Los Angeles, California Monthly Retirement Planning: A Comprehensive Guide to Ensure Financial Security Los Angeles, the "City of Angels," offers a vibrant and diverse retirement landscape, making it a popular destination for retirees seeking a fulfilling and enjoyable post-work life. To make the most of your retirement years in the city, proper financial planning becomes crucial. Los Angeles, California Monthly Retirement Planning services aim to assist retirees in creating a solid financial foundation in their golden years. Monthly retirement planning in Los Angeles encompasses various strategies and solutions tailored to the unique needs and aspirations of retirees. These services help individuals effectively manage their expenses, invest wisely, and ensure a steady income stream to support their desired lifestyle. Whether you're a retiree looking to enjoy the cultural attractions, indulge in outdoor activities, or simply relax by the beach, monthly retirement planning provides the necessary financial tools and guidance for a worry-free retirement in the City of Angels. Types of Los Angeles, California Monthly Retirement Planning: 1. Investment Management: Retirees in Los Angeles can rely on professional investment management services to grow their assets and maintain a steady income flow. These services include portfolio diversification, risk analysis, and regular assessments to ensure optimal returns while minimizing potential losses. 2. Income Planning: A crucial aspect of retirement planning is creating reliable income streams. Monthly retirement planning services in Los Angeles help retirees determine the best strategies to generate income, ensuring their financial stability throughout retirement. These strategies may involve assessing Social Security benefits, pension plans, annuities, dividends, and other potential income sources. 3. Asset Protection: Los Angeles Monthly Retirement Planning professionals offer strategies to safeguard retirees' assets against potential risks. From long-term care planning to legal protection measures, such as creating living trusts or maximizing insurance coverage, asset protection ensures financial security in case of unforeseen circumstances. 4. Tax Planning: Retirees often seek ways to minimize tax liabilities while maximizing their income. Los Angeles Monthly Retirement Planning services include tax planning strategies tailored to California's unique tax regulations. These strategies may involve optimizing tax-efficient investments, charitable giving, estate planning, or taking advantage of special tax breaks applicable to retirees. 5. Healthcare Planning: Ensuring access to quality healthcare is vital during retirement. Monthly retirement planning services in Los Angeles assist retirees in navigating healthcare options, including Medicare, supplemental health insurance, and long-term care plans. Retirement planning experts help retirees estimate healthcare expenses and incorporate them into their financial plans, ensuring they can afford necessary medical care without compromising their lifestyle. To make the most informed decisions regarding Los Angeles, California Monthly Retirement Planning, it is advisable to consult certified financial planners or retirement planning specialists who possess a deep understanding of the local retirement landscape. They can customize a comprehensive plan that aligns with your specific retirement goals, taking into account factors such as the cost of living, real estate opportunities, local taxes, and the various retirement benefits available in the vibrant city of Los Angeles. Begin your journey towards a worry-free and financially secure retirement in Los Angeles by embracing monthly retirement planning tailored to your unique needs and desires.

Los Angeles California Monthly Retirement Planning

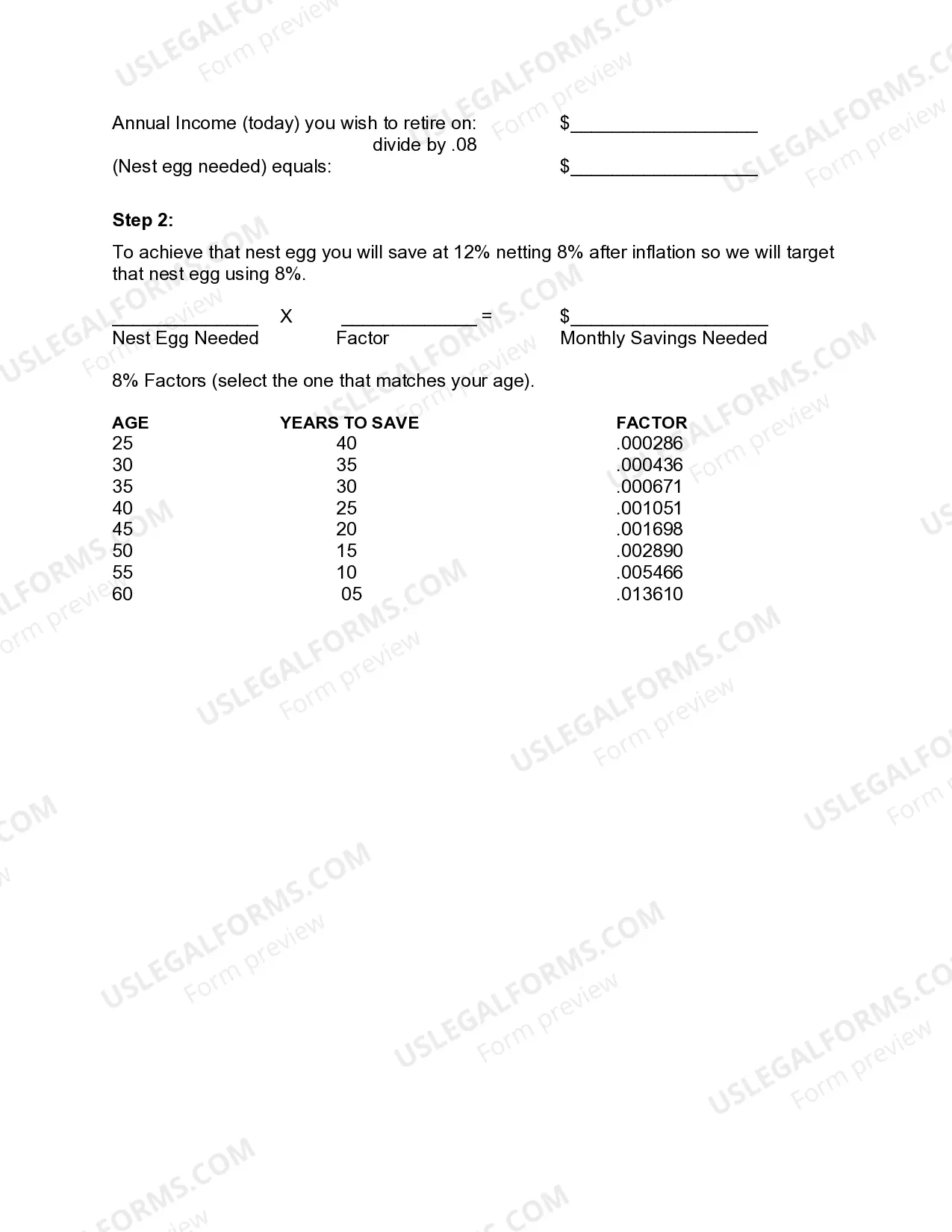

Description

How to fill out Los Angeles California Monthly Retirement Planning?

Drafting papers for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Los Angeles Monthly Retirement Planning without professional assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Los Angeles Monthly Retirement Planning on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Los Angeles Monthly Retirement Planning:

- Examine the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that fits your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any situation with just a few clicks!