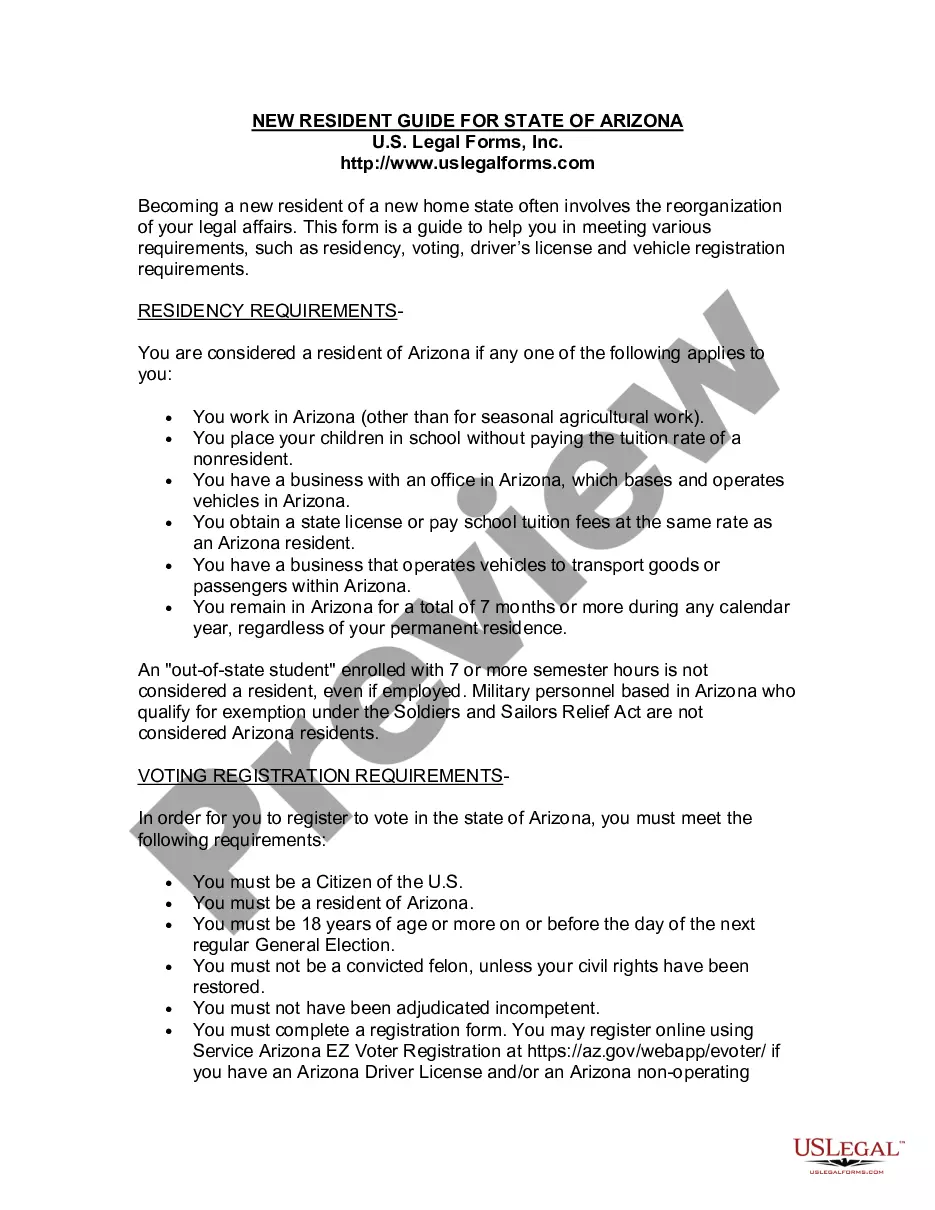

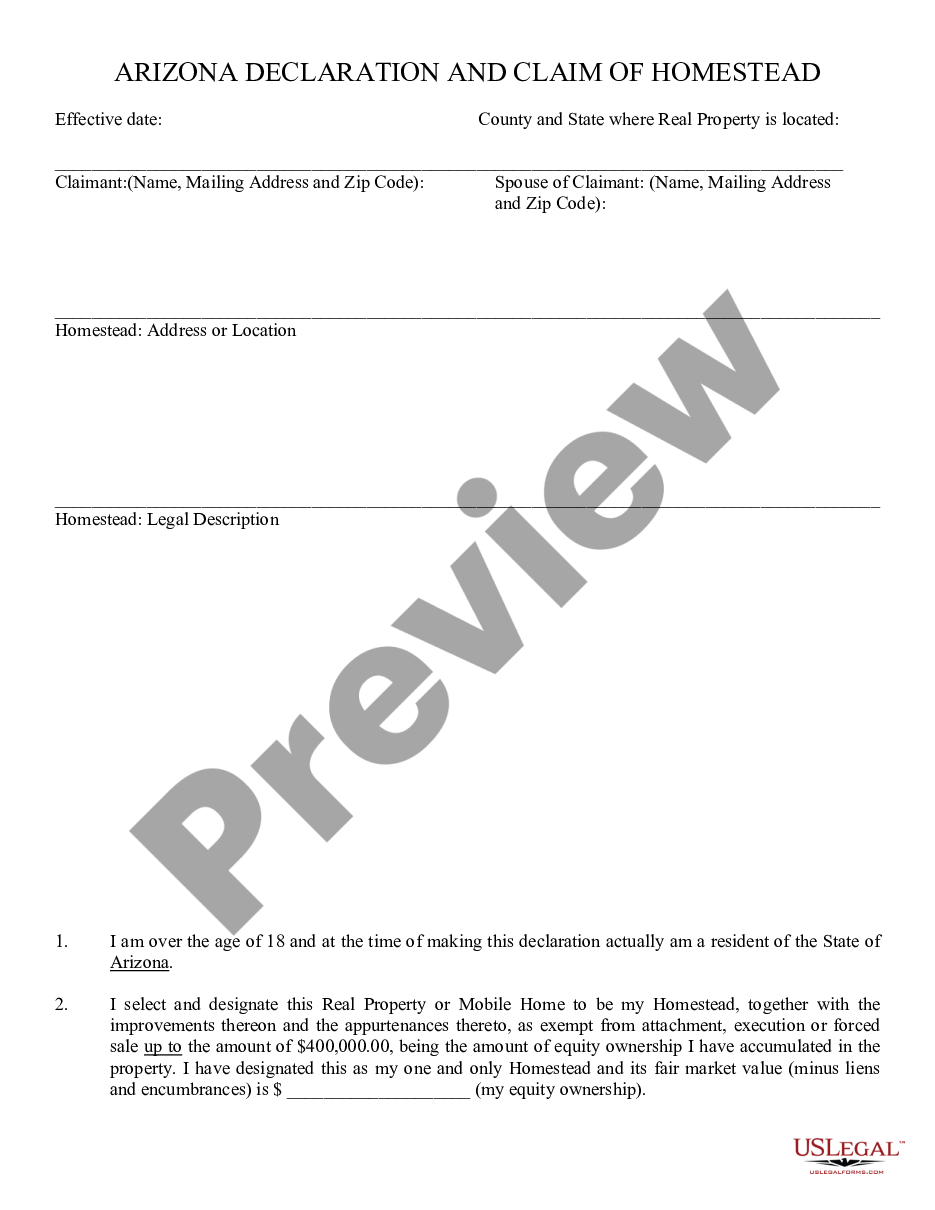

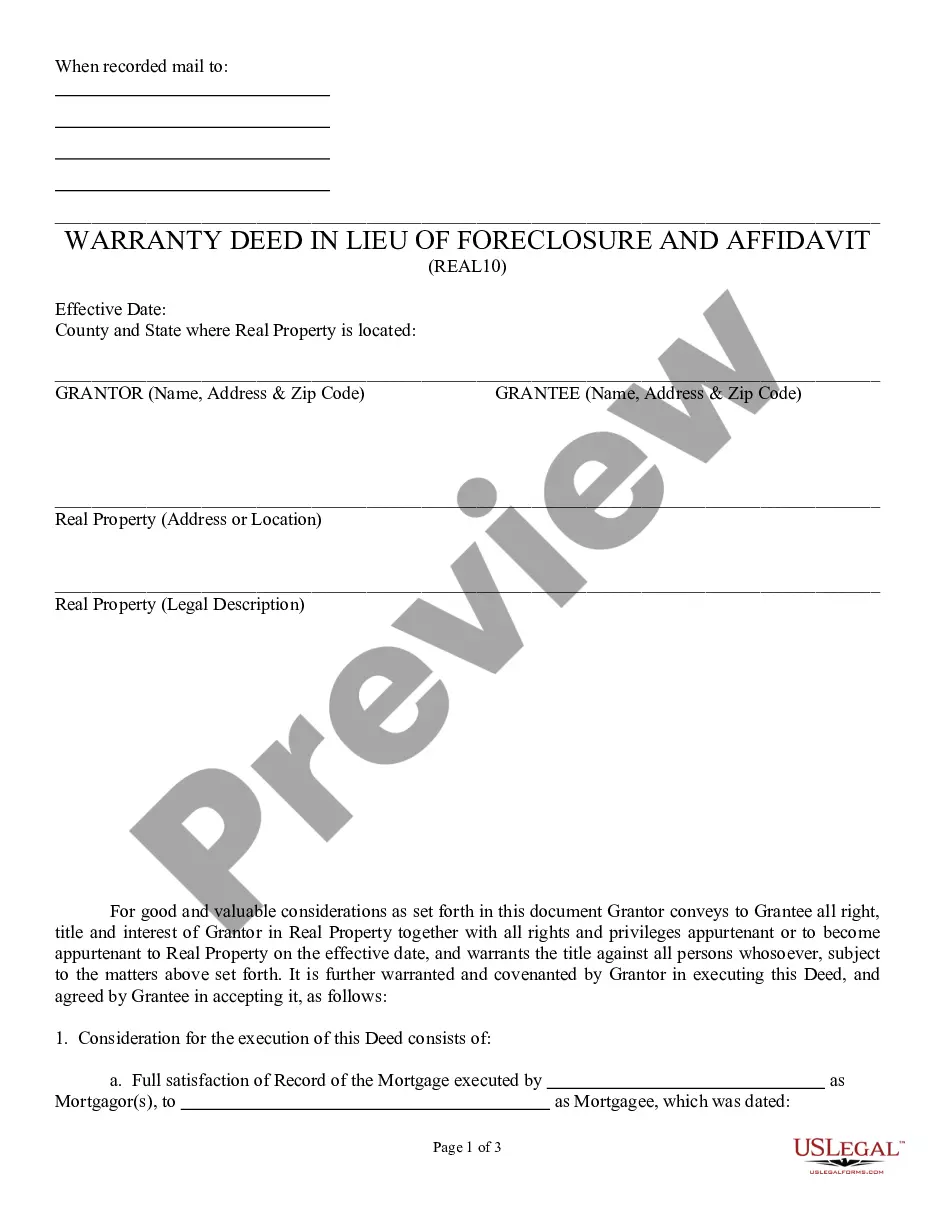

Maricopa, Arizona Consumer Equity Sheet is a valuable financial tool providing a comprehensive overview of an individual's or household's equity position. This detailed document outlines the current market value of their assets and liabilities, enabling them to assess their net worth. The Maricopa, Arizona Consumer Equity Sheet primarily focuses on a consumer's residential property, which is often the most significant asset. It includes important information such as property value, mortgage balance, and any other liens or encumbrances associated with the property. In addition to property-related details, this equity sheet may also include other types of assets, such as bank accounts, investments, retirement