Dallas Texas Assignment of Leases and Rents as Collateral Security for a Commercial Loan is a legal agreement that provides lenders with additional protection when issuing a commercial loan by using the borrower's leases and rental income as collateral. This arrangement helps secure the loan by allowing the lender to have a claim on the rental income generated by the property under the borrower's lease agreements. Keyword: Dallas Texas Assignment of Leases and Rents In Dallas, Texas, the Assignment of Leases and Rents as Collateral Security for a Commercial Loan is a common practice in the commercial real estate industry. It is a valuable tool for lenders, allowing them to mitigate the risk associated with a loan and ensure repayment. The Assignment of Leases and Rents acts as a legal document that enables the lender to step in to collect rent payments directly from tenants if the borrower defaults on the loan. By doing so, the lender seeks to protect their investment and maintain a continuous stream of income to repay the outstanding debt. There are different types of Dallas Texas Assignment of Leases and Rents as Collateral Security for a Commercial Loan available, each offering varying levels of protection and flexibility: 1. Absolute Assignment: Under this type of assignment, the borrower transfers all rights, title, and interest in the leases and rental income to the lender. The lender retains full control and ownership of the rents until the loan is fully repaid. 2. Conditional Assignment: Here, the borrower assigns the leases and rents to the lender as collateral but still maintains the right to collect rent payments unless a default occurs. If the borrower fails to make timely loan payments or breaches the loan agreement, the lender gains the right to collect the rents directly. 3. Rent Interception Agreement: This agreement allows the lender to intercept rent payments from tenants directly and redirect them towards loan repayment. The borrower retains ownership of the leases and rental income until a default occurs, triggering the lender's right to intercept. 4. Subordination Agreement: In some cases, multiple lenders may be involved. A subordination agreement establishes the priority of claims on the leases and rental income if multiple loans are outstanding. This document clarifies the order in which lenders are entitled to receive rent payments. The Dallas Texas Assignment of Leases and Rents as Collateral Security for a Commercial Loan serves as a safeguard for lenders in the event of loan default. It ensures an additional layer of security by allowing them to recover outstanding debts through the collection of lease payments. This practice reinforces the stability and reliability of commercial lending, fostering growth and development in the thriving business environment of Dallas, Texas.

Dallas Texas Assignment of Leases and Rents as Collateral Security for a Commercial Loan

