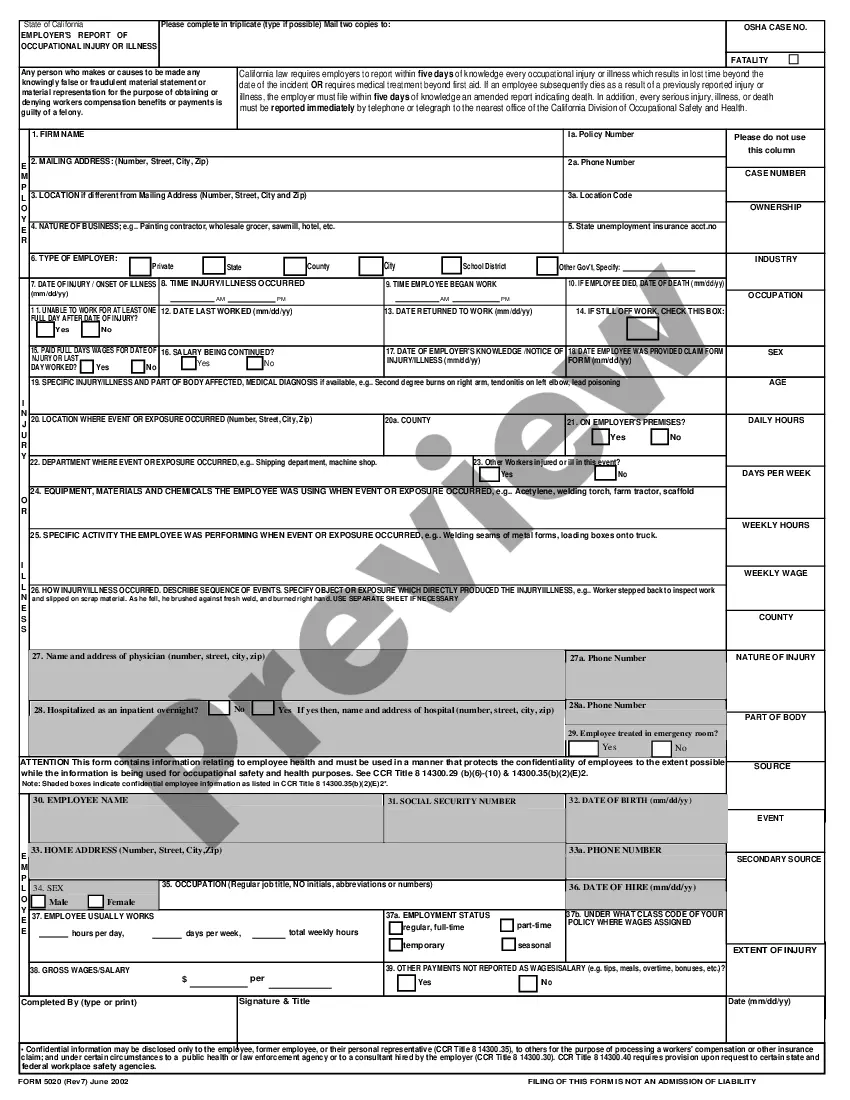

How to fill out San Diego California Letter To Creditor Requesting A Temporary Payment Reduction?

If you need to get a reliable legal paperwork provider to get the San Diego Letter to Creditor Requesting a Temporary Payment Reduction, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can search from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support make it simple to find and execute various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply type to look for or browse San Diego Letter to Creditor Requesting a Temporary Payment Reduction, either by a keyword or by the state/county the document is created for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the San Diego Letter to Creditor Requesting a Temporary Payment Reduction template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be instantly ready for download as soon as the payment is completed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less expensive and more reasonably priced. Create your first company, organize your advance care planning, create a real estate contract, or execute the San Diego Letter to Creditor Requesting a Temporary Payment Reduction - all from the comfort of your sofa.

Join US Legal Forms now!