Hennepin Minnesota Monthly Cash Flow Plan is a financial tool used by individuals and families residing in Hennepin County, Minnesota to track and manage their monthly income and expenses. It enables individuals to gain a clear understanding of their financial situation and make informed decisions to achieve their financial goals. This cash flow plan is designed to provide a comprehensive overview of a person's or family's financial inflows and outflows on a monthly basis. By categorizing and tracking expenses such as housing, transportation, groceries, utilities, education, healthcare, entertainment, and more, individuals can easily determine where their money is being spent, identify areas of overspending, and uncover potential savings opportunities. The Hennepin Minnesota Monthly Cash Flow Plan allows individuals to establish a realistic budget by considering their regular income sources, including salaries, wages, freelance earnings, investments, and any other sources of revenue. It also captures irregular income such as bonuses, tax refunds, or side hustles. By having a clear picture of their monthly cash inflow, individuals can effectively allocate their income towards various expenses and savings goals. This cash flow plan also supports individuals in setting aside money for emergency funds, debt repayment, investments, and future financial obligations such as college tuition or retirement planning. By considering both short-term and long-term financial goals, individuals can make informed decisions about their spending, prioritize savings, and work towards achieving financial stability and security. While there may not be different types of "Hennepin Minnesota Monthly Cash Flow Plan," individuals can customize the plan based on their specific needs and circumstances. Some individuals may choose to create separate cash flow plans for different purposes, such as personal expenses, business expenses, or rental property expenses. However, the core concept of tracking monthly income and expenses remains the same. Overall, the Hennepin Minnesota Monthly Cash Flow Plan is a vital tool for individuals in Hennepin County to gain control over their finances, make informed financial decisions, and work towards achieving their financial goals. By regularly updating and reviewing this plan, individuals can adjust their spending habits, maximize their savings, and ultimately improve their overall financial well-being.

Hennepin Minnesota Monthly Cash Flow Plan

Description

How to fill out Hennepin Minnesota Monthly Cash Flow Plan?

Whether you intend to open your business, enter into a contract, apply for your ID update, or resolve family-related legal issues, you must prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business case. All files are grouped by state and area of use, so picking a copy like Hennepin Monthly Cash Flow Plan is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Hennepin Monthly Cash Flow Plan. Follow the guide below:

- Make sure the sample fulfills your personal needs and state law regulations.

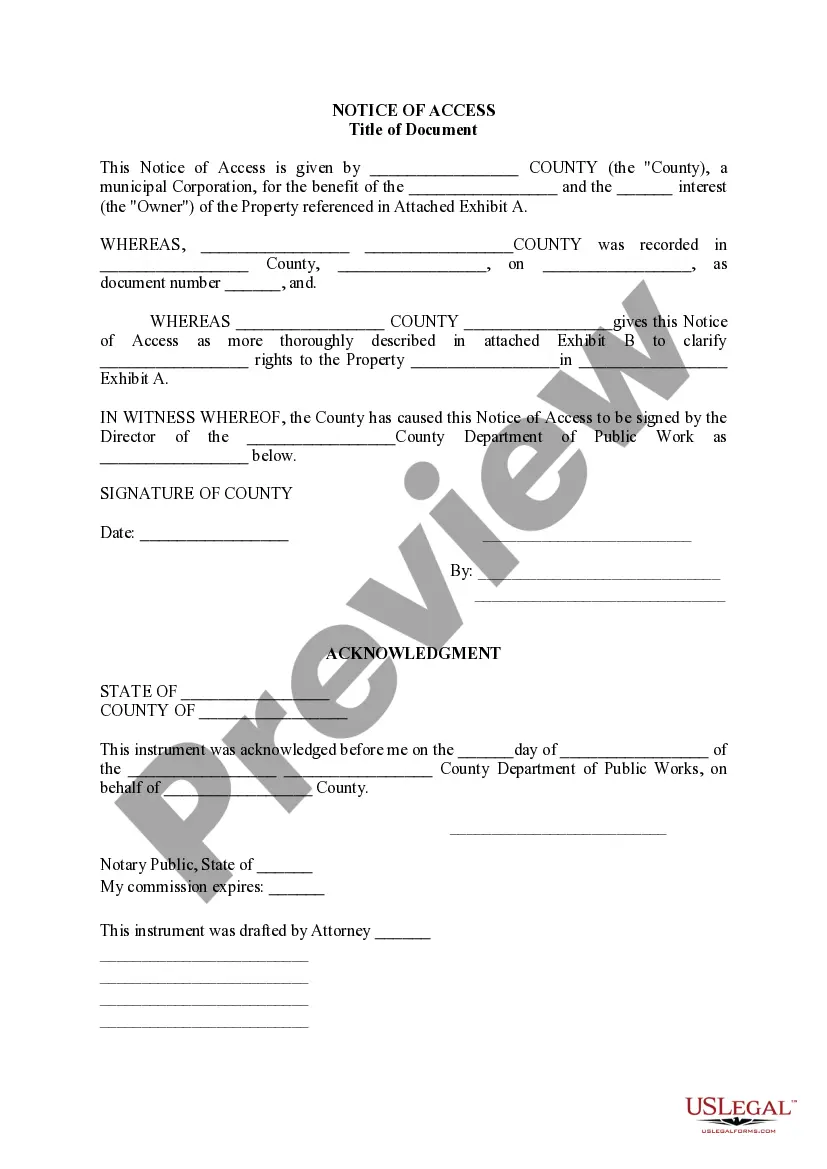

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the proper one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Hennepin Monthly Cash Flow Plan in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!