Title: Understanding Maricopa, Arizona: Crafting a Letter Requesting a Temporarily Lower Credit Card Interest Rate INTRODUCTION: Maricopa, Arizona, is a vibrant city known for its picturesque landscapes, welcoming community, and rich cultural heritage. Situated in Pinal County, this thriving suburban area offers an ideal setting to call home. In this article, we will delve into the specifics of crafting a letter from a debtor in Maricopa, Arizona, to their credit card company, requesting a lower interest rate for a specific time period. 1. Importance of Negotiating a Lower Interest Rate: It is essential for debtors to be proactive in managing their finances, especially when dealing with credit card debt. By seeking a lower interest rate on their outstanding balance, debtors can reduce their financial burden, allocate more funds towards repayment, and gradually improve their overall financial well-being. 2. Elements of the Letter: a) Proper Formatting: Begin the letter by including your personal details, such as your full name, address, and contact information, followed by the credit card company's details. b) Polite and Professional Tone: Maintain a courteous and respectful tone throughout the letter, using formal language and appropriate salutations. c) Clear and Concise Request: Clearly state your purpose for writing the letter: to request a temporary reduction in the interest rate on your credit card. Explain the reasons behind your request, such as financial difficulties, unexpected expenses, or current market trends affecting interest rates. d) Supporting Information: Include any pertinent details that strengthen your case, such as a good payment history, loyalty to the credit card company, or financial measures taken to improve your situation. e) Proposed Time Frame: Specify the desired duration for the temporarily reduced interest rate. This could range from a few months to a fixed period facilitating a specific goal, such as debt consolidation or financial recovery. f) Closing Remarks: Express gratitude for the credit card company's consideration and ensure them of your commitment to responsibly handle your financial obligations. 3. Additional Types of Letters: a) Letter Requesting a Permanent Interest Rate Reduction: If you believe that your current interest rate is excessively high and unsustainable in the long run, you may opt to request a permanent interest rate reduction instead of a temporary one. b) Letter Requesting a Rate Reduction Due to COVID-19 Hardships: During times of economic instability, such as the COVID-19 pandemic, debtors may face unique financial challenges. Crafting a letter requesting a temporary interest rate reduction based on pandemic-related hardships can assist in mitigating financial strain. c) Letter Requesting a Lower Interest Rate with Potential Consolidation Options: When a debtor is considering debt consolidation, it can be beneficial to request a lower interest rate to facilitate the repayment process. In this type of letter, debtors can also inquire about potential consolidation options available through the credit card company. CONCLUSION: Crafting a well-structured and thoughtful letter requesting a lower interest rate from your credit card company can be a helpful step towards minimizing financial stress. By considering the provided guidelines and adapting the letter to suit your personal circumstances, debtors in Maricopa, Arizona, can increase their chances of successfully negotiating a temporary interest rate reduction, allowing them to regain control of their finances and achieve their financial goals.

Maricopa Arizona Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out Maricopa Arizona Letter From Debtor To Credit Card Company Requesting A Lower Interest Rate For A Certain Period Of Time?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Maricopa Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Maricopa Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Maricopa Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time:

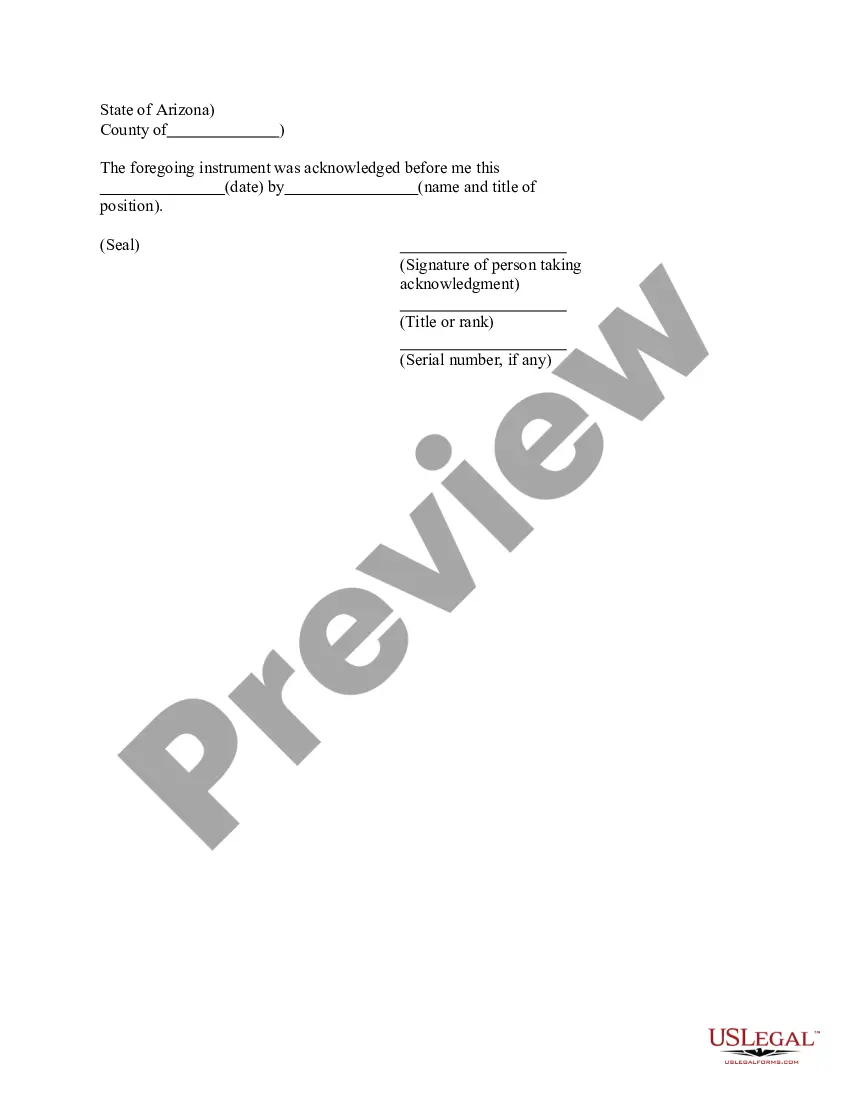

- Take a look at the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!