Title: Harris Texas Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed: A Comprehensive Guide Keywords: Harris Texas, letter to creditor, confirming agreement, monthly payments, temporarily postponed Introduction: In Harris Texas, individuals experiencing financial hardship may find it necessary to seek temporary payment postponements with their creditors. To ensure a formal agreement, a well-drafted letter is crucial. This article provides a detailed description of the Harris Texas Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed, including its purpose, essential components, and potential variations. 1. Purpose of the Harris Texas Letter to Creditor: The Harris Texas Letter to Creditor serves as a formal written agreement between a debtor and a creditor, acknowledging the debtor's request to temporarily postpone monthly payments due to financial difficulties. 2. Essential Components of the Letter: — Personal Information: The debtor's full name, address, contact details, and account number. — Creditor Information: The full name and address of the creditor. — Salutation: Properly addressing the recipient with a formal salutation, such as "Dear [Creditor's Name]." — Clear Statement of Intent: State the purpose of the letter upfront, explicitly mentioning the agreement to temporarily postpone monthly payments. — Explanation of Financial Hardship: Provide a concise but detailed explanation of the financial hardship faced by the debtor, such as loss of employment, medical expenses, or unforeseen circumstances. — Proposed Temporary Payment Suspension: Clearly state the proposed dates or period for which the debtor requests the suspension of monthly payments. — Assurance of Resuming Payments: Offer a commitment to resume payments at the agreed-upon date or a defined future date, while expressing gratitude for the creditor's cooperation. — Contact Information: Provide updated contact details to ensure seamless communication during the agreed period. — Formal Closure: Use a polite closing, such as "Sincerely," followed by the debtor's printed name and signature. 3. Potential Variations of the Harris Texas Letter: a. Harris Texas Letter to Creditor Confirming Agreement due to COVID-19: This variation specifically addresses the financial hardships arising from the COVID-19 pandemic, outlining the unique circumstances and requesting temporary payment postponements. b. Harris Texas Letter to Creditor Confirming Agreement during Natural Disasters: It is crucial to have special provisions in this letter to address the impact of hurricanes, floods, or other natural disasters in Harris Texas, allowing debtors to temporarily halt payments until they can recover from the extraordinary circumstances. c. Harris Texas Letter to Creditor Confirming Agreement for Student Loan Repayments: This variation focuses on student loans, providing an explanation of financial hardship related to education expenses and seeking temporary postponement of monthly payments through a specific agreement. d. Harris Texas Letter to Creditor Confirming Agreement for Medical Bills: Dedicated to individuals facing medical challenges, this variant highlights the financial burden caused by medical bills and requests temporary payment relief as part of the agreement. Conclusion: Composing a well-crafted Harris Texas Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed is essential for individuals in financial distress. By including the essential components mentioned above and considering potential variations based on specific circumstances, debtors can effectively communicate their situation to creditors and seek temporary relief.

Harris Texas Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

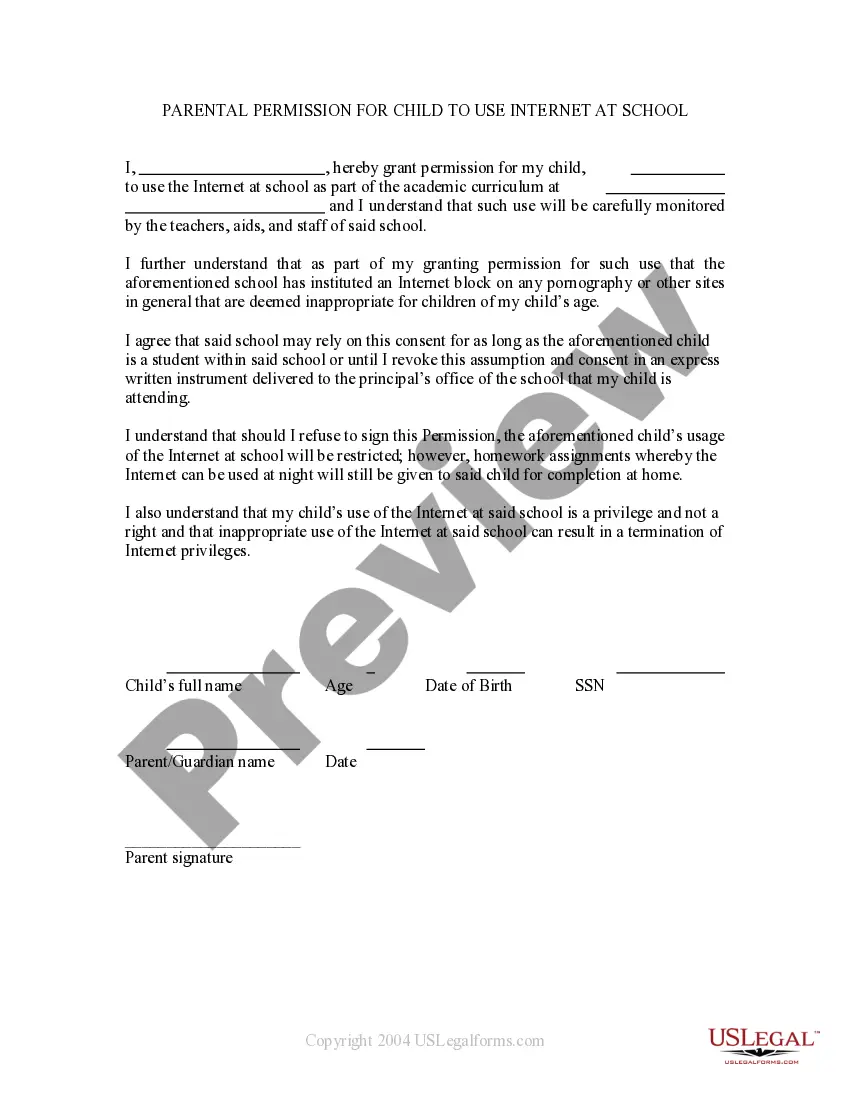

How to fill out Harris Texas Letter To Creditor Confirming Agreement That Monthly Payments Be Temporarily Postponed?

How much time does it typically take you to draft a legal document? Since every state has its laws and regulations for every life situation, finding a Harris Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. Aside from the Harris Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Experts verify all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can pick the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Harris Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Harris Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!