Description

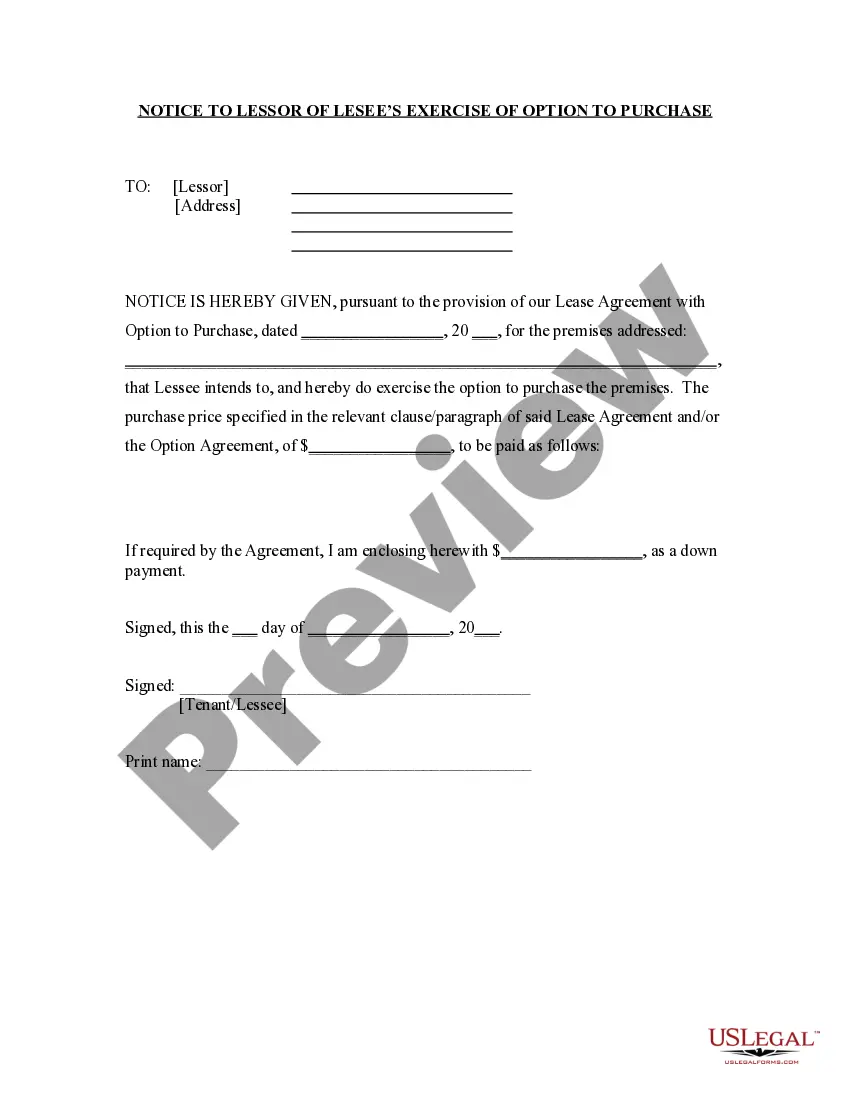

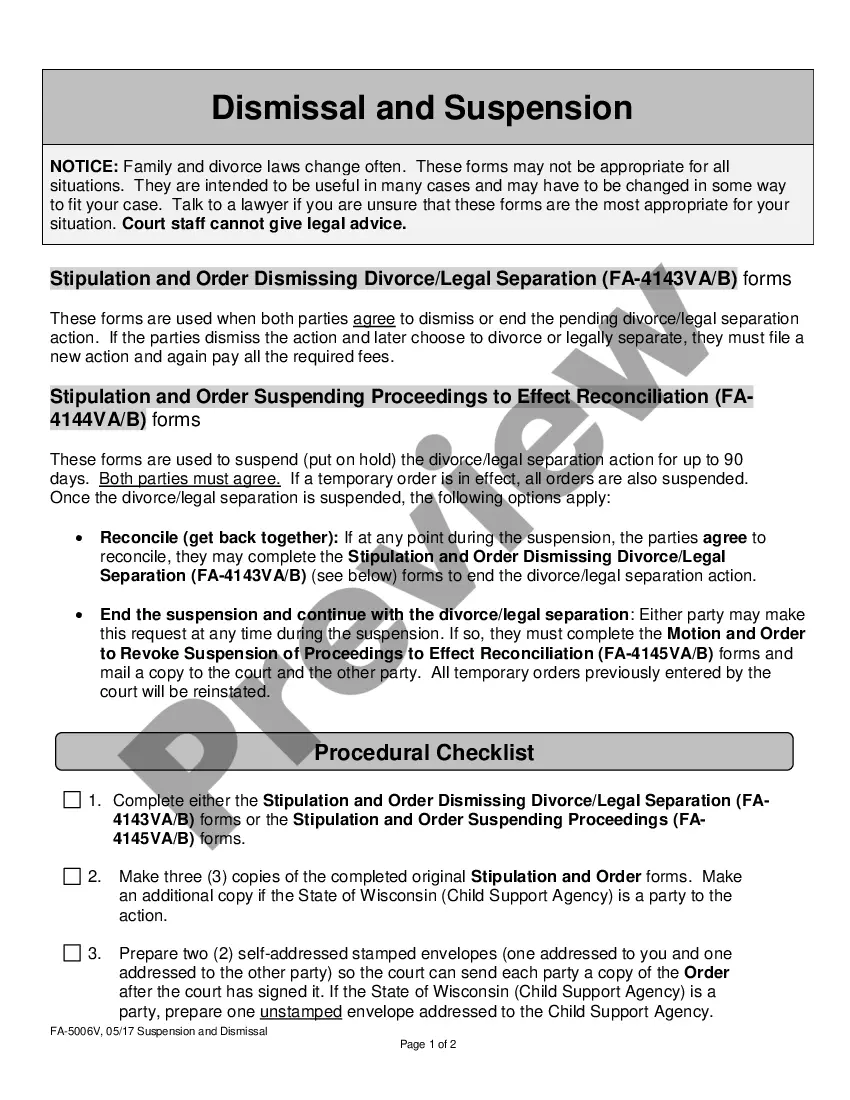

How to fill out Dallas Texas Assignment Of Leases And Rents As Collateral Security For A Commercial Loan?

Draftwing forms, like Dallas Assignment of Leases and Rents as Collateral Security for a Commercial Loan, to take care of your legal matters is a difficult and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can consider your legal issues into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms created for various scenarios and life circumstances. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Dallas Assignment of Leases and Rents as Collateral Security for a Commercial Loan template. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before downloading Dallas Assignment of Leases and Rents as Collateral Security for a Commercial Loan:

- Ensure that your document is compliant with your state/county since the regulations for writing legal paperwork may differ from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Dallas Assignment of Leases and Rents as Collateral Security for a Commercial Loan isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start using our service and download the document.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment details.

- Your template is good to go. You can try and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!