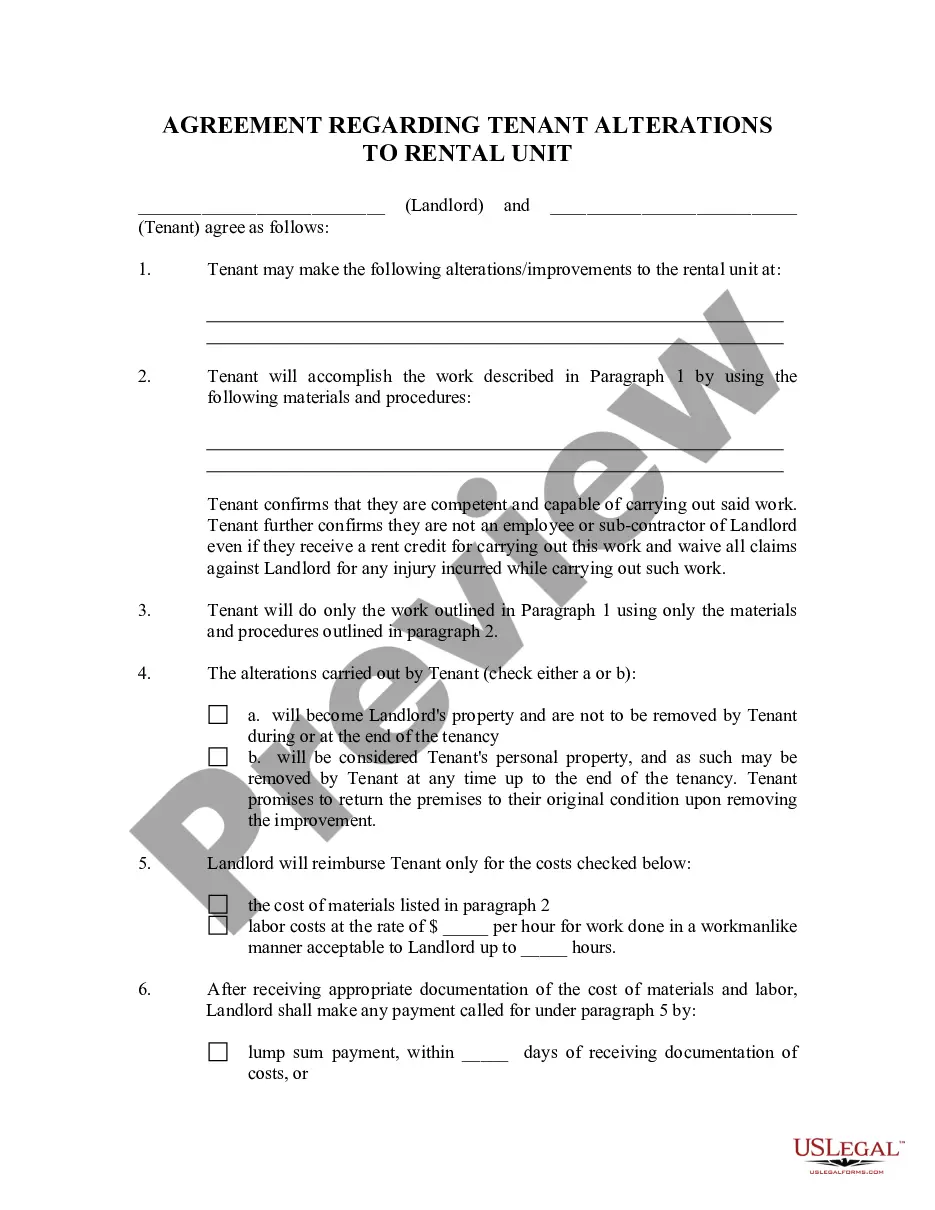

Chicago, Illinois stands as a bustling metropolis and economic hub renowned for its vibrant business landscape. In this thriving urban center, commercial property owners often seek financing solutions to propel their ventures forward. One such option is the Assignment of Commercial Leases as Collateral for a Commercial Loan, a popular avenue for securing funding in Chicago's competitive market. The Assignment of Commercial Leases as Collateral for a Commercial Loan involves transferring the rights and benefits of leases associated with a commercial property to a lender. By doing so, property owners offer these leases as collateral, allowing lenders to mitigate their risk while providing the necessary financing to support local businesses. This arrangement protects the lender's investment and provides a level of certainty that helps expedite the loan approval process. Different types of Assignment of Commercial Leases as Collateral for Commercial Loan arrangements can cater to various circumstances in Chicago. Let's explore a few: 1. Absolute Assignment: This type of assignment involves transferring full control over the leases to the lender. In the event of default, the lender can step in and collect rent directly from the tenants until the outstanding loan balance is cleared. 2. Conditional Assignment: Here, the assignment of leases only occurs if the borrower defaults on their loan obligations. Until such a scenario arises, the property owner retains control over the leases, receiving rent and managing tenant relationships as usual. 3. Fixed Charge Assignment: Under this type of assignment, a specific amount or percentage of rent collected from the tenants is assigned to the lender as repayment towards the commercial loan. The property owner continues to handle lease management but channels a portion of the rental income to the lender. 4. Floating Charge Assignment: In a floating charge assignment, the percentage or amount assigned to the lender varies depending on the property owner's ongoing loan balance. As the loan is repaid, the assigned portion of rent adjusts accordingly to reflect the reduced debt. The Assignment of Commercial Leases as Collateral for a Commercial Loan in Chicago is beneficial for both property owners and lenders. Property owners gain access to vital funds to expand their businesses, renovate properties, or seize new opportunities. Simultaneously, lenders receive added security and a reliable repayment source through the leases associated with the property. For Chicago-based entrepreneurs and investors, understanding the nuances of these assignment types becomes pivotal when seeking commercial loans secured by a property's leases. As leases play a crucial role in revenue generation, leveraging them effectively can pave the way for business growth and advancement in the Windy City.

Chicago Illinois Assignment of Commercial Leases as Collateral for Commercial Loan

Description

How to fill out Chicago Illinois Assignment Of Commercial Leases As Collateral For Commercial Loan?

