Montgomery Maryland Monthly Retirement Planning is a comprehensive financial strategy aimed at helping individuals and couples in Montgomery, Maryland prepare for their post-work years. This involves analyzing their current financial situation, setting retirement goals, and devising a strategic plan to achieve those goals within a fixed timeframe. The process of Montgomery Maryland Monthly Retirement Planning typically begins with a thorough assessment of an individual's or couple's financial situation. This includes evaluating their current income, expenses, assets, and liabilities. Retirement planning experts then utilize this information to determine a realistic retirement savings goal, taking into account factors such as desired retirement age, lifestyle expectations, and potential medical expenses. Once the retirement savings goal is established, Montgomery Maryland Monthly Retirement Planning focuses on developing a customized investment strategy. Depending on the individual's risk tolerance and time horizon, various investment options may be explored, such as stocks, bonds, mutual funds, or real estate. The aim is to create a diversified asset portfolio that balances potential returns with risk management. Montgomery Maryland Monthly Retirement Planning also takes into consideration social security benefits and other potential sources of retirement income. Retirement planners help individuals explore their eligibility for social security benefits and guide them in determining the most advantageous claiming strategy. Additionally, they provide guidance on other potential sources of income, such as pensions, annuities, and rental properties. Another crucial aspect of Montgomery Maryland Monthly Retirement Planning is tax management. Experts analyze an individual's tax situation and recommend appropriate strategies to minimize taxes during retirement. This could involve strategies such as converting traditional IRAs to Roth IRAs, utilizing tax-efficient investment vehicles, or exploring tax deductions related to healthcare expenses. Different types of Montgomery Maryland Monthly Retirement Planning may cater to specific needs or circumstances. For instance, some individuals may require focused estate planning as part of their retirement strategy. This could involve creating wills, trusts, or powers of attorney to ensure a smooth transfer of assets to heirs. Other retirees may benefit from assistance in long-term care planning, such as considering long-term care insurance or exploring Medicaid eligibility. In summary, Montgomery Maryland Monthly Retirement Planning is a comprehensive process that encompasses assessing an individual's or couple's financial situation, setting retirement goals, devising an investment strategy, optimizing retirement income sources, minimizing taxes, and potentially incorporating specific needs like estate planning or long-term care. This holistic approach aims to provide individuals and couples in Montgomery, Maryland with a solid foundation for a financially secure and enjoyable retirement.

Montgomery Maryland Monthly Retirement Planning

Description

How to fill out Montgomery Maryland Monthly Retirement Planning?

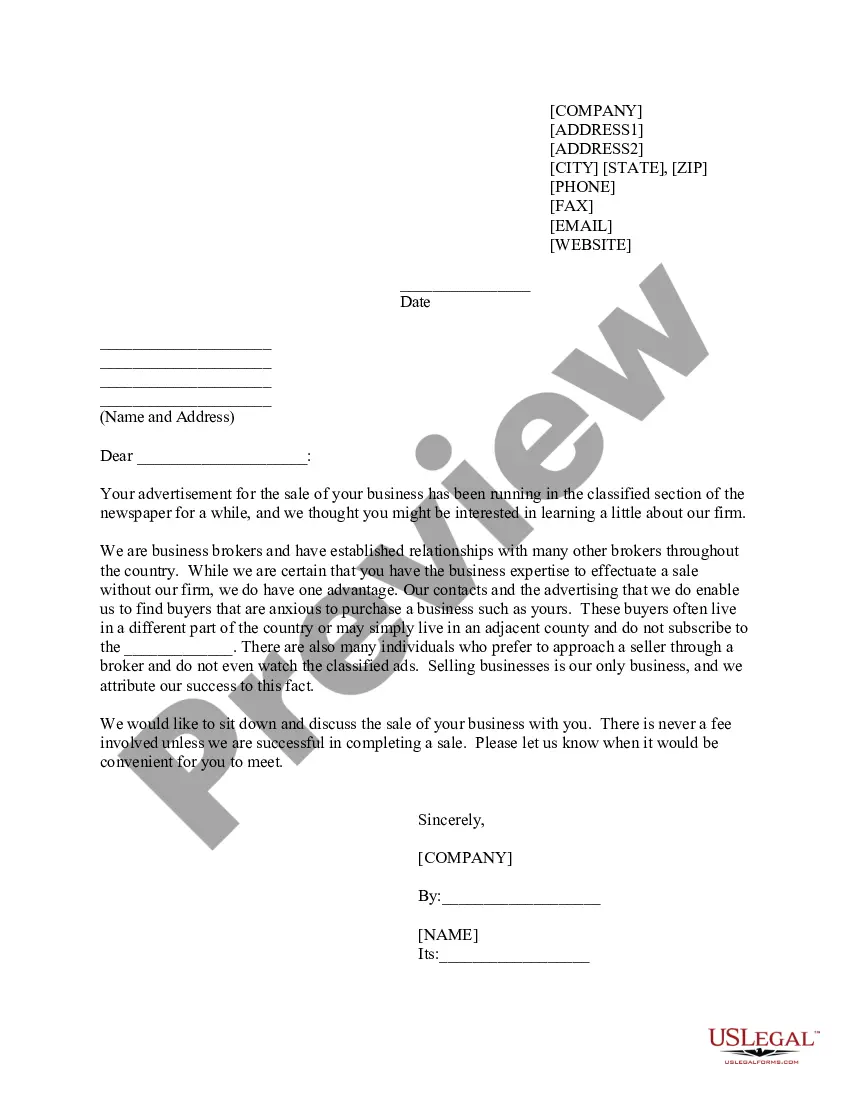

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from scratch, including Montgomery Monthly Retirement Planning, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in various categories varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information materials and guides on the website to make any tasks related to paperwork completion simple.

Here's how to locate and download Montgomery Monthly Retirement Planning.

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Examine the related document templates or start the search over to locate the right document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Montgomery Monthly Retirement Planning.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Montgomery Monthly Retirement Planning, log in to your account, and download it. Of course, our platform can’t replace an attorney entirely. If you need to cope with an extremely difficult case, we advise using the services of a lawyer to examine your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Join them today and get your state-compliant paperwork with ease!