Orange California Assignment of Leases and Rents as Collateral Security for a Commercial Loan is a legal document that provides protection to lenders in the event of default by the borrower. This agreement allows the lender to use the income from the leases and rents of a commercial property located in Orange, California, as collateral for the loan. The assignment of leases and rents serves as a security measure for lenders to ensure they have a means of recouping their investment in case the borrower fails to repay the loan. In this arrangement, the borrower assigns their right to receive income from the leases and rents of the property to the lender as collateral for the loan. There are several types of Orange California Assignment of Leases and Rents as Collateral Security for a Commercial Loan: 1. Absolute Assignment: This type of assignment is the most common. It involves the borrower assigning all rights to receive income from leases and rents to the lender, providing the lender with full control over the property's cash flow in the event of default. 2. Conditional Assignment: In a conditional assignment, the lender only gains control over the income from leases and rents if the borrower defaults on the loan. Until that point, the borrower retains full control over the property's income. 3. Floating Assignment: A floating assignment allows the borrower to continue managing the commercial property and receiving the income from leases and rents as long as they remain in good standing with their loan payments. However, if the borrower defaults, the assignment becomes effective, and the lender gains control over the property's income. 4. Partial Assignment: A partial assignment involves the borrower assigning only a portion of their right to receive income from leases and rents to the lender. This arrangement is often used when the borrower wants to retain some control over the property's cash flow. Orange California Assignment of Leases and Rents as Collateral Security for a Commercial Loan is a crucial legal agreement that provides lenders with a level of protection by using the income from leases and rents as collateral. It ensures that lenders have a means of recovering their investment if the borrower defaults on the loan. The specific type of assignment chosen will depend on the agreement between the lender and borrower, considering factors such as the borrower's creditworthiness, risk tolerance, and desired level of control over the property's income.

Orange California Assignment of Leases and Rents as Collateral Security for a Commercial Loan

