Maricopa, Arizona is a vibrant city located in the southern part of the state, offering a wide range of opportunities for residents and businesses alike. Among the various financial tools available in Maricopa for commercial entities, one noteworthy option is the Assignment of Commercial Leases as Collateral for Commercial Loan. The Assignment of Commercial Leases as Collateral for Commercial Loan in Maricopa, Arizona allows businesses to leverage their existing leases as collateral when seeking a commercial loan. This means that by assigning their lease agreement to a lender, businesses can secure the loan and access the necessary capital for expansion, operations, or any other commercial purpose. One of the primary advantages of utilizing the Assignment of Commercial Leases as Collateral for a Commercial Loan is that it allows businesses to tap into the value of their lease even if they do not own the property. This can be especially beneficial for businesses operating in retail spaces, office buildings, or industrial complexes that want to unlock the potential of their lease agreement to secure additional financing. Several types of Maricopa Arizona Assignment of Commercial Leases as Collateral for Commercial Loan are available to meet different business needs: 1. Full Assignment: In this type, the entire lease is assigned as collateral for the commercial loan. The lender assumes full rights and obligations associated with the lease until the loan is repaid, including rent collection and property maintenance responsibilities. 2. Partial Assignment: With a partial assignment, only a portion of the lease is assigned as collateral for the loan. This allows businesses to retain some control over their lease while still leveraging its value to secure financing. 3. Subordination Agreement: In this arrangement, the lender agrees to subordinate their lien on the lease to another mortgage or lien holder. This type of assignment allows businesses to utilize the lease as collateral for multiple loans or credit facilities. It is crucial to understand that Maricopa, Arizona Assignment of Commercial Leases as Collateral for Commercial Loan is a legally binding agreement between the business owner, lender, and property owner, all parties should engage legal professionals with expertise in commercial real estate transactions to ensure compliance with local regulations and laws. By utilizing the Assignment of Commercial Leases as Collateral for Commercial Loan in Maricopa, Arizona, businesses gain the potential to unlock the value of their lease agreements, providing a valuable tool for accessing the finance necessary for growth, expansion, and operational improvements.

Maricopa Arizona Assignment of Commercial Leases as Collateral for Commercial Loan

Description

How to fill out Maricopa Arizona Assignment Of Commercial Leases As Collateral For Commercial Loan?

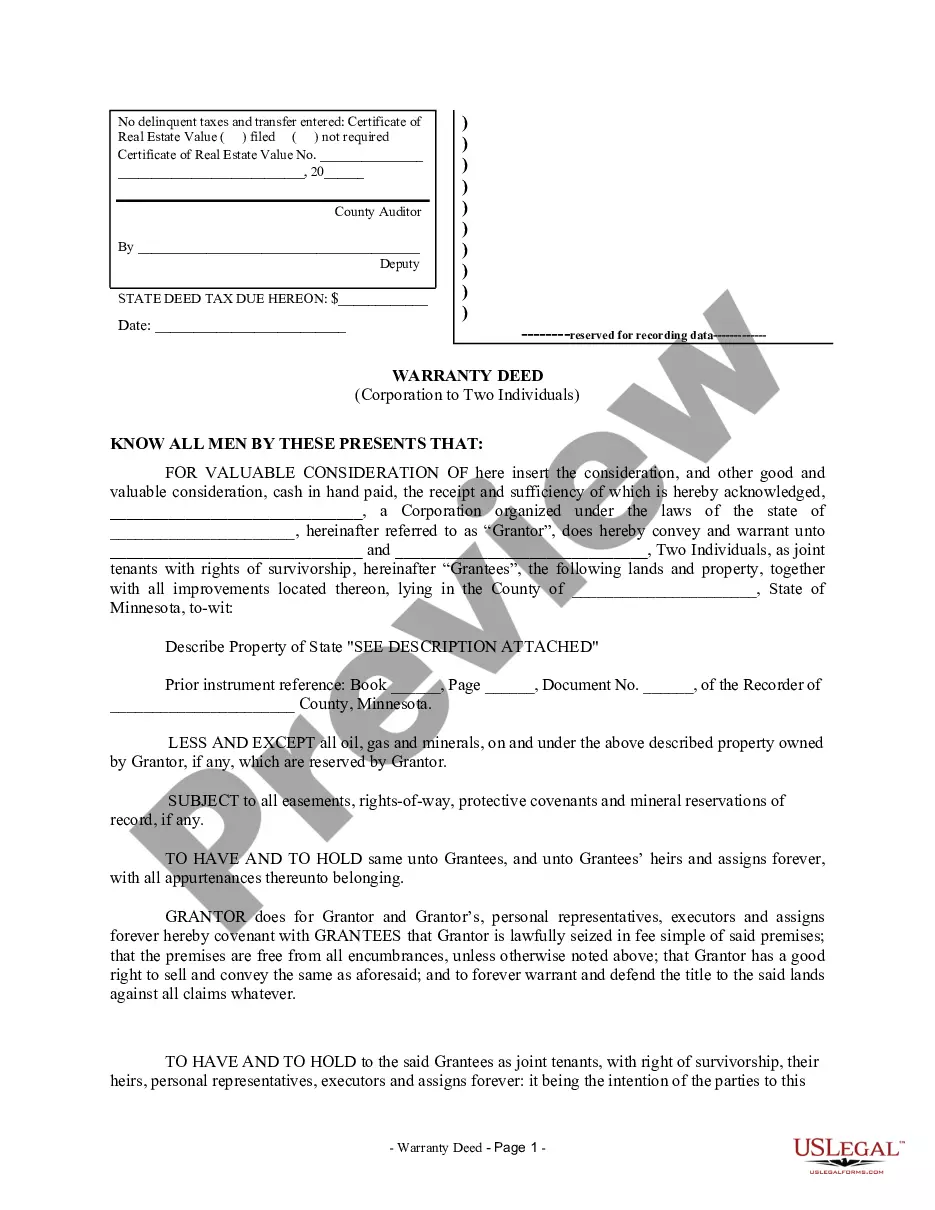

Are you looking to quickly create a legally-binding Maricopa Assignment of Commercial Leases as Collateral for Commercial Loan or probably any other document to handle your personal or corporate matters? You can select one of the two options: contact a professional to draft a valid document for you or draft it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get professionally written legal papers without paying sky-high fees for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-specific document templates, including Maricopa Assignment of Commercial Leases as Collateral for Commercial Loan and form packages. We provide templates for an array of life circumstances: from divorce papers to real estate documents. We've been on the market for over 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the needed document without extra troubles.

- First and foremost, carefully verify if the Maricopa Assignment of Commercial Leases as Collateral for Commercial Loan is adapted to your state's or county's regulations.

- In case the form includes a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the document isn’t what you were seeking by utilizing the search bar in the header.

- Select the plan that best fits your needs and move forward to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Maricopa Assignment of Commercial Leases as Collateral for Commercial Loan template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Moreover, the paperwork we provide are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!