Oakland Michigan is a county located in the state of Michigan, United States. It is a diverse and vibrant community with a population of approximately 1.2 million residents. In this article, we will explore the importance of savings, particularly focusing on budgeting and emergency funds in Oakland Michigan. Budgeting is crucial in managing personal finances effectively. It involves creating a plan for income and expenses for a specific period, typically on a monthly basis. By budgeting, individuals can allocate their income towards essential expenses such as housing, transportation, utilities, groceries, healthcare, and education, while also setting aside funds for savings. When it comes to savings, having a breakdown of each category is beneficial in achieving financial goals. Some common types of savings for budgeting in Oakland Michigan include: 1. Housing: This category includes saving for rent or mortgage payments, property taxes, and home insurance. It is essential to set aside a portion of income towards housing expenses to ensure stability and avoid financial strain. 2. Transportation: Saving money for transportation expenses is crucial, whether it is for fuel costs, car maintenance, public transportation, or even purchasing a vehicle. In Oakland Michigan, having a reliable mode of transportation is vital for commuting to work, school, or other activities. 3. Utilities: This category encompasses saving for monthly utility bills such as electricity, gas, water, and internet services. Managing and tracking these expenses is important to avoid any unexpected financial burden. 4. Groceries: Allocating a specific amount for grocery expenses is necessary for individuals and families residing in Oakland Michigan. This includes shopping for food items, household supplies, and personal care products. 5. Healthcare: Saving for healthcare expenses, including health insurance premiums, medical consultations, prescription medications, and other medical necessities, is crucial to maintaining physical well-being. In Oakland Michigan, individuals have access to various healthcare providers and facilities. 6. Education: Education plays a significant role in Oakland Michigan, with many residents pursuing higher education or supporting their children's educational needs. Setting aside savings for tuition fees, school supplies, and educational expenses is essential for personal growth and development. In addition to budgeting, having an emergency fund is crucial for financial security and peace of mind. An emergency fund acts as a financial safety net in case of unexpected expenses, such as medical emergencies, job loss, or home repairs. It is recommended to save at least three to six months' worth of living expenses in this fund. In conclusion, understanding and implementing a breakdown of savings for budgeting and emergency funds is vital for individuals residing in Oakland Michigan. By allocating funds strategically towards housing, transportation, utilities, groceries, healthcare, and education, individuals can effectively manage their finances and achieve their financial goals. Additionally, having an emergency fund provides financial stability during unforeseen circumstances, ensuring peace of mind for Oakland Michigan residents.

Oakland Michigan Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Oakland Michigan Breakdown Of Savings For Budget And Emergency Fund?

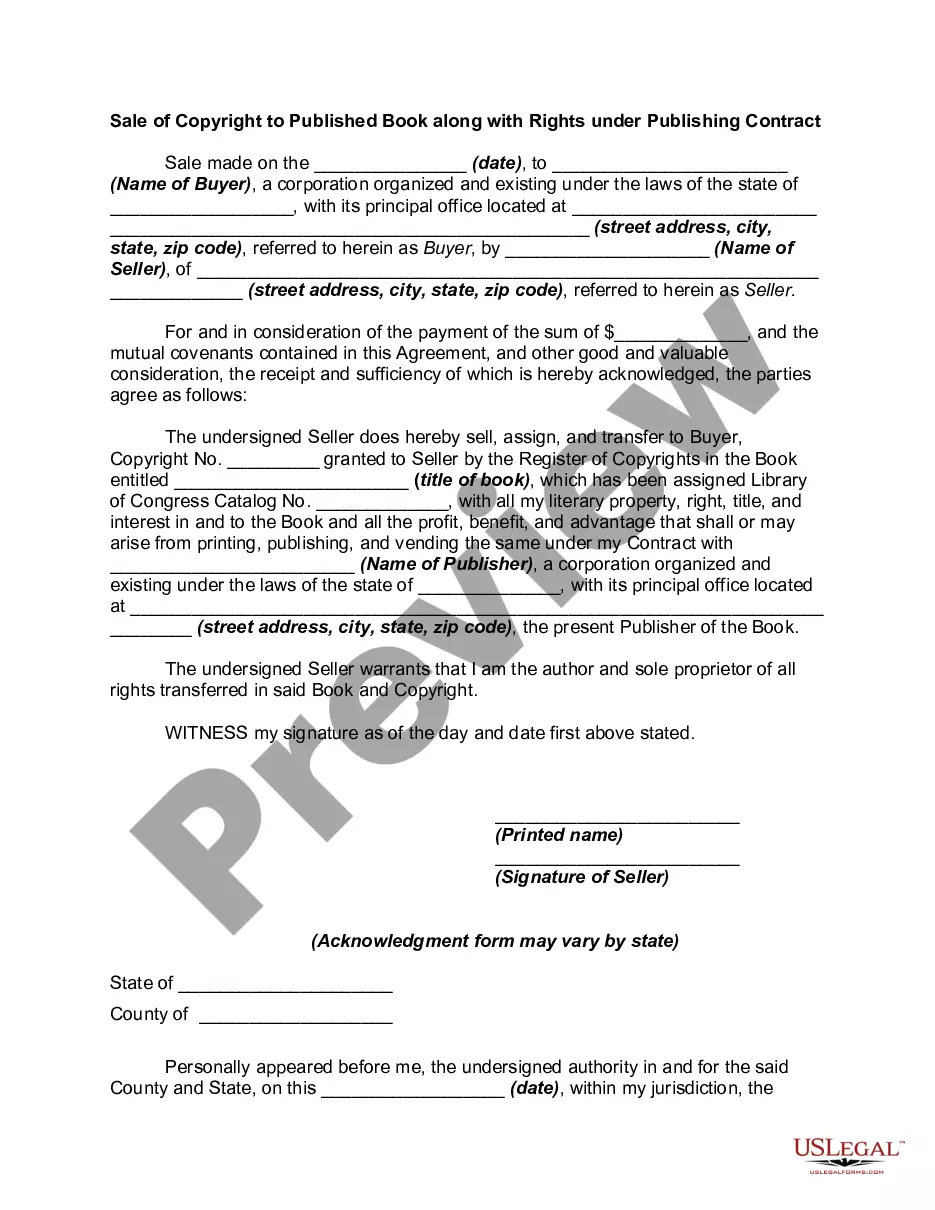

Preparing legal documentation can be burdensome. In addition, if you decide to ask an attorney to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Oakland Breakdown of Savings for Budget and Emergency Fund, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Therefore, if you need the latest version of the Oakland Breakdown of Savings for Budget and Emergency Fund, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Oakland Breakdown of Savings for Budget and Emergency Fund:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Oakland Breakdown of Savings for Budget and Emergency Fund and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!