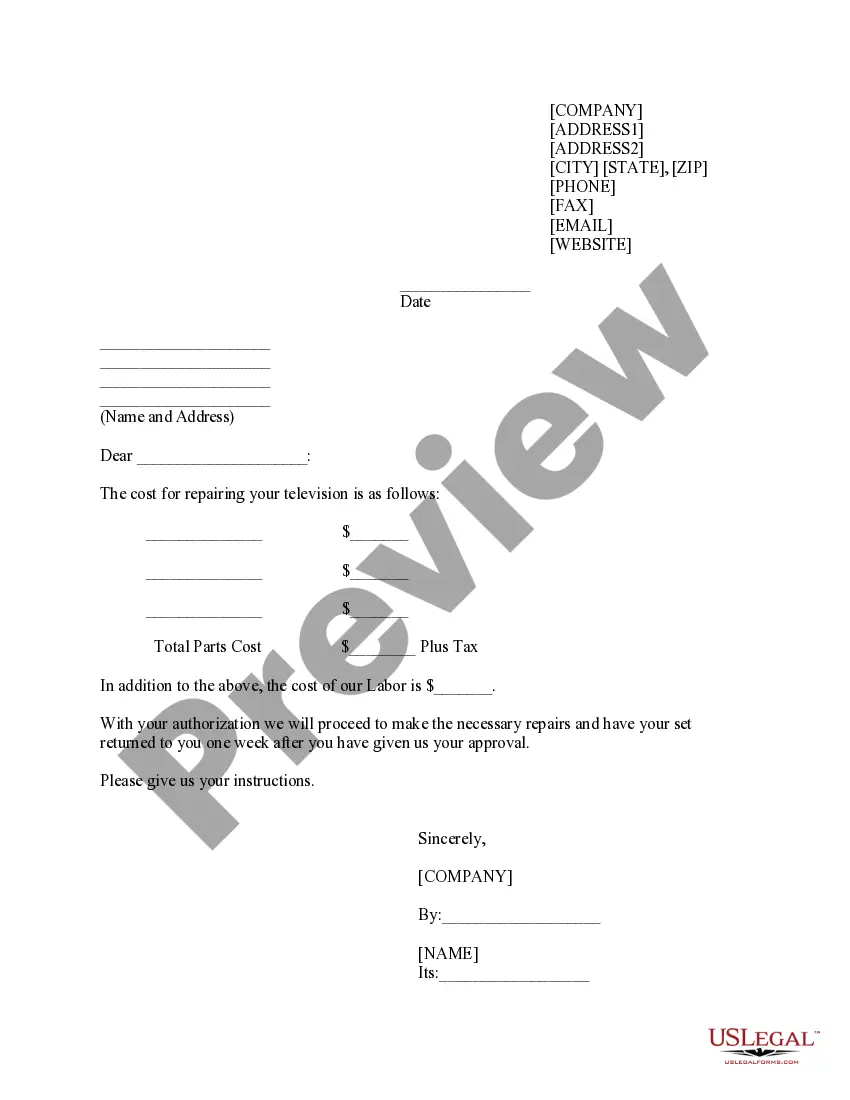

Do you need to quickly create a legally-binding Chicago Assignment of Commercial Leases as Collateral for Commercial Loan or probably any other form to take control of your personal or business matters? You can go with two options: contact a legal advisor to write a valid paper for you or draft it completely on your own. Thankfully, there's another option - US Legal Forms. It will help you get neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-compliant form templates, including Chicago Assignment of Commercial Leases as Collateral for Commercial Loan and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the needed template without extra troubles.

- First and foremost, carefully verify if the Chicago Assignment of Commercial Leases as Collateral for Commercial Loan is adapted to your state's or county's laws.

- If the form includes a desciption, make sure to check what it's suitable for.

- Start the search again if the document isn’t what you were looking for by utilizing the search bar in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Chicago Assignment of Commercial Leases as Collateral for Commercial Loan template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Moreover, the documents we provide are updated by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

