The Alameda California Monthly Cash Flow Plan is a financial management tool designed to efficiently track and manage your income and expenses on a monthly basis. With this plan in place, individuals can gain a deeper understanding of their financial situation, make informed decisions, and effectively allocate funds to meet their goals. This monthly cash flow plan enables Alameda residents to monitor and control their monthly cash inflows and outflows, helping them achieve greater financial stability. With a focus on tracking expenses, understanding income sources, and saving for long-term goals, the Alameda California Monthly Cash Flow Plan empowers individuals to take control of their financial health and work towards financial freedom. The Alameda California Monthly Cash Flow Plan comes in various types to cater to individual needs and preferences. These could include: 1. Basic Monthly Cash Flow Plan: This plan involves tracking and categorizing essential income and expenses, such as housing costs, utilities, transportation, groceries, and debt payments. It provides a framework for individuals to balance their income and expenses and identify areas where adjustments or cost-saving measures can be implemented. 2. Advanced Monthly Cash Flow Plan: Building upon the basic plan, the advanced version provides a more comprehensive analysis of income and expenses. It incorporates tracking and managing various financial aspects, including investments, insurance premiums, retirement contributions, and discretionary spending. This plan offers individuals a more detailed view of their cash flow and helps them make informed decisions to optimize their financial resources. 3. Business Monthly Cash Flow Plan: Specifically designed for entrepreneurs and small business owners in Alameda, this plan focuses on tracking business income, expenses, and cash flow. It enables individuals to effectively manage their business finances, track customer payments, monitor vendor expenses, and plan for business growth. This plan equips business owners with the necessary tools to make informed financial decisions and ensure the continued success of their enterprises. Implementing the Alameda California Monthly Cash Flow Plan can revolutionize a person's financial well-being. By having a clear picture of income and expenses, individuals can proactively manage their finances, eliminate unnecessary spending, and save for emergencies or future financial goals. This plan empowers Alameda residents to make better financial choices and pave the way towards long-term financial stability and success.

Alameda California Monthly Cash Flow Plan

Description

How to fill out Alameda California Monthly Cash Flow Plan?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Alameda Monthly Cash Flow Plan, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Alameda Monthly Cash Flow Plan from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Alameda Monthly Cash Flow Plan:

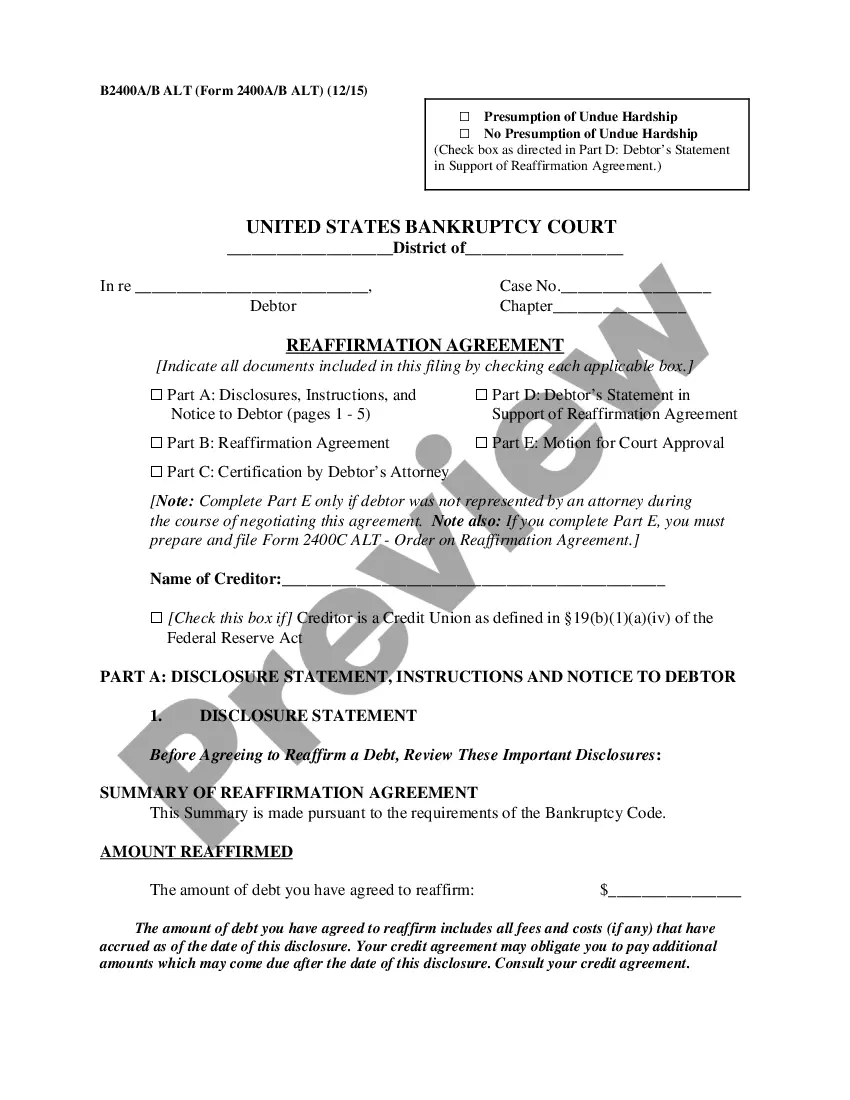

- Take a look at the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!