accounts, vehicles, and personal possessions of significant value. The liabilities section highlights debts owed, including mortgages, loans, credit card balances, and any other outstanding obligations. Understanding the Maricopa, Arizona Consumer Equity Sheet helps individuals gain insight into their financial position, determine their borrowing capacity, and plan for future investments or applying for credit. It serves as a valuable tool for financial planning, budgeting, and tracking progress towards long-term goals. Different types of Maricopa, Arizona Consumer Equity Sheets may exist based on specific requirements or industries. For example: 1. Real Estate Equity Sheet: Specifically focused on residential or commercial properties, this sheet provides detailed metrics related to property value, mortgage details, and any other relevant property-specific information. 2. Investment Equity Sheet: Designed for individuals with considerable investment portfolios, this sheet highlights the market value of various investments like stocks, mutual funds, bonds, and other financial instruments. It also includes liabilities related to margin accounts or investment loans. 3. Personal Equity Sheet: This type of equity sheet covers a broader scope, including all assets and liabilities of an individual or household, regardless of their nature. It encompasses properties, investments, bank accounts, vehicles, and other high-value possessions. With its detailed account of assets and liabilities, the Maricopa, Arizona Consumer Equity Sheet provides individuals with crucial financial insights, empowering them to make informed decisions and optimize their financial well-being.

