Collin Texas Consumer Equity Sheet is a financial document that provides a detailed breakdown of a consumer's equity. It primarily focuses on individuals residing in Collin County, Texas. This document outlines the financial status of the consumer, specifically highlighting their assets, liabilities, and net worth. The Collin Texas Consumer Equity Sheet is a valuable tool for individuals to assess and monitor their financial health. By analyzing their equity, consumers can gain insights into their overall wealth and make informed decisions regarding budgeting, investments, and debt management. It allows consumers to have a comprehensive view of their financial situation, helping them plan for the future and achieve their goals. The equity sheet typically contains several key sections. Firstly, it includes a summary of the consumer's assets, which may encompass various categories like real estate, investments, vehicles, and savings accounts. Each asset is listed along with its current value, providing an overview of the consumer's wealth. The next section details the consumer's liabilities, including debts and financial obligations. This could involve mortgages, student loans, credit card balances, and any other outstanding debts. Each liability is listed with the respective outstanding balance, enabling the consumer to understand their overall debt load. By subtracting the total liabilities from the total assets, the Collin Texas Consumer Equity Sheet calculates the consumer's net worth. This figure represents the financial value the consumer holds after accounting for their debts. A positive net worth suggests that the consumer's assets exceed their liabilities, indicating a sound financial position. Different types of Collin Texas Consumer Equity Sheets may exist to cater to specific needs. For instance, there could be variants designed for individuals, married couples, or families. Moreover, specialized equity sheets might exist for businesses, providing a separate analysis of their assets, liabilities, and net worth. In summary, the Collin Texas Consumer Equity Sheet is a valuable financial document that allows consumers to assess their financial health. It provides a comprehensive breakdown of assets, liabilities, and net worth, enabling individuals to make informed financial decisions. By utilizing this tool, individuals can track their progress, set financial goals, and plan for a secure future.

Collin Texas Consumer Equity Sheet

Description

How to fill out Collin Texas Consumer Equity Sheet?

Creating forms, like Collin Consumer Equity Sheet, to take care of your legal matters is a challenging and time-consumming task. Many cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can consider your legal affairs into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms crafted for various cases and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Collin Consumer Equity Sheet template. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before downloading Collin Consumer Equity Sheet:

- Make sure that your document is compliant with your state/county since the regulations for creating legal paperwork may vary from one state another.

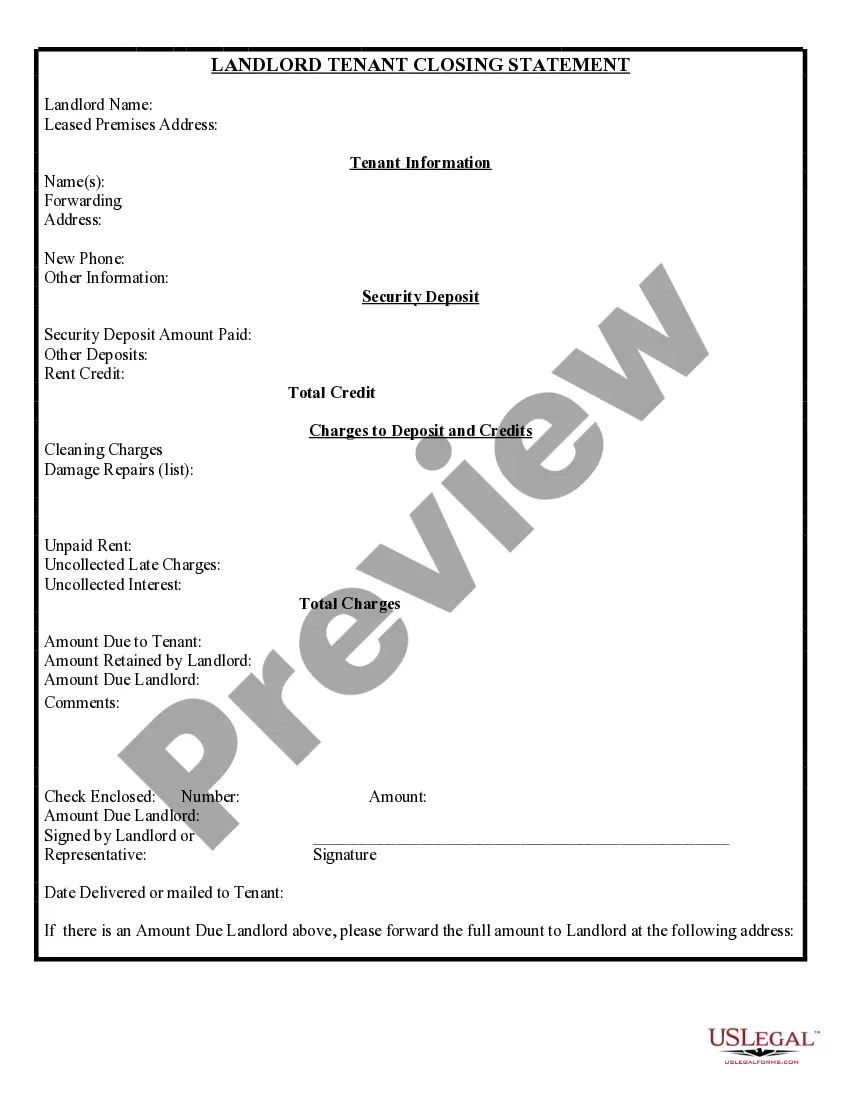

- Learn more about the form by previewing it or going through a quick description. If the Collin Consumer Equity Sheet isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to start utilizing our website and download the document.

- Everything looks great on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your form is ready to go. You can try and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!