Riverside, California is a vibrant city located in the Inland Empire region of Southern California. Known for its rich history, diverse population, and scenic attractions, Riverside offers a range of opportunities for residents and visitors alike. In terms of budgeting and emergency funds, it is essential to prioritize financial planning to ensure stability and peace of mind. A breakdown of savings for budget and emergency funds in Riverside, California would typically consist of the following categories: 1. Housing Expenses: Allocating a significant portion of monthly savings towards housing expenses is crucial. This includes rent or mortgage payments, property taxes, home insurance, and maintenance costs. Riverside provides a diverse housing market, catering to various budgets and preferences. 2. Transportation Costs: Riverside residents depend on reliable transportation options. Considering expenses such as car loan payments, insurance, fuel, maintenance, and public transportation fees is essential. In a car-centric city like Riverside, having a well-maintained vehicle or utilizing public transport can impact one's financial planning positively. 3. Utilities and Bills: Managing monthly utility bills like electricity, water, gas, and internet is a necessity. Allocating a portion of savings towards these expenses helps ensure a stable budget. Riverside's utility rates may vary slightly, so it is advisable to research and factor in estimated costs to maintain an accurate budget breakdown. 4. Groceries and Essential Goods: Budgeting for groceries and essential goods is vital in any financial planning. Riverside has a variety of grocery stores and shopping centers, offering residents numerous choices to meet their dietary needs and preferences. 5. Medical and Health Expenses: When creating a breakdown of savings, it is essential to account for medical and health expenses. These may include health insurance premiums, copay, medications, and emergency medical visits. Riverside is home to several hospitals, medical centers, and clinics, providing residents with access to quality healthcare. 6. Recreation and Entertainment: Riverside offers a range of recreational and entertainment options, including parks, museums, theaters, and sports activities. Allocating a portion of savings for leisure activities helps maintain a balanced budget while enjoying what the city has to offer. Emergency Fund Types: 1. Job Loss or Income Reduction: Creating an emergency fund specifically for unexpected job loss or income reduction is advisable. This fund acts as a safety net, providing a financial cushion during challenging times. 2. Medical Emergencies: A separate emergency fund can be allocated to cope with unforeseen medical emergencies. This helps cover any unexpected medical expenses, providing peace of mind and preventing a potential financial crisis. 3. Home Repairs and Maintenance: Setting aside funds for emergency home repairs or maintenance is crucial. Riverside experiences occasional natural disasters such as earthquakes and wildfires, making it essential to account for any unexpected damages. 4. Car Repairs or Replacement: Allocating funds for unexpected car repairs or the need for a replacement vehicle ensures that transportation needs are met swiftly in case of unexpected breakdowns or accidents. By creating a comprehensive breakdown of savings for both a budget and emergency fund in Riverside, California, individuals and families can proactively secure their financial stability, meet daily expenses, and prepare for unforeseen circumstances.

Riverside California Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Riverside California Breakdown Of Savings For Budget And Emergency Fund?

