San Diego, California is a vibrant city located on the coast of Southern California, known for its stunning beaches, diverse culture, and thriving business community. It is a popular destination for both tourists and entrepreneurs, offering numerous opportunities for commercial growth and development. Assignment of Commercial Leases as Collateral for Commercial Loan is a legal agreement in San Diego, California where a commercial property owner assigns their lease agreements as collateral for obtaining a commercial loan. This arrangement allows the lender to claim ownership and control over the leased property if the borrower defaults on the loan. It provides a level of security to lenders by offering an additional asset to recover their investment in case of loan default. There are several types of Assignment of Commercial Leases as Collateral for Commercial Loan in San Diego, California. These include: 1. Traditional Assignment: This is the most common type of assignment where the lease agreement is transferred to the lender as collateral. It gives the lender the right to assume all the rights and obligations of the lease, including collecting rent, maintaining the property, and making lease-related decisions. 2. Absolute Assignment: In this type of assignment, the borrower transfers complete ownership and control of the leased property to the lender. The lender assumes all responsibilities of the lease, including legal and financial liabilities, giving them full control over the property. 3. Conditional Assignment: This type of assignment specifies certain conditions that need to be met before the transfer of lease occurs. These conditions may include timely loan repayments, maintaining the property in a certain condition, or meeting specific performance targets. Only upon meeting these conditions, does the lender gain control over the lease. 4. Partial Assignment: In certain cases, property owners may choose to assign only a portion of the lease as collateral. This enables them to retain control over certain aspects of the property while offering a part of the lease as collateral for the loan. Assignment of Commercial Leases as Collateral for Commercial Loan in San Diego, California provides lenders with a valuable security instrument, ensuring their investment is protected. It also allows property owners to leverage their lease agreements to secure financing for business expansion, renovations, or other commercial ventures.

San Diego California Assignment of Commercial Leases as Collateral for Commercial Loan

Description

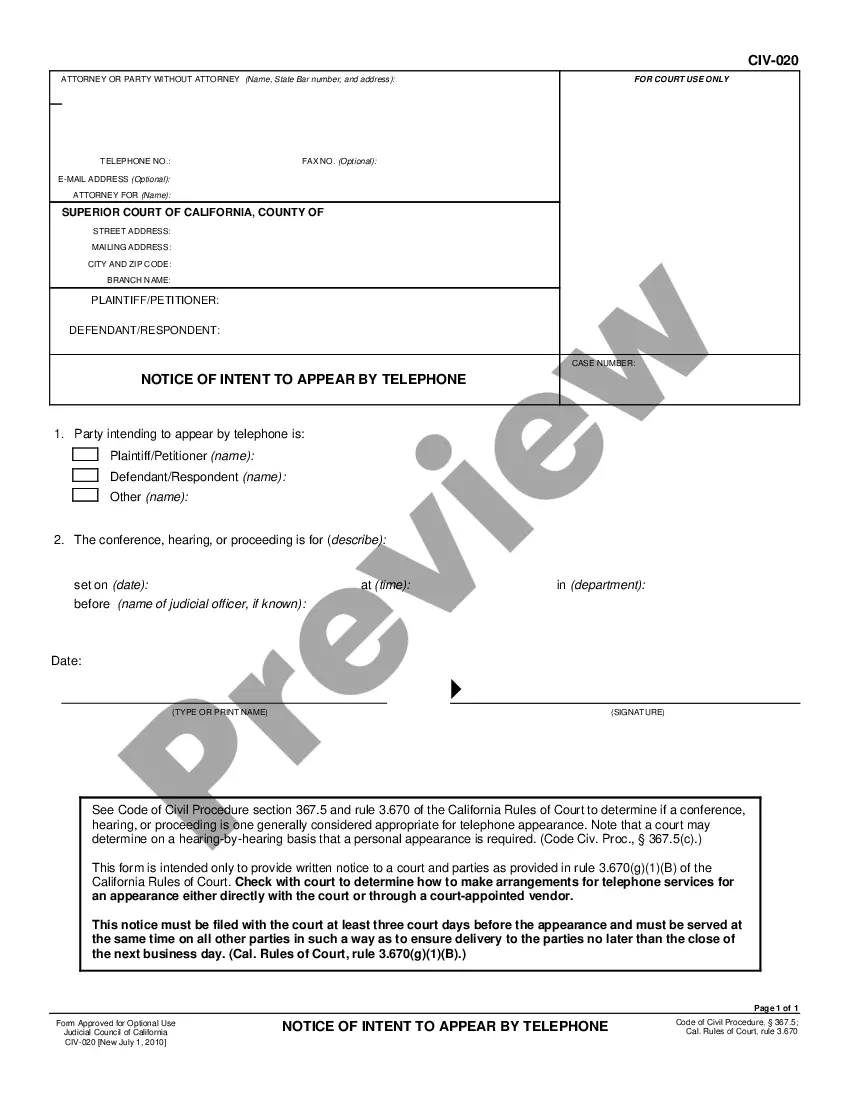

How to fill out San Diego California Assignment Of Commercial Leases As Collateral For Commercial Loan?

If you need to find a reliable legal paperwork provider to find the San Diego Assignment of Commercial Leases as Collateral for Commercial Loan, look no further than US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can browse from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support make it easy to get and execute various paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply type to search or browse San Diego Assignment of Commercial Leases as Collateral for Commercial Loan, either by a keyword or by the state/county the form is intended for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the San Diego Assignment of Commercial Leases as Collateral for Commercial Loan template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and select a subscription option. The template will be immediately available for download as soon as the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less pricey and more affordable. Set up your first business, arrange your advance care planning, create a real estate agreement, or execute the San Diego Assignment of Commercial Leases as Collateral for Commercial Loan - all from the comfort of your home.

Join US Legal Forms now!