TITLE: San Antonio Texas — Breakdown of Savings for Budget and Emergency Fund: A Comprehensive Guide for Financial Stability and Preparedness INTRODUCTION: In today's uncertain economic climate, having a proper savings plan is crucial for individuals and families residing in San Antonio, Texas. Establishing a budget and emergency fund can provide financial stability and security during unexpected situations. This detailed description aims to explore the different types of savings for budget and emergency funds available to San Antonio residents, offering a breakdown of savings strategies, relevant tips, and the importance of preparedness. 1. Traditional Savings Accounts: A traditional savings account is a fundamental starting point for budgeting and building an emergency fund. These accounts are typically offered by banks or credit unions and provide a safe place to deposit surplus funds. San Antonio residents can set aside a portion of their income into these accounts, ensuring the accumulation of savings for future expenses. 2. High-Yield Savings Accounts: For individuals seeking higher interest rates on their savings, opting for high-yield savings accounts might be a favorable choice. These accounts often require a higher minimum balance but offer more substantial returns on investments. San Antonio residents can find various financial institutions and online banks that provide high-yield savings options, allowing their savings to grow faster. 3. Certificates of Deposit (CDs): Certificates of Deposit (CDs) are a fixed-term savings option widely used in San Antonio for budgeting and emergency funds. CDs typically provide higher interest rates than traditional savings accounts but may require funds to be inaccessible for a specific period, ranging from a few months to several years. By strategically allocating funds into CDs with staggered maturity dates, San Antonio residents can maintain both short-term access and long-term growth. 4. Money Market Accounts: Money market accounts present another viable alternative for saving and budgeting in San Antonio. These accounts offer higher interest rates than traditional savings accounts while allowing limited check-writing capabilities. Money market accounts usually require a higher minimum deposit and can be ideal for individuals with more substantial savings looking for liquidity and moderate growth. 5. Cash Management Accounts: San Antonio residents may consider utilizing cash management accounts for both budgeting and building an emergency fund. These accounts function as a hybrid of checking and savings accounts, offering higher interest rates, ATM access, check-writing abilities, and often no minimum balance requirements. Cash management accounts merge the convenience of checking accounts with the growth potential of savings accounts. 6. Emergency Funds: Apart from regular savings accounts, setting up a dedicated emergency fund is of utmost importance for San Antonio residents. Emergency funds must be readily accessible in times of unexpected financial needs, such as medical emergencies or job loss. Financial experts often recommend keeping three to six months' worth of living expenses in an easily accessible and separate account. CONCLUSION: In conclusion, San Antonio Texas offers a wide range of savings options for budgeting and building an emergency fund. Residents must explore various account types, such as traditional savings accounts, high-yield savings accounts, CDs, money market accounts, and cash management accounts, to find one that aligns with their financial goals and circumstances. Establishing a well-structured savings plan, including dedicated emergency funds, is critical in ensuring financial stability, preparedness, and peace of mind for the San Antonio community.

San Antonio Texas Breakdown of Savings for Budget and Emergency Fund

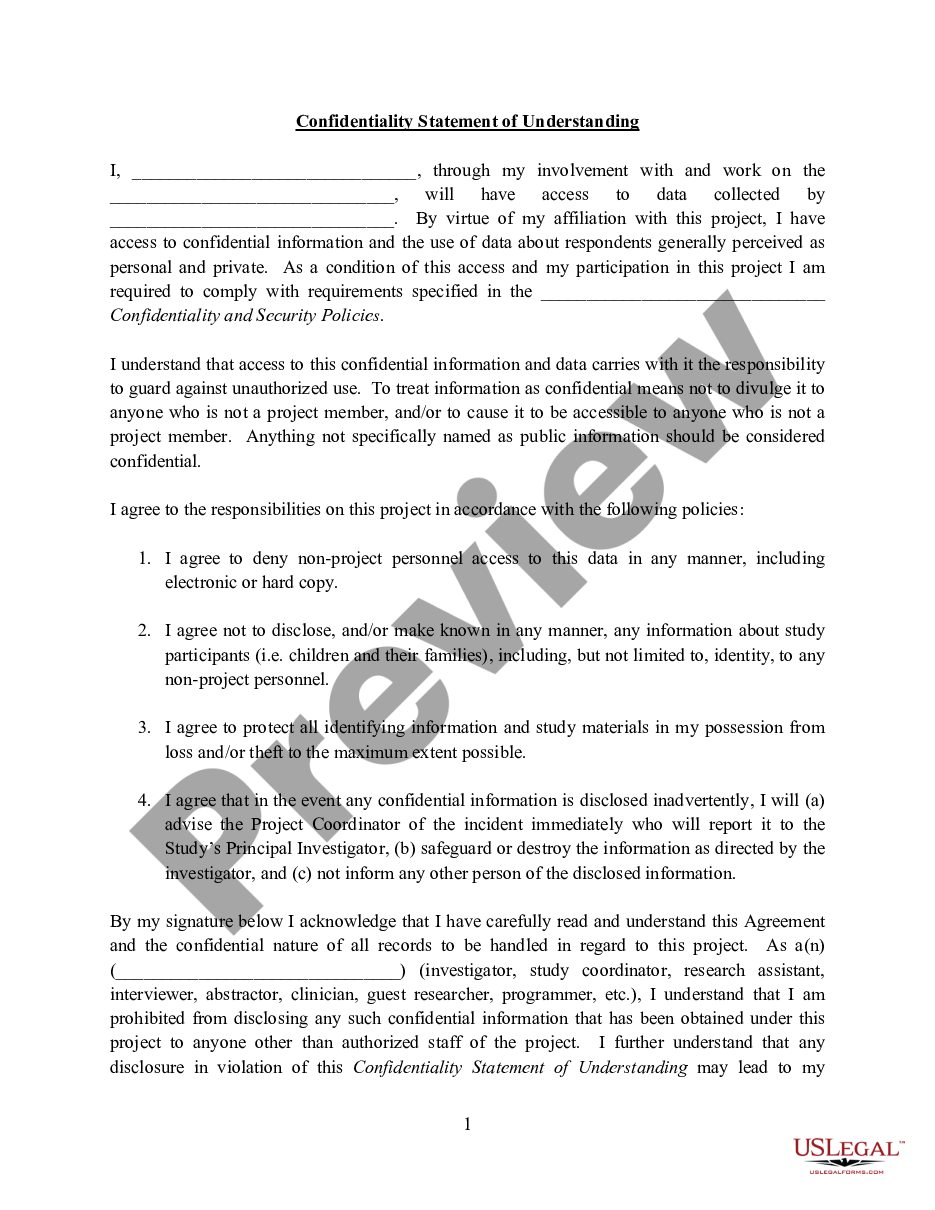

Description

How to fill out San Antonio Texas Breakdown Of Savings For Budget And Emergency Fund?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, locating a San Antonio Breakdown of Savings for Budget and Emergency Fund meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. In addition to the San Antonio Breakdown of Savings for Budget and Emergency Fund, here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can get the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your San Antonio Breakdown of Savings for Budget and Emergency Fund:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the San Antonio Breakdown of Savings for Budget and Emergency Fund.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!