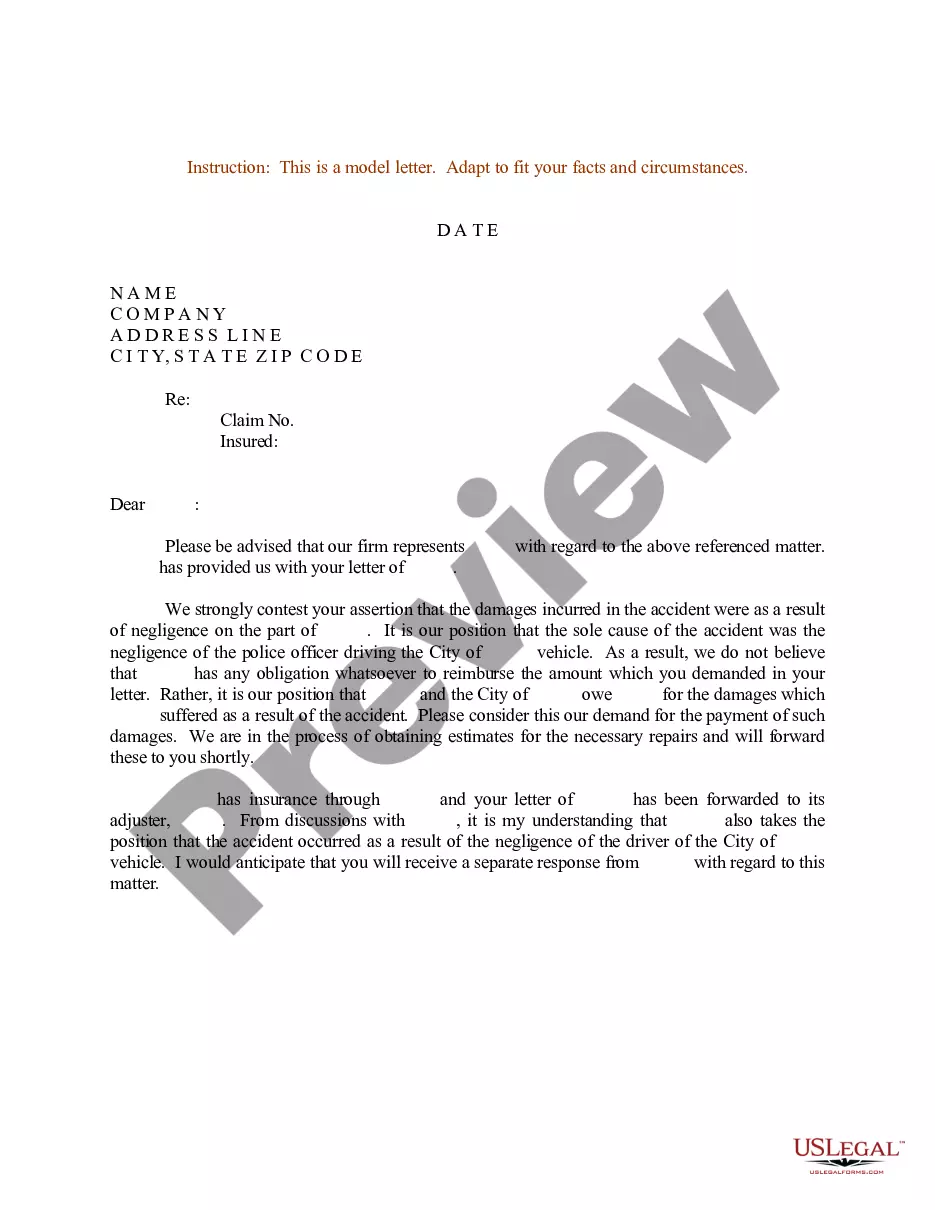

A collateral assignment of lease is a legal contract that transfers the rights to rental payments from the asset's owner to a lender to secure funding. In this contract, the lease's rentals are like a loan from the funder to the lessor and the lease acts as security.

Assignment of leases and rents allows lenders to a degree of financial protection in case a loan default occurs. This document is an agreement made between a borrower and a lender of mortgage loans. It often details an exact amount the lender will be entitled to if a default happens.

An assignment of leases and rents is used to create a security interest in the rent and other income generated by real property securing a commercial real estate loan.

Collateral assignment of life insurance lets you use a life insurance policy as an asset to secure a loan. If you die while the policy is in place and still owe money on the loan, the death benefit goes to pay off the remaining debt. Any money remaining goes to your beneficiaries.

An ?assignment of rents? allows the lender to collect the rent payments, if the borrower defaults on their loan payments.

Any sort of residential house can be accepted as collateral by your lender. It can be a self-occupied house you are currently staying in, a rented residential property that you are using as a source of income, or a vacant residential house that you aren't currently using.

