Maricopa Arizona Recommended Spending Percentages offer a comprehensive guideline for individuals, households, and businesses to allocate their financial resources effectively. These recommended spending percentages assist residents in attaining financial stability, managing their expenses, and achieving their financial goals. By following these recommendations, individuals can make informed decisions regarding their spending habits and optimize their financial well-being. 1. Housing: The Maricopa Arizona Recommended Spending Percentage for housing typically ranges from 25% to 35% of an individual's or household's income. This encompasses rent or mortgage payments, property taxes, homeowner's insurance, and maintenance costs. It is essential to find a balance between housing expenses and other financial obligations. 2. Transportation: The recommended spending percentage for transportation in Maricopa Arizona is typically around 10% to 15% of one's income. These expenses include vehicle payments, fuel costs, insurance, maintenance, and public transit fares. Efficiently managing transportation expenses is crucial for maintaining a sensible budget. 3. Food and Groceries: The recommended spending percentage for food and groceries is usually around 10% to 15% of one's income. This includes expenses related to groceries, dining out, and eating at home. Striking a balance between convenience and saving is key in this category. 4. Healthcare: Healthcare expenses in Maricopa Arizona are recommended to be allocated around 5% to 10% of one's income. This category includes health insurance premiums, co-payments, prescription medications, and unexpected medical expenses. 5. Utilities: The recommended spending percentage for utilities, such as electricity, water, gas, internet, and cable, is generally around 5% to 10% of one's income. By managing these costs effectively, individuals can mitigate unnecessary expenses and ensure financial stability. 6. Debt Repayment: Maricopa Arizona's recommended spending percentage for debt repayment is often around 5% to 10% of an individual's or household's income. This includes credit card payments, student loan payments, and other outstanding debts. Allocating a reasonable percentage toward debt repayment is crucial for long-term financial health. 7. Savings and Investments: The Maricopa Arizona Recommended Spending Percentages generally recommend putting aside around 10% to 20% of one's income for savings and investments. This includes emergency funds, retirement savings, and investments for future financial goals. It is important to note that these recommended percentages are not rigid rules but rather guidelines to assist individuals in managing their finances effectively. Personal circumstances and financial goals may warrant adjustments to suit individual needs. By utilizing these guidelines and making necessary adjustments, residents of Maricopa Arizona can work towards achieving financial security and economic prosperity.

Maricopa Arizona Recommended Spending Percentages

Description

How to fill out Maricopa Arizona Recommended Spending Percentages?

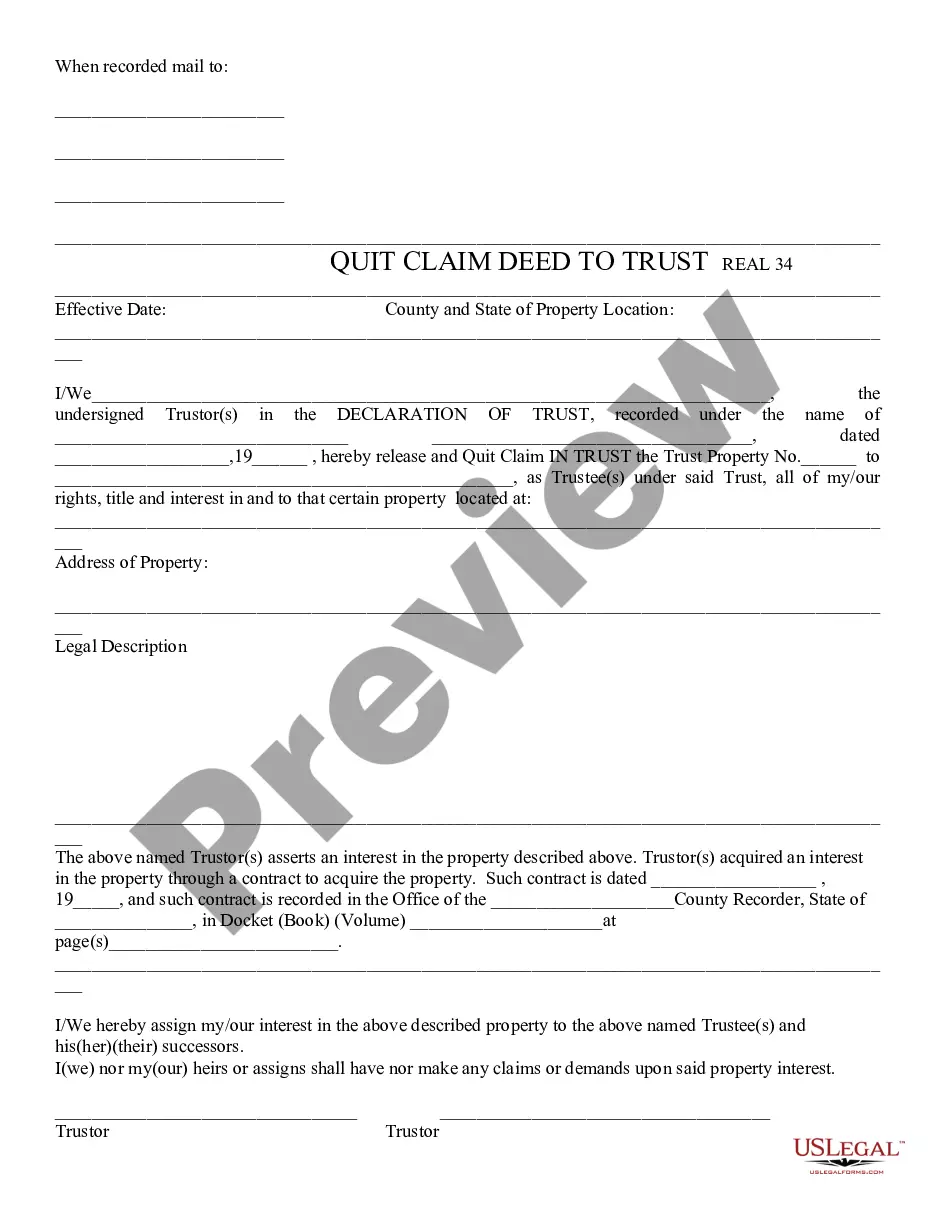

Whether you plan to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Maricopa Recommended Spending Percentages is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Maricopa Recommended Spending Percentages. Follow the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Recommended Spending Percentages in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!