The Travis Texas Consumer Equity Sheet is a comprehensive financial document that provides detailed information and insights regarding the equity held by consumers in Travis County, Texas. It is primarily used by financial institutions, market researchers, and real estate professionals to assess the financial stability and potential of individuals and households in the region. The Travis Texas Consumer Equity Sheet displays various key factors that contribute to the equity of consumers, such as the market value of properties owned, outstanding mortgage balances, and other financial assets. It provides a snapshot of the net worth of individuals or households in Travis County, enabling a thorough understanding of their financial standing. Different types of Travis Texas Consumer Equity Sheets may include: 1. Residential Equity Sheet: This type focuses specifically on residential properties owned by consumers in Travis County, providing an overview of the equity accumulated through homeownership. 2. Commercial Equity Sheet: Designed for businesses and commercial property owners, this variant assesses the equity tied to commercial properties and other assets owned by consumers in the county. 3. Investment Equity Sheet: This type emphasizes the equity generated through various investment ventures such as stocks, bonds, retirement funds, and other financial instruments held by consumers in Travis County. The information present in a Travis Texas Consumer Equity Sheet is derived from a combination of public records, market data, and consumer credit reports. It enables lenders to evaluate creditworthiness, market researchers to analyze economic trends, and real estate professionals to identify potential candidates for property transactions. Through the Travis Texas Consumer Equity Sheet, financial institutions can identify potential borrowers with substantial equity, assess their risk profiles, and develop personalized loan offers. Market researchers may utilize the data to study patterns in consumer equity accumulation, gauge the economic health of the region, and identify emerging investment opportunities. Real estate professionals can also leverage the insights provided by the equity sheet to identify potential buyers or sellers, evaluate property values, and determine suitable marketing strategies. In summary, the Travis Texas Consumer Equity Sheet provides a comprehensive overview of the equity held by consumers in Travis County. It includes information on various types of equity, such as residential, commercial, and investment. Financial institutions, market researchers, and real estate professionals utilize this valuable tool to assess financial stability, identify potential borrowers, study economic trends, and make informed decisions regarding property transactions.

Travis Texas Consumer Equity Sheet

Description

How to fill out Travis Texas Consumer Equity Sheet?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from the ground up, including Travis Consumer Equity Sheet, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various categories ranging from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information materials and tutorials on the website to make any activities related to document completion straightforward.

Here's how to find and download Travis Consumer Equity Sheet.

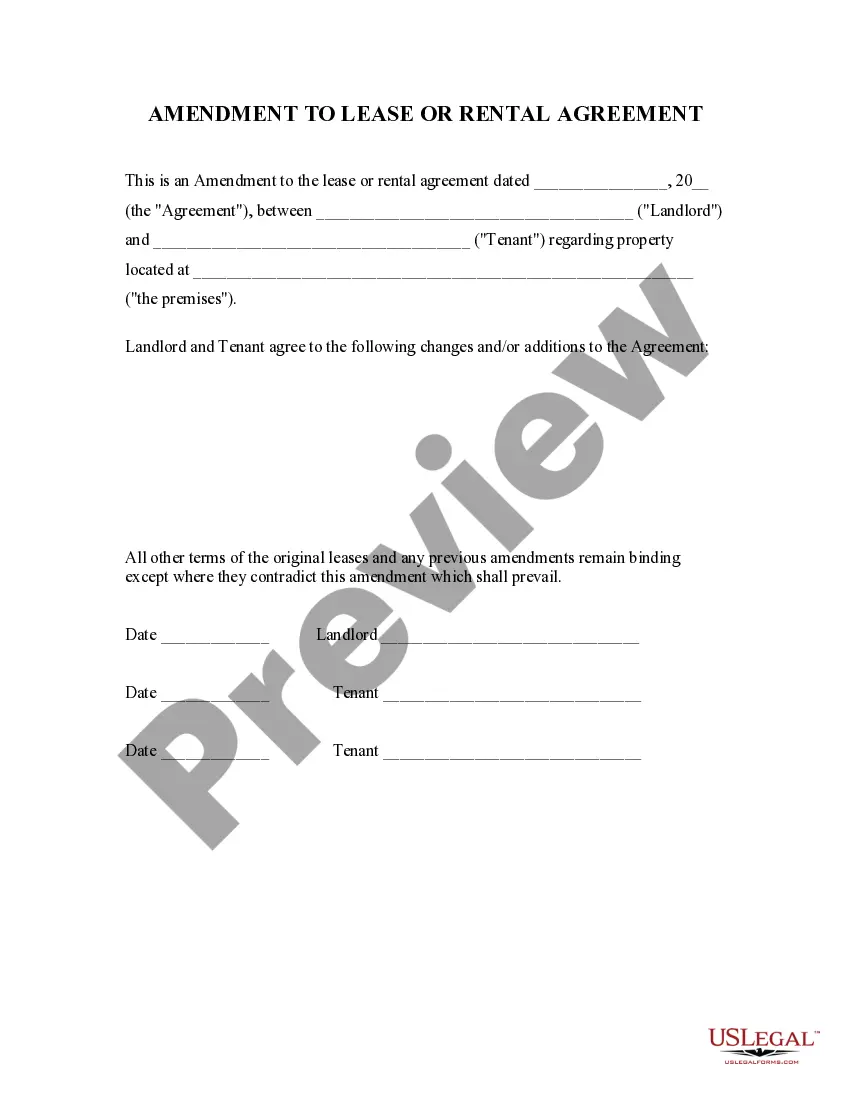

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the legality of some records.

- Examine the related document templates or start the search over to find the right file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and buy Travis Consumer Equity Sheet.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Travis Consumer Equity Sheet, log in to your account, and download it. Of course, our website can’t take the place of a lawyer completely. If you need to deal with an extremely difficult situation, we advise using the services of a lawyer to review your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and get your state-specific paperwork effortlessly!