Maricopa Arizona Monthly Retirement Planning is a comprehensive financial planning service designed specifically for retirees or individuals approaching retirement age, in the city of Maricopa, Arizona. This service helps individuals effectively manage their finances, budget their expenses, and maximize their income during retirement. The Maricopa Arizona Monthly Retirement Planning offers personalized financial guidance to help retirees make informed decisions and create a secure and sustainable retirement plan. The service takes into consideration various aspects such as income sources, Social Security benefits, investment portfolios, healthcare expenses, and potential longevity risk. Through Maricopa Arizona Monthly Retirement Planning, individuals can gain insights and understanding on topics like retirement savings, tax planning, estate planning, investment strategies, healthcare costs, and Social Security optimization. The service facilitates retirees in optimizing their retirement income, minimizing tax obligations, and ensuring their financial goals are met. Additionally, Maricopa Arizona Monthly Retirement Planning provides various types of retirement plans tailored to meet different needs and circumstances. These plans may include: 1. Basic Retirement Planning: This plan is suitable for individuals who are just starting to plan for retirement. It covers essential aspects such as budgeting, savings, and setting up a retirement account. 2. Investment-focused Retirement Planning: This plan is geared towards retirees who are interested in optimizing their investment portfolios to generate maximum income throughout their retirement years. It considers risk tolerance, market trends, and time horizons to design a personalized investment strategy aligned with the retiree's goals. 3. Income and Tax Planning: This plan focuses on maximizing retirement income and reducing tax obligations. It explores strategies such as annuities, tax-efficient investment options, and other income-generating opportunities. 4. Healthcare Planning: This plan addresses the potential high costs associated with healthcare during retirement. It includes analyzing Medicare options, long-term care insurance, and anticipating potential medical expenses. Ultimately, Maricopa Arizona Monthly Retirement Planning aims to offer retirees peace of mind and a sense of financial security throughout their retirement journey. By providing tailored, relevant advice and guidance, this service enables individuals to make well-informed decisions that align with their financial goals and objectives.

Maricopa Arizona Monthly Retirement Planning

Description

How to fill out Maricopa Arizona Monthly Retirement Planning?

