Allegheny Pennsylvania Assignment of Leases and Rents as Collateral Security for a Commercial Loan is a legal mechanism used to secure a commercial loan by assigning the leases and rental income from a property in Allegheny County, Pennsylvania. This type of collateral security arrangement provides lenders with an additional layer of protection, ensuring their interests are safeguarded in case of loan default or non-payment. When a borrower applies for a commercial loan in Allegheny County, they may agree to assign the leases and rents associated with the property to the lender as collateral security. This means that in the event of default, the lender can step in and collect the rental income generated from the property to recoup their investment. The assignment of leases and rents essentially gives the lender the right to step into the borrower's shoes and collect the income stream from tenants directly. There are different types of Assignment of Leases and Rents as Collateral Security for a Commercial Loan in Allegheny, Pennsylvania. Some common variations include: 1. Absolute Assignment: This type of assignment grants the lender full control over the leases and rents, allowing them to manage and collect the funds directly. The borrower loses all control and decision-making power regarding the leases and rents associated with the property. 2. Conditional Assignment: In this type of assignment, the lender gains control over the leases and rents only when specific conditions are triggered, such as loan default or non-payment. Until then, the borrower retains control and continues to manage the property's income stream. 3. Partial Assignment: With a partial assignment, the borrower assigns a portion of the rental income to the lender as collateral security. This arrangement may involve assigning a specific percentage or a fixed amount of the rental income to the lender while the borrower retains control over the rest. 4. Revocable Assignment: This type of assignment allows the borrower to revoke the collateral security arrangement in certain circumstances, such as loan repayment or meeting specific conditions specified in the loan agreement. The lender's control over the leases and rents is subject to the borrower's discretion. Assigning leases and rents as collateral security provides assurance to lenders that they have a reliable source of income to recover their investment in case of default. It safeguards their interests and allows them to minimize potential losses. This arrangement also demonstrates the borrower's commitment to meeting their loan obligations and enhances their chances of securing favorable loan terms. In conclusion, Allegheny Pennsylvania Assignment of Leases and Rents as Collateral Security for a Commercial Loan is a legally binding agreement that protects lenders by assigning the leases and rental income from a property as collateral. Various types of assignment exist, such as absolute, conditional, partial, and revocable, offering different levels of control and flexibility for both lenders and borrowers. It is an essential mechanism in securing commercial loans and maintaining financial stability for both parties involved.

Allegheny Pennsylvania Assignment of Leases and Rents as Collateral Security for a Commercial Loan

Description

How to fill out Allegheny Pennsylvania Assignment Of Leases And Rents As Collateral Security For A Commercial Loan?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal paperwork that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any personal or business objective utilized in your region, including the Allegheny Assignment of Leases and Rents as Collateral Security for a Commercial Loan.

Locating samples on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Allegheny Assignment of Leases and Rents as Collateral Security for a Commercial Loan will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to get the Allegheny Assignment of Leases and Rents as Collateral Security for a Commercial Loan:

- Make sure you have opened the correct page with your regional form.

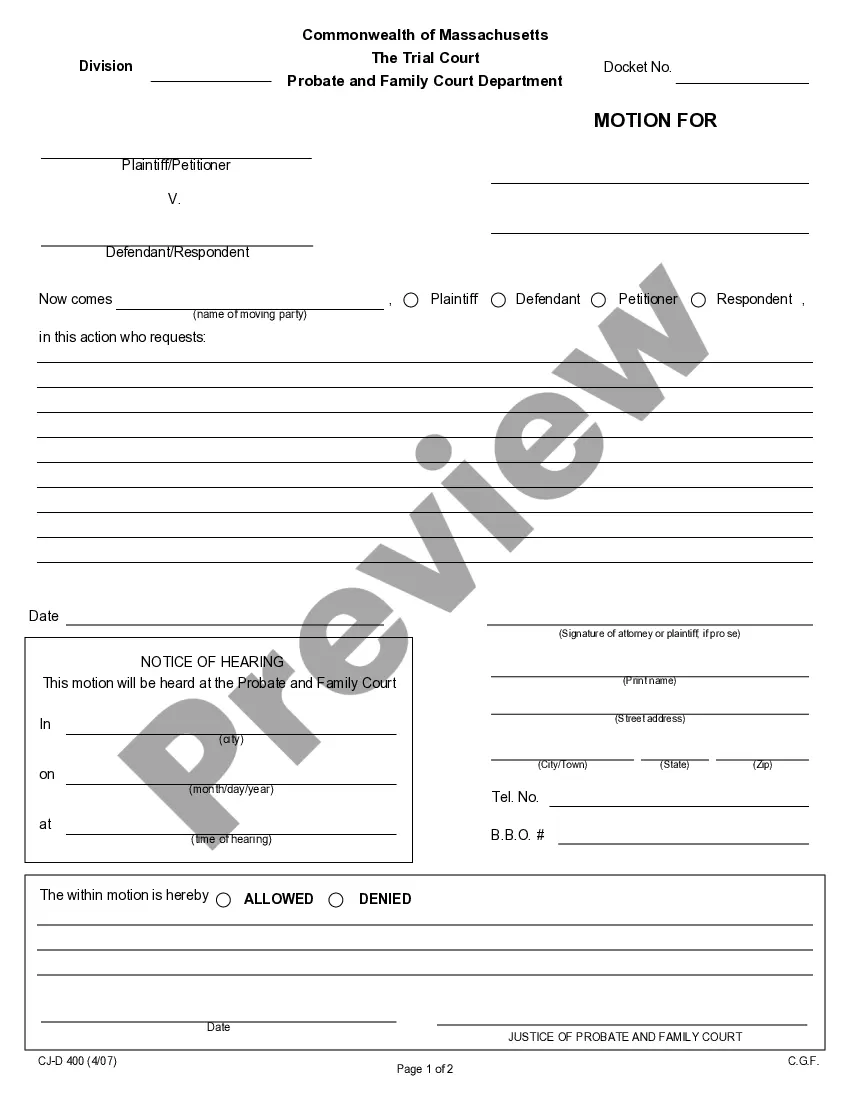

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Allegheny Assignment of Leases and Rents as Collateral Security for a Commercial Loan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!