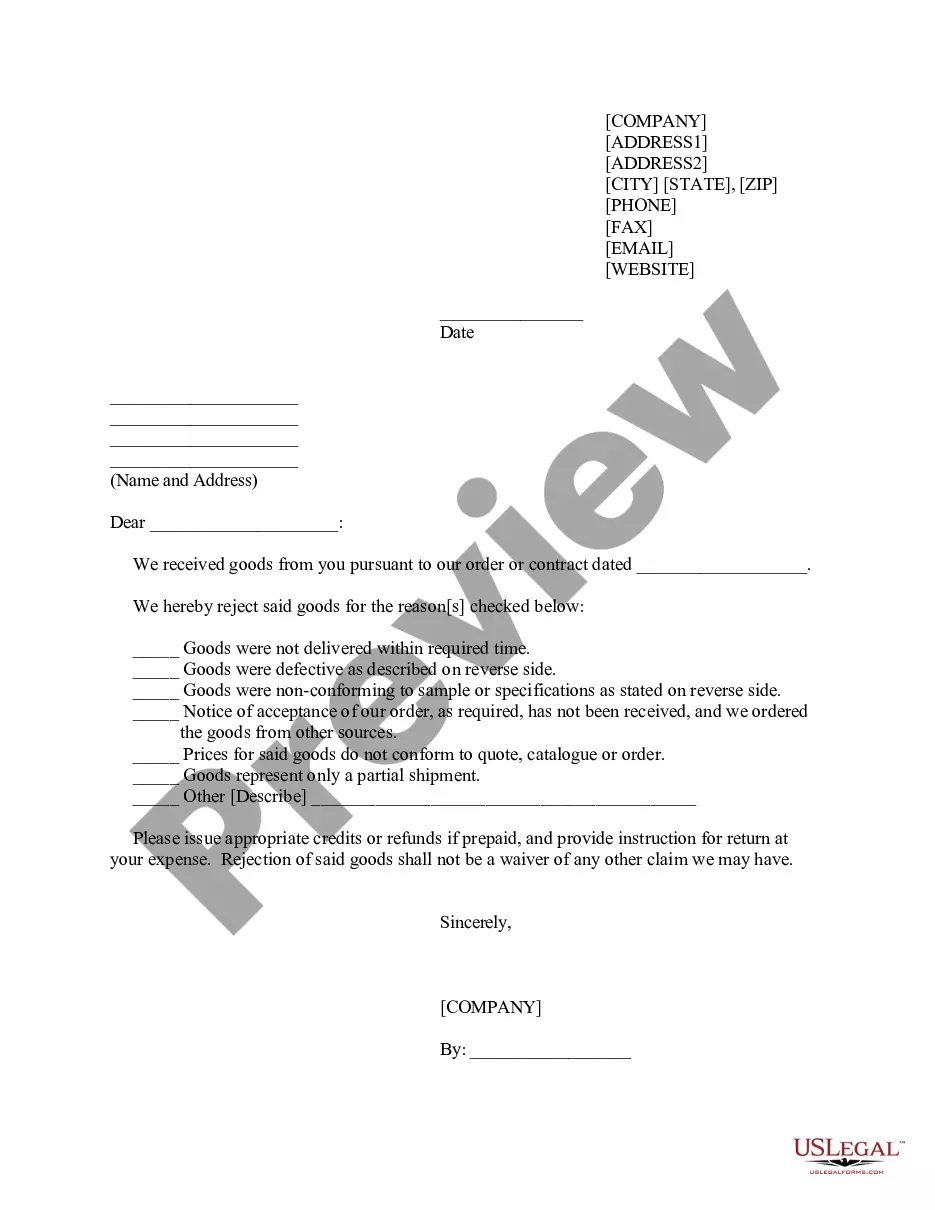

An assignment is when the tenant transfers their lease interest to a new tenant using a Lease Assignment. The assignee takes the assignor's place in the landlord-tenant relationship, although the assignor may remain liable for damages, missed rent payments, and other lease violations.

Collateral assignment is the transfer of the rights to the rental payments from and a security interest (lien ) in a leased asset by the asset's owner and lessor to lenders ? the lease funders ? to secure the funding upon payment of the consideration by the funder to the lessor, typically structured on a nonrecourse

A Collateral Assignment of Rents agreement is used when a landlord seeks to place a mortgage on a property subject to a pre-existing lease. In such situations, a lender will typically ask that the lease payments serve as collateral, in addition to the property itself.

Assignment of Mortgage ? The Basics. When your original lender transfers your mortgage account and their interests in it to a new lender, that's called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner.