Wake North Carolina Assignment of Leases and Rents as Collateral Security for a Commercial Loan is a legal agreement made between a lender and a borrower in the context of a commercial loan transaction. This agreement allows the lender to use the borrower's leases and rental income as collateral to secure their loan. In Wake North Carolina, there are two primary types of Assignment of Leases and Rents as Collateral Security for a Commercial Loan: 1. Absolute Assignment of Leases and Rents: Under this type of assignment, the borrower transfers full control and ownership of their leases and rental income to the lender. The lender has the right to collect and use the rents from the property in the event of default by the borrower. The lender also assumes responsibility for managing the property and enforcing lease agreements. 2. Conditional Assignment of Leases and Rents: This type of assignment provides the lender with a conditional right to collect and use the rents, usually triggered by a specific event such as default or non-payment by the borrower. Unlike an absolute assignment, the borrower typically retains control and ownership of their leases and rental income until a specified event occurs. The Wake North Carolina Assignment of Leases and Rents as Collateral Security for a Commercial Loan typically includes various key provisions to protect the lender's interests: 1. Grant of Security Interest: This provision outlines the borrower's agreement to pledge their leases and rental income as collateral for the commercial loan, granting the lender a security interest in these assets. 2. Assignment Clause: This clause details the assignment of the leases and rents, specifying whether it is an absolute or conditional assignment and indicating the affected properties and associated leases. 3. Payment and Collection Rights: This section describes how the lender will exercise their rights to collect rents and other income generated by the underlying leases, ensuring that they are used to repay the commercial loan. 4. Subordination Clause: In some cases, there may be existing leases or encumbrances on the property. This clause addresses the priority of the lender's rights over such existing rights, ensuring that the lender's interest is protected. 5. Events of Default and Remedies: This provision outlines the specific circumstances that would constitute a default by the borrower and the actions the lender can take in response, such as accelerating the loan, foreclosing on the property, or assuming management control. The Wake North Carolina Assignment of Leases and Rents as Collateral Security for a Commercial Loan serves as an essential legal document that safeguards the lender's investment by providing collateral in the form of the borrower's leases and rental income. It ensures that the lender has a valid claim to these assets in the event of default, offering a level of security that encourages lending in commercial real estate transactions.

Wake North Carolina Assignment of Leases and Rents as Collateral Security for a Commercial Loan

Description

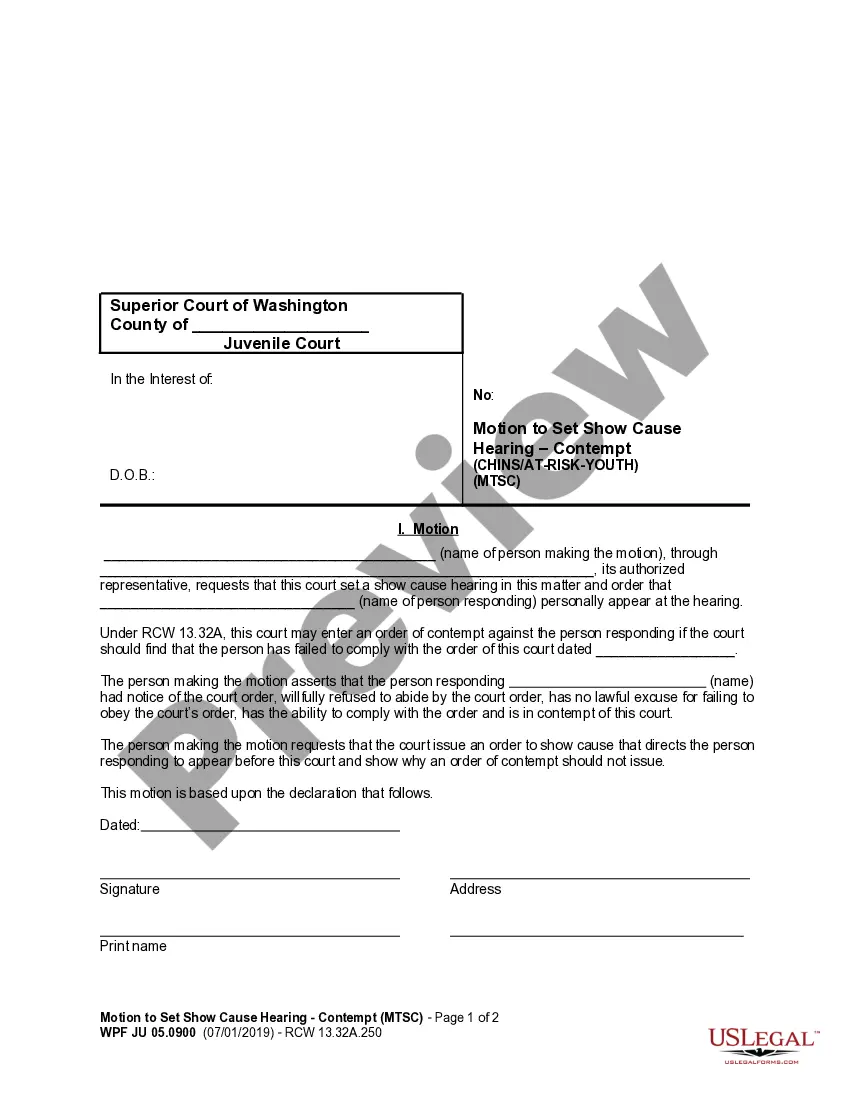

How to fill out Wake North Carolina Assignment Of Leases And Rents As Collateral Security For A Commercial Loan?

Preparing legal documentation can be burdensome. In addition, if you decide to ask an attorney to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Wake Assignment of Leases and Rents as Collateral Security for a Commercial Loan, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Therefore, if you need the latest version of the Wake Assignment of Leases and Rents as Collateral Security for a Commercial Loan, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Wake Assignment of Leases and Rents as Collateral Security for a Commercial Loan:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Wake Assignment of Leases and Rents as Collateral Security for a Commercial Loan and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Collateral assignment of life insurance lets you use a life insurance policy as an asset to secure a loan. If you die while the policy is in place and still owe money on the loan, the death benefit goes to pay off the remaining debt. Any money remaining goes to your beneficiaries.

An assignment of leases and rents is used to create a security interest in the rent and other income generated by real property securing a commercial real estate loan.

A collateral assignment of life insurance is a conditional assignment appointing a lender as the primary beneficiary of a death benefit to use as collateral for a loan. If the borrower is unable to pay, the lender can cash in the life insurance policy and recover what is owed.

A collateral assignment of life insurance is a conditional assignment appointing a lender as the primary beneficiary of a death benefit to use as collateral for a loan. If the borrower is unable to pay, the lender can cash in the life insurance policy and recover what is owed.

A collateral assignment of lease is a legal contract that transfers the rights to rental payments from the asset's owner to a lender to secure funding. In this contract, the lease's rentals are like a loan from the funder to the lessor and the lease acts as security.

Collateral Assignment of Contracts means the assignment of representations, warranties, covenants, indemnities and rights to the Agent, in respect of the Loan Parties' rights under that certain Escrow Agreement executed in connection with the Riverstone Acquisition delivered on the Original Closing Date.

Assignment of Rents and Leases The Borrower hereby assigns to the Lender all right, title, and interest of the Borrower in the Rent and Leases to have and to hold absolutely until all monies secured by this Mortgage and all obligations of the Borrower in this Mortgage have been fully paid and satisfied.

The assignment of leases and rents, also known as the assignment of leases rents and profits, is a legal document that gives a mortgage lender right to any future profits that may come from leases and rents when a property owner defaults on their loan. This document is usually attached to a mortgage loan agreement.

Collateral assignment is the transfer of the rights to the rental payments from and a security interest (lien ) in a leased asset by the asset's owner and lessor to lenders the lease funders to secure the funding upon payment of the consideration by the funder to the lessor, typically structured on a nonrecourse

The assignment of leases and rents, also known as the assignment of leases rents and profits, is a legal document that gives a mortgage lender right to any future profits that may come from leases and rents when a property owner defaults on their loan. This document is usually attached to a mortgage loan agreement.