Description

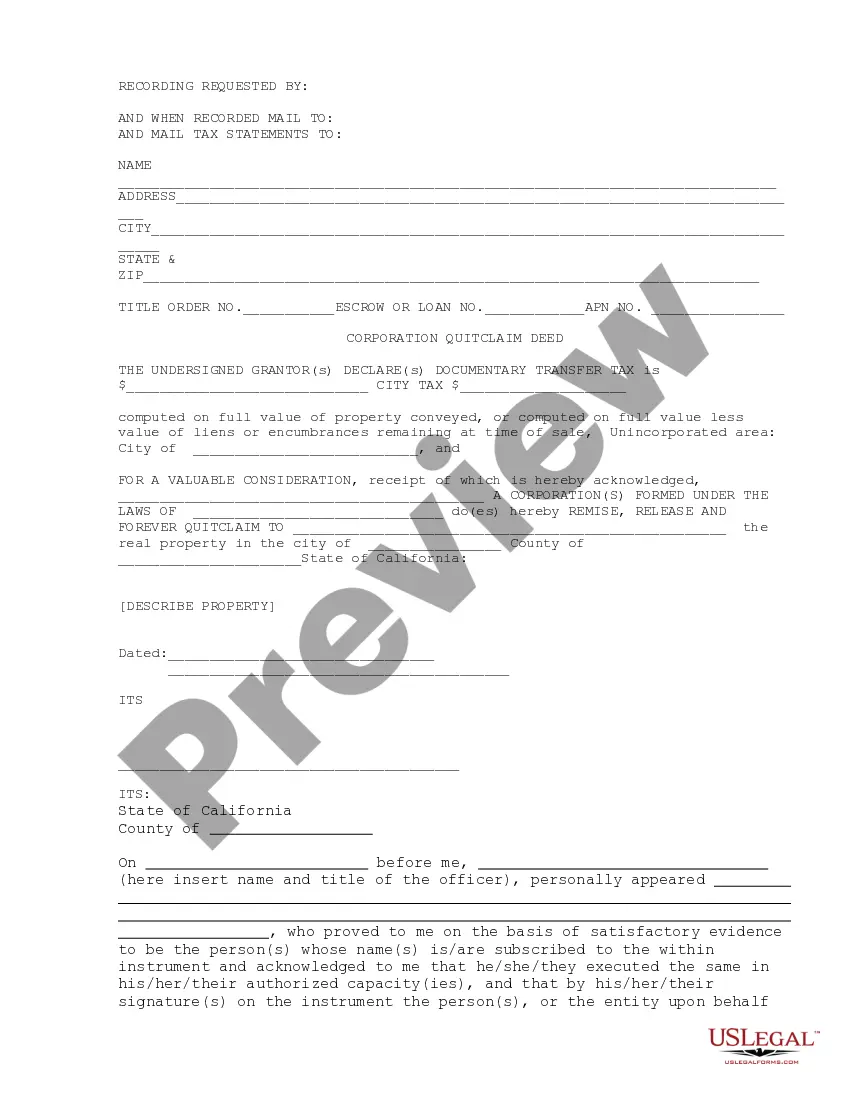

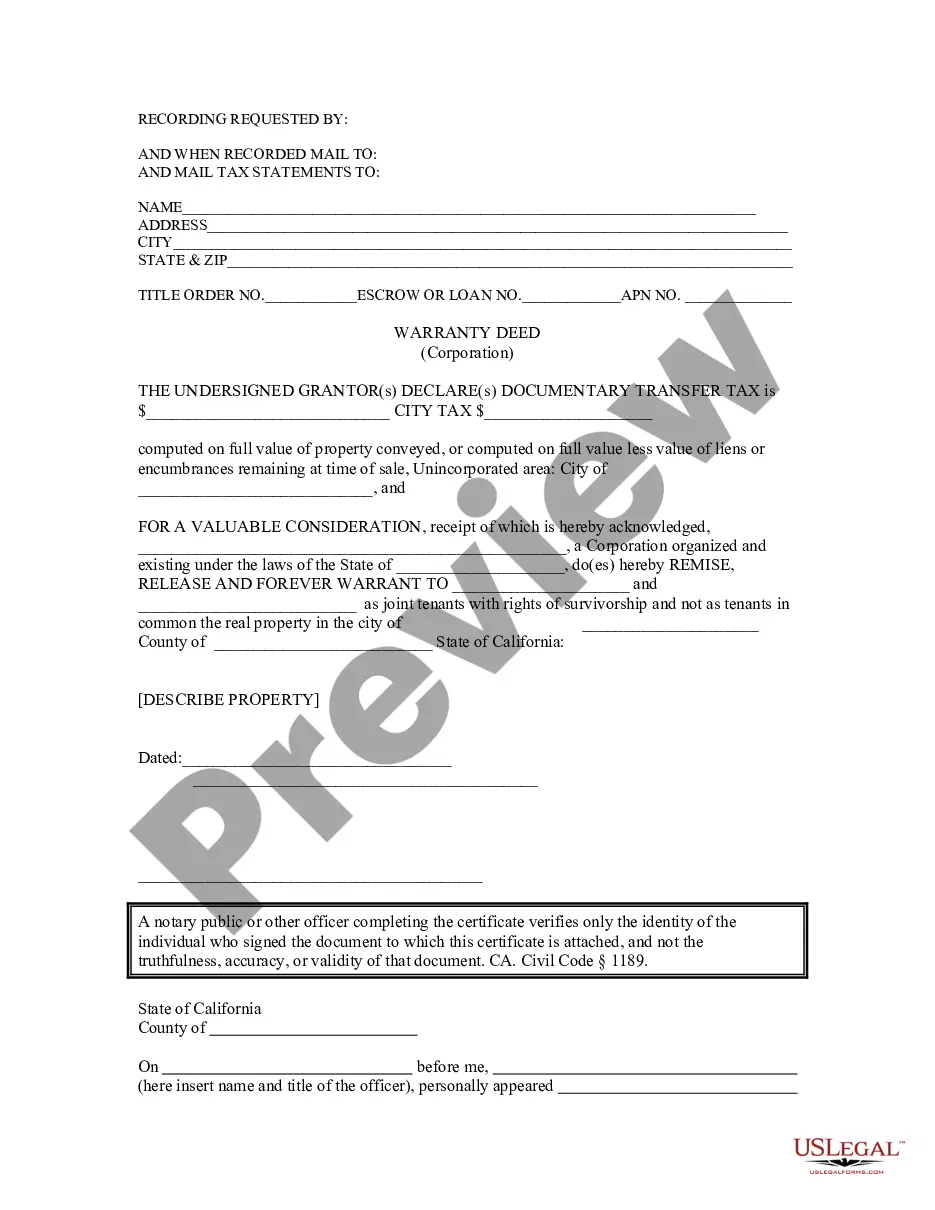

How to fill out Orange California Assignment Of Leases And Rents As Collateral Security For A Commercial Loan?

If you need to find a reliable legal form supplier to find the Orange Assignment of Leases and Rents as Collateral Security for a Commercial Loan, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can browse from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of supporting resources, and dedicated support make it simple to get and execute different documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply select to search or browse Orange Assignment of Leases and Rents as Collateral Security for a Commercial Loan, either by a keyword or by the state/county the document is intended for. After locating required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Orange Assignment of Leases and Rents as Collateral Security for a Commercial Loan template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Create an account and select a subscription option. The template will be immediately available for download once the payment is completed. Now you can execute the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less pricey and more reasonably priced. Create your first company, arrange your advance care planning, draft a real estate contract, or complete the Orange Assignment of Leases and Rents as Collateral Security for a Commercial Loan - all from the convenience of your sofa.

Sign up for US Legal Forms now!