Riverside California Assignment of Leases and Rents as Collateral Security for a Commercial Loan is a legal agreement that serves as a protective measure for lenders in the event of a borrower defaulting on their commercial loan. This arrangement provides lenders with an additional level of security by allowing them to collect rental income and assume control over lease agreements in case of non-payment. In Riverside California, there are two main types of Assignment of Leases and Rents as Collateral Security for a Commercial Loan: 1. Absolute Assignment: This type of assignment gives the lender full control and ownership of the leases and rental income. The borrower transfers all rights, title, and interest in the leases to the lender, who then has the authority to collect and use the rental proceeds to recover their loan amount. 2. Conditional Assignment: Unlike the absolute assignment, this type of assignment only grants the lender control over the lease agreements and rental income under specific conditions, usually related to the borrower defaulting on their loan obligations. In such cases, the lender can step in, collect the rents, and use them to offset the outstanding loan balance. Both types of Assignment of Leases and Rents as Collateral Security for a Commercial Loan provide lenders with a safety net, ensuring that they can recover some of their investment by utilizing the rental income generated by the property in case of default. These arrangements are commonly used in commercial real estate financing and protect the lender's interests in Riverside California. It is important to note that the details and terms of the Assignment of Leases and Rents may vary depending on the specific loan agreement and the lender's requirements. As such, borrowers and lenders should consult legal professionals familiar with Riverside California laws to ensure compliance and effective utilization of this collateral security mechanism in commercial loan transactions.

Riverside California Assignment of Leases and Rents as Collateral Security for a Commercial Loan

Description

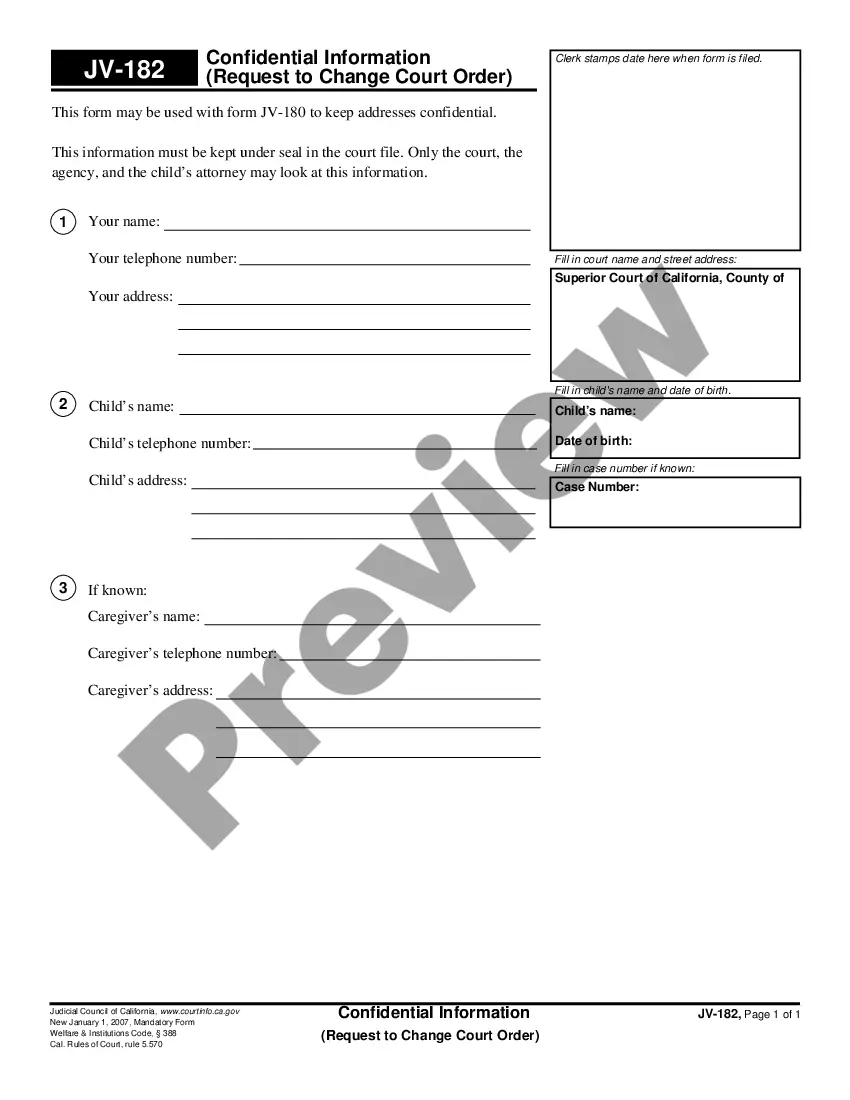

How to fill out Riverside California Assignment Of Leases And Rents As Collateral Security For A Commercial Loan?

Draftwing documents, like Riverside Assignment of Leases and Rents as Collateral Security for a Commercial Loan, to take care of your legal affairs is a tough and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task expensive. However, you can get your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents crafted for different cases and life circumstances. We make sure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Riverside Assignment of Leases and Rents as Collateral Security for a Commercial Loan template. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before getting Riverside Assignment of Leases and Rents as Collateral Security for a Commercial Loan:

- Ensure that your form is specific to your state/county since the regulations for creating legal papers may differ from one state another.

- Discover more information about the form by previewing it or going through a quick intro. If the Riverside Assignment of Leases and Rents as Collateral Security for a Commercial Loan isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to begin using our service and get the form.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment details.

- Your template is good to go. You can try and download it.

It’s an easy task to find and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!