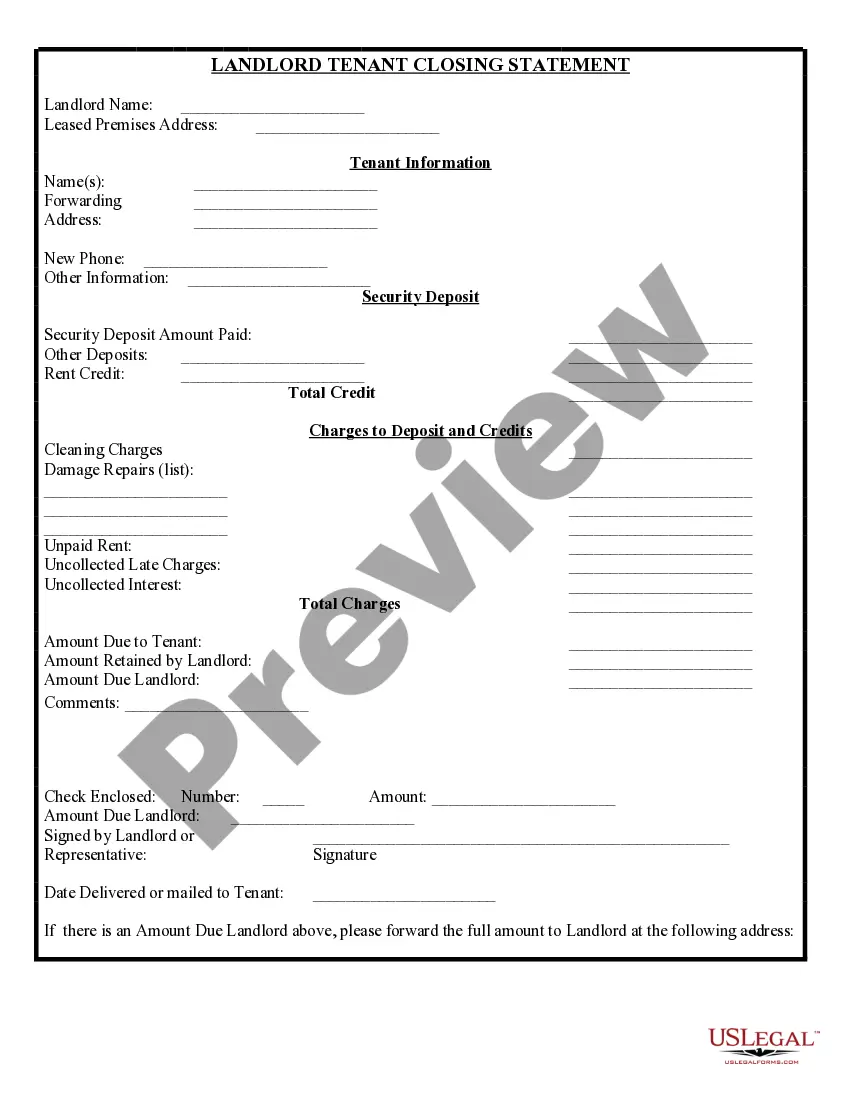

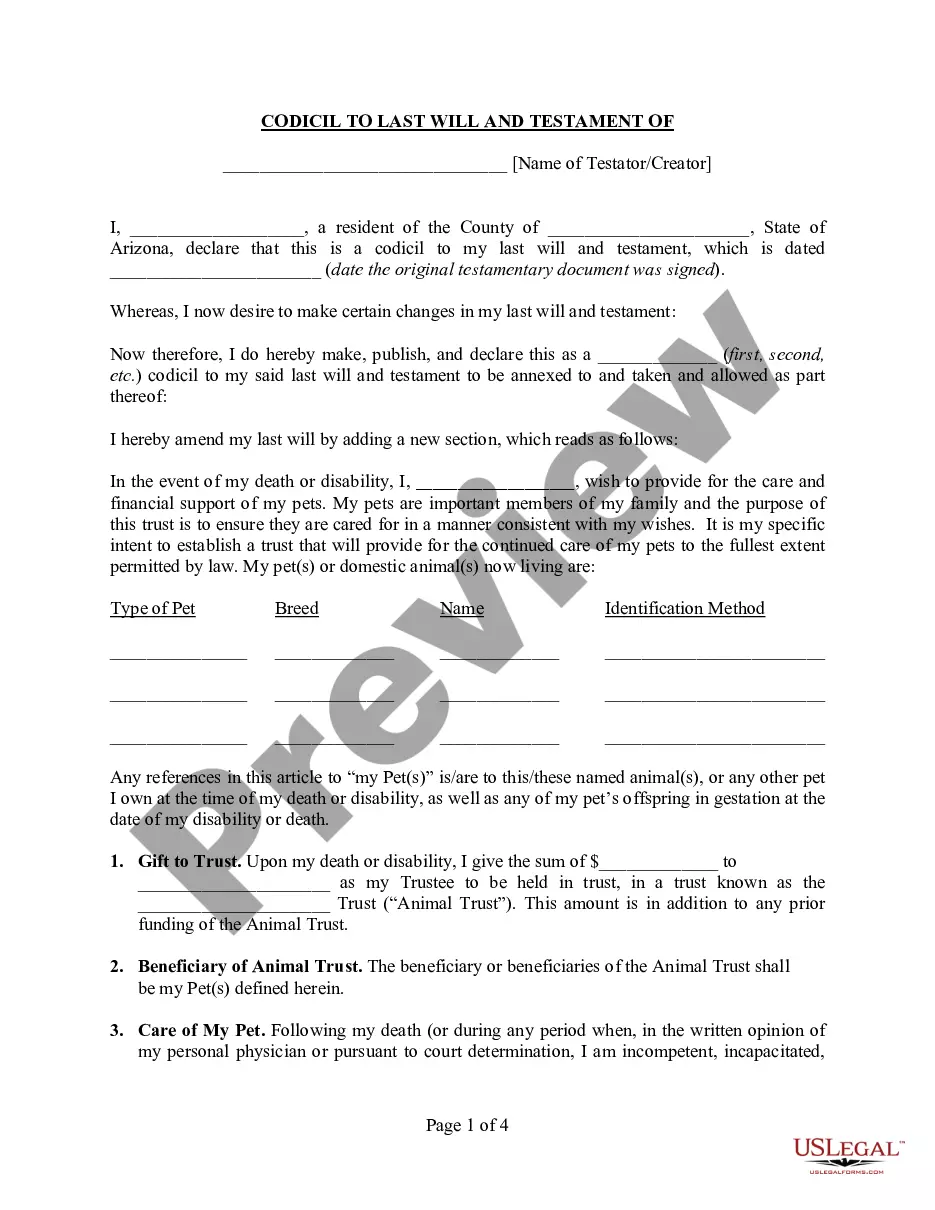

Are you looking to quickly create a legally-binding Riverside Breakdown of Savings for Budget and Emergency Fund or maybe any other document to handle your personal or corporate affairs? You can select one of the two options: contact a professional to draft a legal paper for you or draft it entirely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you get neatly written legal papers without paying unreasonable prices for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant document templates, including Riverside Breakdown of Savings for Budget and Emergency Fund and form packages. We provide documents for a myriad of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary document without extra troubles.

- First and foremost, carefully verify if the Riverside Breakdown of Savings for Budget and Emergency Fund is tailored to your state's or county's laws.

- In case the document has a desciption, make sure to verify what it's intended for.

- Start the search again if the template isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the plan that best fits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Riverside Breakdown of Savings for Budget and Emergency Fund template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. In addition, the documents we offer are updated by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!