San Diego, California Recommended Spending Percentages: 1. Housing: Approximately 30% of your monthly income is a commonly suggested percentage for housing expenses in San Diego, California. This includes rent/mortgage, property taxes, and home insurance. 2. Transportation: Allocate around 15-20% of your budget for transportation costs, which encompass car payments, gas, maintenance, insurance, and public transportation. 3. Food: Budgeting around 10-15% of your income for groceries, dining out, and meals can be a reasonable percentage for San Diego residents. 4. Utilities: Allocate approximately 5-10% of your budget towards essential utilities such as electricity, water, internet, and phone bills. 5. Healthcare: Health insurance premiums, co-payments, and medical expenses should ideally account for 5-10% of your income. 6. Education: If applicable, consider allocating a small percentage of your budget (up to 5%) towards educational expenses like college tuition, courses, or professional development. 7. Savings: Financial advisors often recommend setting aside at least 10-15% of your income for savings, emergency funds, or investments. 8. Discretionary Spending: This category can range from 15-30%, depending on individual preferences and financial goals. It covers entertainment, hobbies, vacations, shopping, and other non-essential expenses. Overall, it is crucial to personalize these spending percentages based on personal circumstances, such as income level, debt obligations, and individual financial goals. Different Types of San Diego California Recommended Spending Percentages: — Basic Needs: Focusing on housing, transportation, food, and utilities to cover essential living costs. — Balanced Approach: Allocating equal proportions to housing, transportation, food, utilities, healthcare, and savings. — School-Focused: For families or individuals with significant education-related expenses, a higher percentage may be allocated towards education. — Thrifty Living: Prioritizing savings and reducing discretionary spending to have a higher percentage available for future investments or financial security. — Lifestyle-Focused: Emphasizing discretionary spending and allocating a higher percentage towards entertainment, vacations, and luxury items. Remember, these recommended spending percentages are general guidelines, and everyone's financial situation may vary. It is essential to adapt and adjust these percentages as needed to best suit your specific needs, priorities, and long-term goals.

San Diego California Recommended Spending Percentages

Description

How to fill out San Diego California Recommended Spending Percentages?

Drafting documents for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft San Diego Recommended Spending Percentages without professional help.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid San Diego Recommended Spending Percentages by yourself, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the San Diego Recommended Spending Percentages:

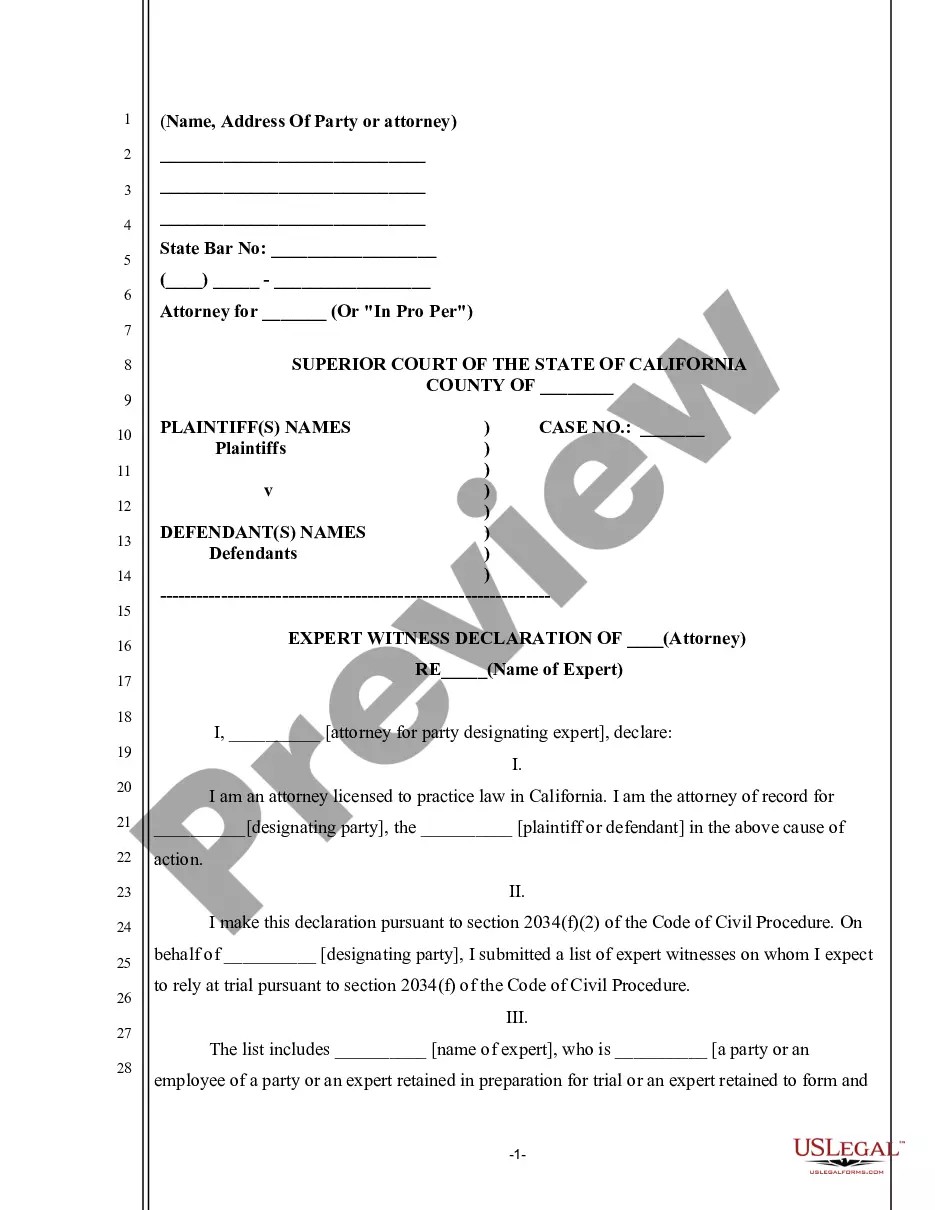

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any use case with just a few clicks!