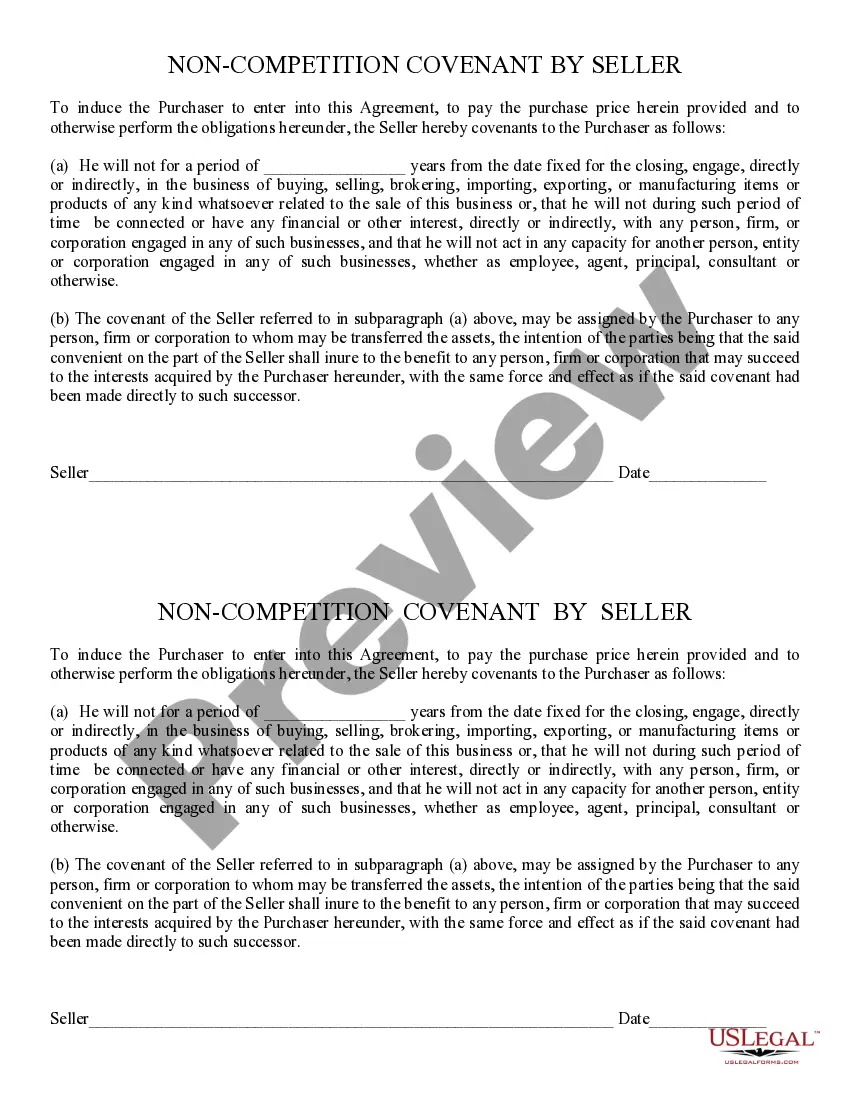

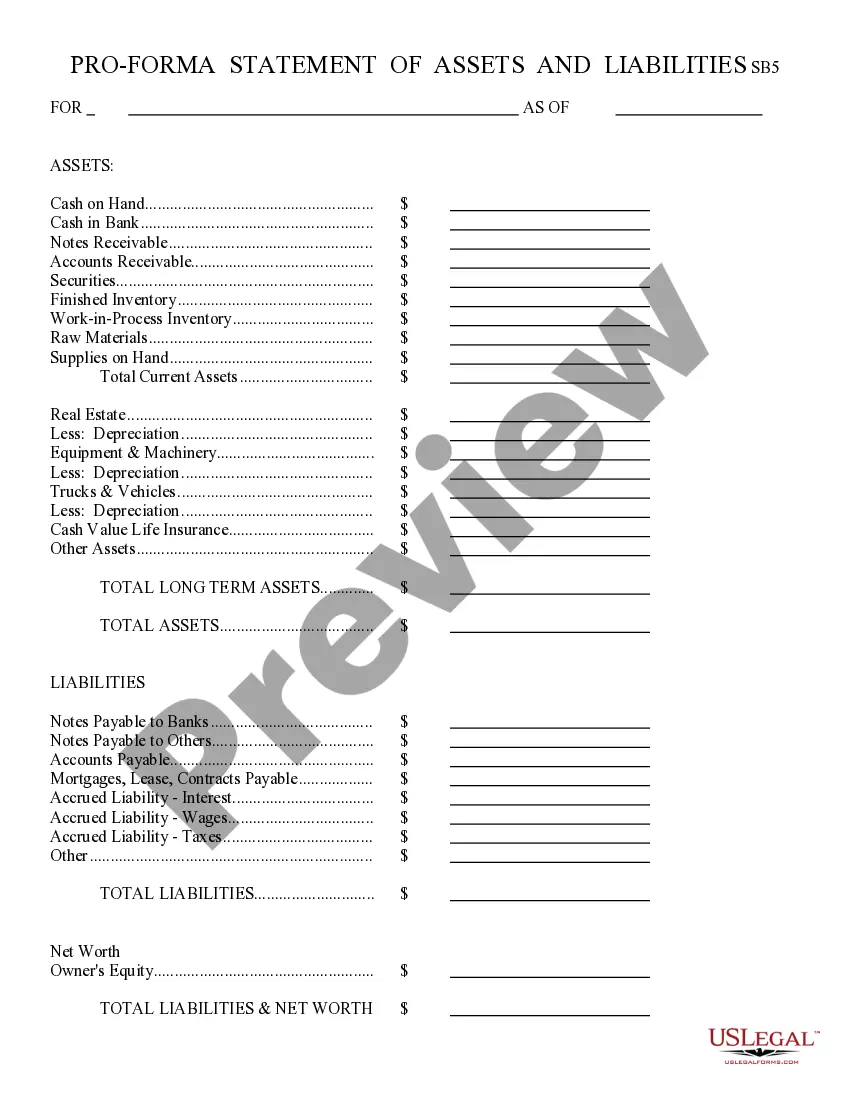

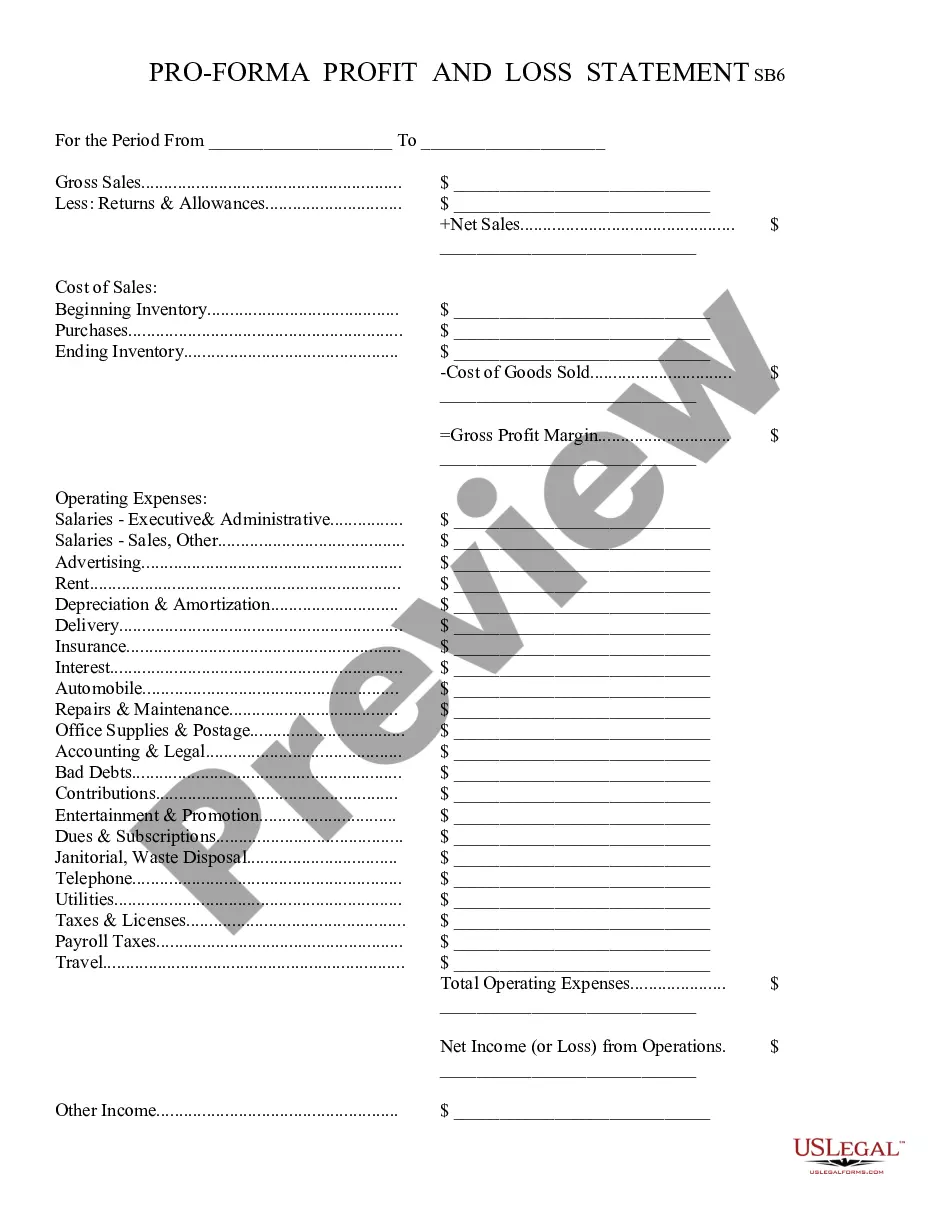

How much time does it typically take you to draft a legal document? Given that every state has its laws and regulations for every life situation, locating a Maricopa Monthly Retirement Planning meeting all regional requirements can be stressful, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Apart from the Maricopa Monthly Retirement Planning, here you can find any specific form to run your business or personal affairs, complying with your county requirements. Professionals verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can pick the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Maricopa Monthly Retirement Planning:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Maricopa Monthly Retirement Planning.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!