Maricopa Arizona Consumer Equity Sheet

Description

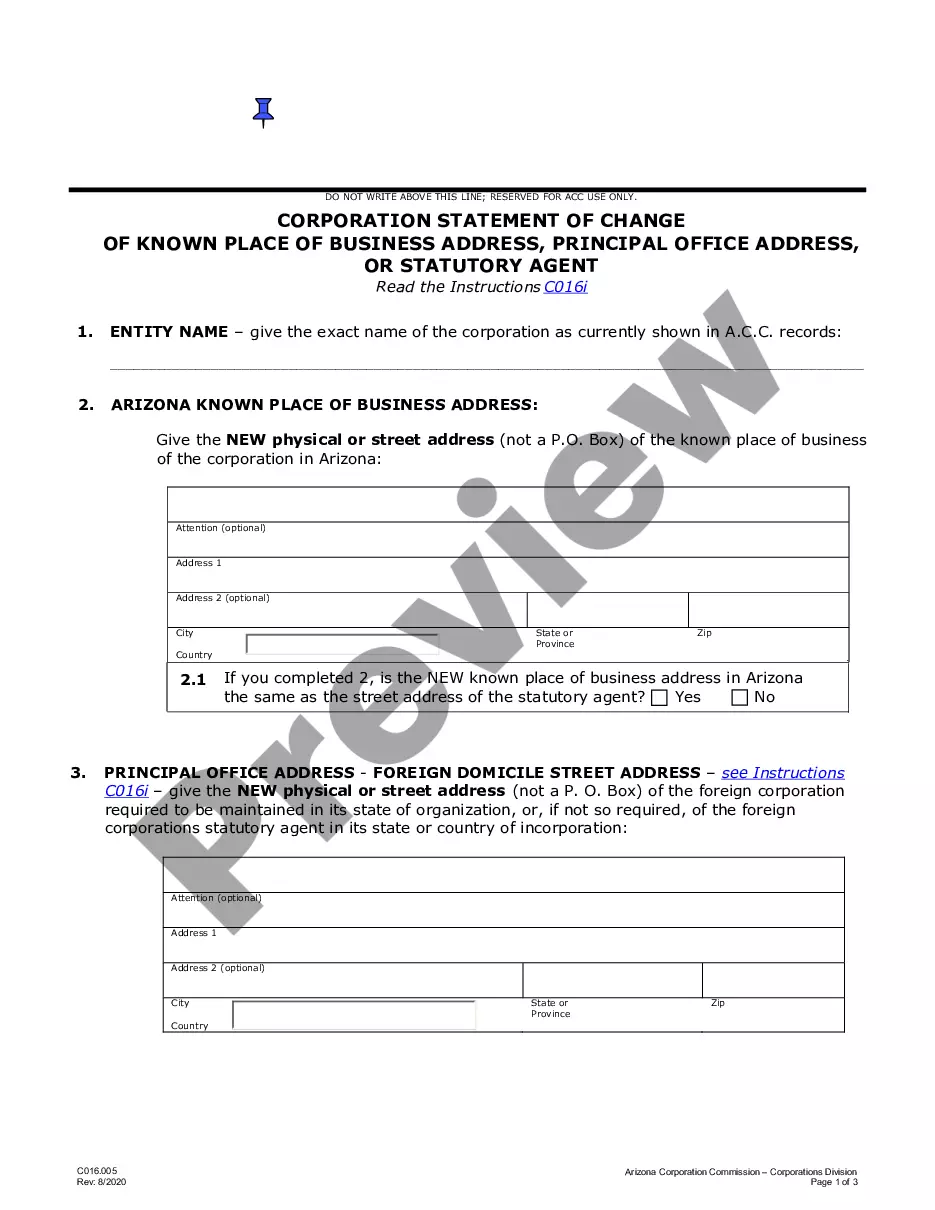

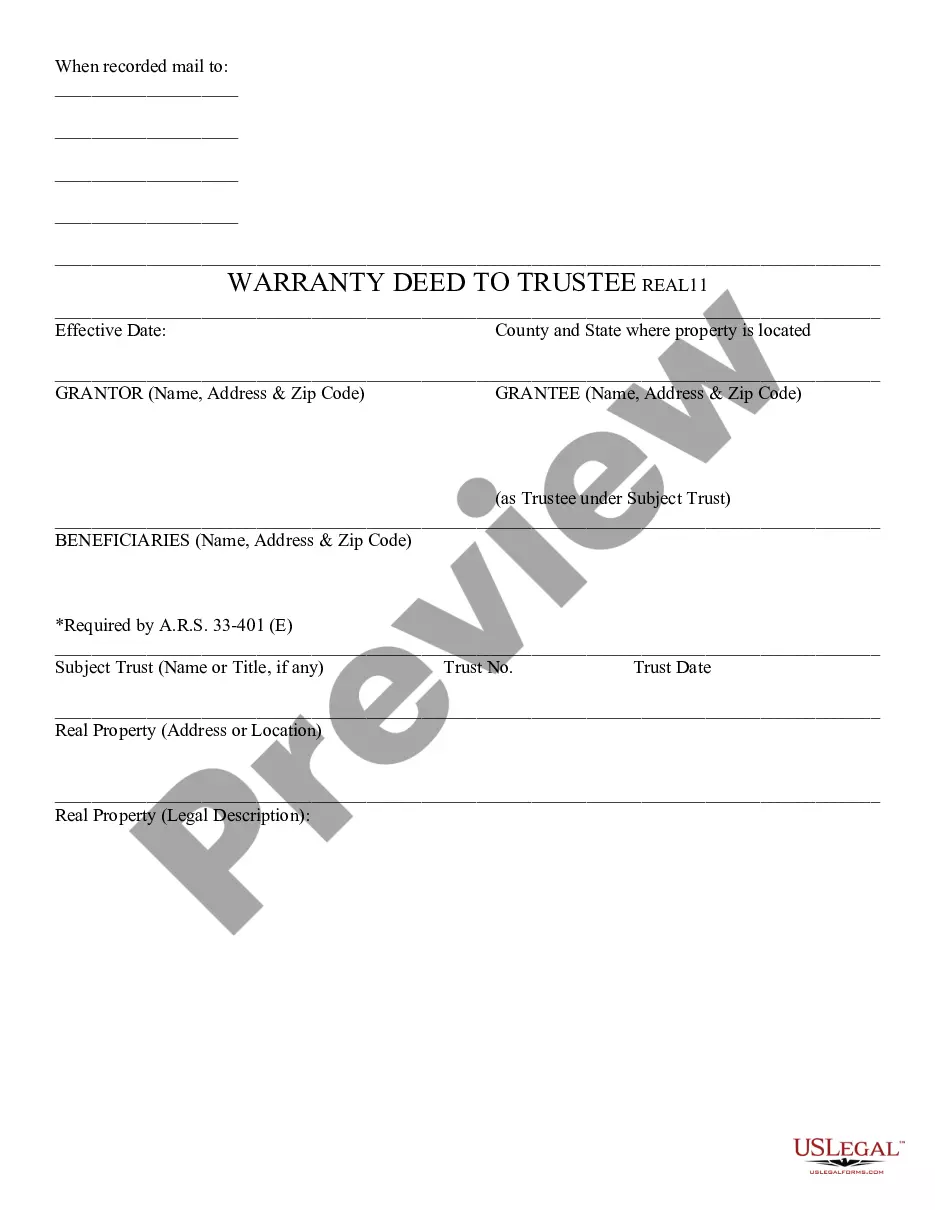

How to fill out Maricopa Arizona Consumer Equity Sheet?

Are you looking to quickly create a legally-binding Maricopa Consumer Equity Sheet or probably any other document to handle your personal or corporate matters? You can go with two options: contact a professional to write a valid document for you or create it entirely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-specific document templates, including Maricopa Consumer Equity Sheet and form packages. We provide documents for a myriad of life circumstances: from divorce papers to real estate document templates. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra troubles.

- To start with, carefully verify if the Maricopa Consumer Equity Sheet is adapted to your state's or county's regulations.

- In case the document includes a desciption, make sure to verify what it's intended for.

- Start the search over if the document isn’t what you were seeking by using the search box in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Maricopa Consumer Equity Sheet template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Moreover, the documents we provide are reviewed by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!