San Jose, California, is a vibrant city located in the heart of Silicon Valley. Known for its thriving tech industry, diverse population, and excellent quality of life, San Jose offers numerous opportunities for businesses and investors. One attractive option for commercial real estate ventures is utilizing the Assignment of Commercial Leases as Collateral for a Commercial Loan. An Assignment of Commercial Leases as Collateral for a Commercial Loan refers to the process of using a commercial lease agreement as collateral in securing a loan for a business or commercial property. This type of arrangement provides lenders with additional security, as it allows them to claim the leased property or its rental income if the borrower defaults on the loan. In San Jose, California, there are various types of Assignment of Commercial Leases as Collateral for Commercial Loan arrangements available, including: 1. Single-Tenant Lease Assignments: In this scenario, the borrower assigns a lease agreement for a property that is exclusively occupied by a single tenant. Lenders may evaluate the financial stability of the tenant to assess the loan's risk and determine the loan amount. 2. Multi-Tenant Lease Assignments: Here, the borrower assigns a lease agreement for a commercial property that has multiple tenants. Lenders may scrutinize the tenant mix, rental income distribution, and overall stability of the property to evaluate the loan's feasibility and amount. 3. Retail Lease Assignments: This type of Assignment of Commercial Leases involves a borrower utilizing retail leases as collateral for a commercial loan. Lenders may pay specific attention to factors such as location, foot traffic, lease terms, and tenant creditworthiness. 4. Office Lease Assignments: In this case, the borrower assigns office leases as collateral for a commercial loan. Lenders may consider the occupancy rate, lease duration, rental rates, and the creditworthiness of tenants when evaluating the loan viability. 5. Industrial Lease Assignments: This type involves borrowers using industrial leases as collateral for a commercial loan. Lenders may assess factors such as property location, lease terms, industry demand, and tenant creditworthiness. It is important for borrowers and lenders in San Jose, California to carefully analyze the specific terms of the lease agreements, understand local zoning regulations, and assess the property's market value when considering an Assignment of Commercial Leases as Collateral for a Commercial Loan. Seeking advice from legal and financial professionals experienced in real estate transactions is highly recommended navigating any potential complexities and ensure a smooth and successful process. Keywords: San Jose, California, commercial lease, collateral, commercial loan, Silicon Valley, tech industry, Assignment of Commercial Leases, loan security, single-tenant, multi-tenant, retail, office, industrial, lease agreement, property, rental income, borrower, lender, real estate, market value, zoning regulations

San Jose California Assignment of Commercial Leases as Collateral for Commercial Loan

Description

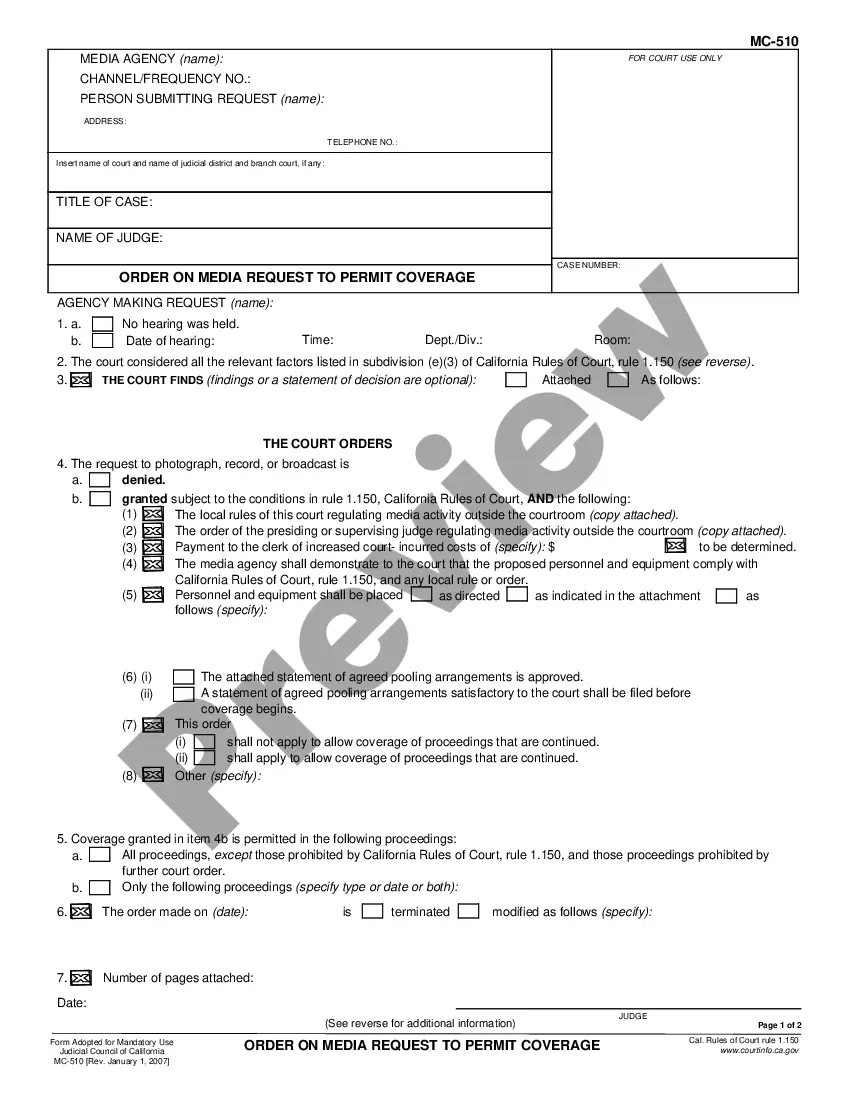

How to fill out San Jose California Assignment Of Commercial Leases As Collateral For Commercial Loan?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a lawyer to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Jose Assignment of Commercial Leases as Collateral for Commercial Loan, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Therefore, if you need the current version of the San Jose Assignment of Commercial Leases as Collateral for Commercial Loan, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Jose Assignment of Commercial Leases as Collateral for Commercial Loan:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your San Jose Assignment of Commercial Leases as Collateral for Commercial Loan and save it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!