Philadelphia Pennsylvania Monthly Cash Flow Plan is a comprehensive financial tool that helps individuals, families, and businesses in Philadelphia manage their income and expenses effectively. This plan is designed to provide a structured framework for tracking and analyzing cash flow on a monthly basis. By creating a detailed budget, setting financial goals, and monitoring spending patterns, the Philadelphia Pennsylvania Monthly Cash Flow Plan allows for better financial planning and decision-making. The primary objective of the Philadelphia Pennsylvania Monthly Cash Flow Plan is to optimize financial resources, minimize unnecessary expenses, and increase savings or investments. With this plan, individuals and businesses can evaluate their income sources, track their monthly expenditures, and identify areas where adjustments can be made to improve financial stability. Benefits of the Philadelphia Pennsylvania Monthly Cash Flow Plan include: 1. Enhanced Budgeting: By using this plan, individuals and businesses can develop a realistic budget that aligns with their income and expenses. It allows them to allocate funds for essential needs such as housing, transportation, groceries, and utilities while also accounting for discretionary spending. 2. Expense Tracking: The plan facilitates the tracking of all expenses, ensuring that they are recorded accurately and no expenses go unnoticed. This enables individuals and businesses to identify areas where overspending occurs and make necessary adjustments. 3. Debt Management: The Philadelphia Pennsylvania Monthly Cash Flow Plan assists in managing outstanding debts by incorporating monthly debt payments into the budget. This ensures that debt obligations are met promptly and helps individuals and businesses work towards financial freedom. 4. Financial Goal Setting: With this plan, individuals and businesses can establish short-term and long-term financial goals, such as saving for emergencies, education, retirement, or business expansion. These goals can be prioritized and incorporated into the monthly cash flow plan, enabling individuals to make progress towards achieving them. 5. Savings and Investment Opportunities: By closely monitoring income and expenses, the Philadelphia Pennsylvania Monthly Cash Flow Plan helps identify potential areas where savings can be increased or investments can be made. It empowers individuals and businesses to make informed decisions about their financial future. Different types of Philadelphia Pennsylvania Monthly Cash Flow Plans may cater to specific needs or demographics. Some common variations include: 1. Personal Monthly Cash Flow Plan: Tailored to individual needs, this plan focuses on managing personal finances, such as household income, personal expenses, and savings goals. 2. Family Monthly Cash Flow Plan: Designed for families, this plan incorporates multiple sources of income, joint expenses, and savings targets specifically for family-related expenses and goals. 3. Business Monthly Cash Flow Plan: Suitable for small businesses or startups in Philadelphia, this plan takes into account revenue streams, operational expenses, and profit reinvestment. 4. Real Estate Monthly Cash Flow Plan: Geared towards landlords or property owners in Philadelphia, this plan concentrates on rental income, property expenses, and potential investments in real estate. Overall, the Philadelphia Pennsylvania Monthly Cash Flow Plan is a versatile financial tool that helps Philadelphia residents and businesses gain control over their finances, improve budgeting, manage debts, and work towards achieving their financial goals. By implementing this plan, individuals and organizations can strive for resilience and long-term financial success.

Philadelphia Pennsylvania Monthly Cash Flow Plan

Description

How to fill out Philadelphia Pennsylvania Monthly Cash Flow Plan?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a legal professional to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Philadelphia Monthly Cash Flow Plan, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Consequently, if you need the current version of the Philadelphia Monthly Cash Flow Plan, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Philadelphia Monthly Cash Flow Plan:

- Look through the page and verify there is a sample for your area.

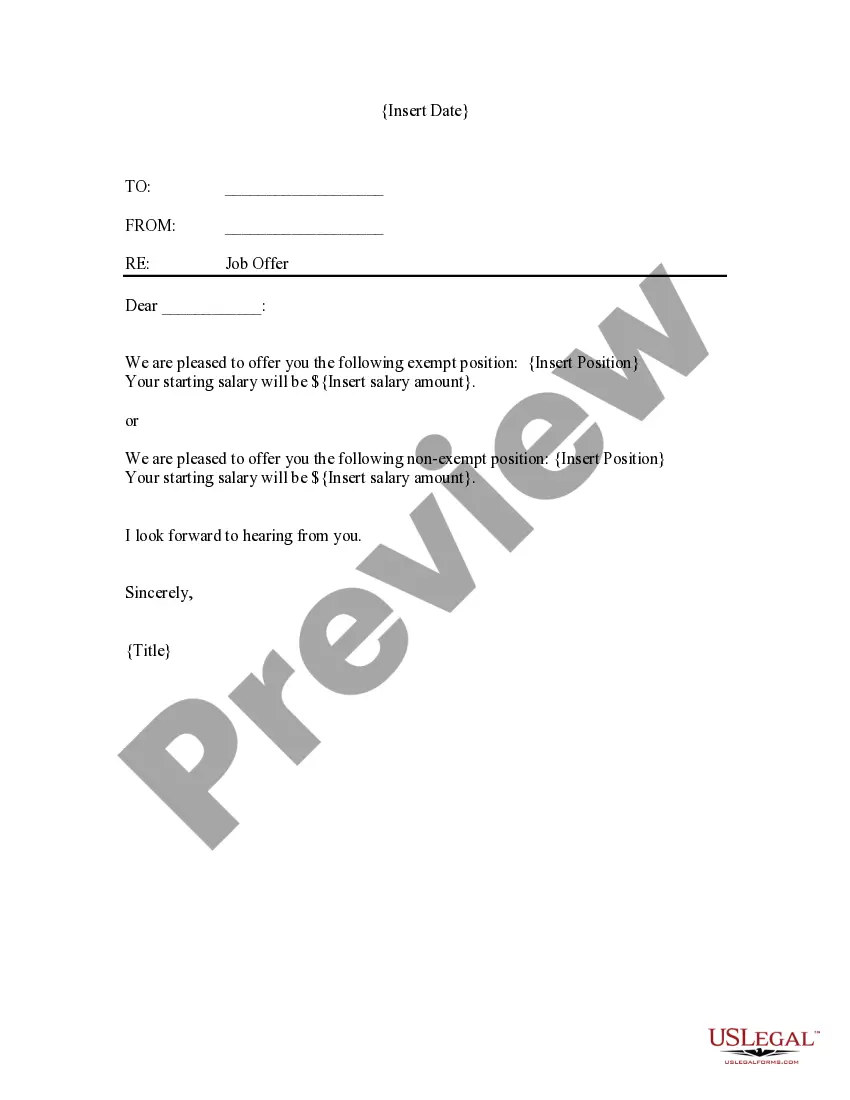

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Philadelphia Monthly Cash Flow Plan and save it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!