The Bronx, located in New York City, offers a variety of commercial loan options to borrowers. One critical aspect of securing a commercial loan in the Bronx is obtaining the Bronx New York Certificate of Borrower. This certificate serves as a vital document in the loan application process, demonstrating the borrower's ability to meet the obligations of the loan. The Bronx New York Certificate of Borrower is an official document provided by the borrower to the lender to establish their creditworthiness as well as their commitment to fulfilling the terms of the commercial loan. This certificate includes comprehensive information about the borrower's financial standing, business operations, and credit history, allowing the lender to assess the borrower's credibility and evaluate the associated risks. The certificate typically includes key details such as the borrower's legal name, contact information, business description, and structure. It highlights the borrower's financial statements, including balance sheets, income statements, and cash flow statements, providing a comprehensive overview of the company's financial health. Additionally, the certificate may mention any collateral offered against the loan, such as property or equipment, reinforcing the borrower's ability to repay the loan. Different types of Bronx New York Certificates of Borrower may exist, tailored to specific commercial loan scenarios or requirements. Some common variations include: 1. Standard Commercial Loan Certificate: This is a general-purpose certificate for borrowers seeking conventional commercial loans in the Bronx. It covers all essential aspects of the borrower's financial position and creditworthiness. 2. Small Business Administration (SBA) Loan Certificate: This certificate is necessary for borrowers availing SBA loans, which are backed by the U.S. Small Business Administration. It includes additional documentation specific to SBA loan eligibility criteria and requirements. 3. Construction Loan Certificate: This certificate may be required when seeking a commercial loan for construction projects in the Bronx. It may focus on the borrower's construction experience, project plans, budgets, and potential risks associated with the development. 4. Loan Refinancing Certificate: Borrowers seeking to refinance their existing commercial loans in the Bronx may need to provide this certificate. It emphasizes the reasons for refinancing, improvements in financial standing, and the borrower's ability to manage the new loan terms. 5. Specialized Industry-Specific Loan Certificate: Depending on the industry or sector in which the borrower operates, specialized certificates may be required. These could include additional information related to regulatory compliance, licensing, or specific industry metrics. In conclusion, the Bronx New York Certificate of Borrower is a crucial document for securing commercial loans in the Bronx. By providing comprehensive information about the borrower's financial health and creditworthiness, it helps lenders assess the risks associated with the loan. Different variations of this certificate exist to cater to specific loan types and borrower circumstances.

Bronx New York Certificate of Borrower regarding Commercial Loan

Description

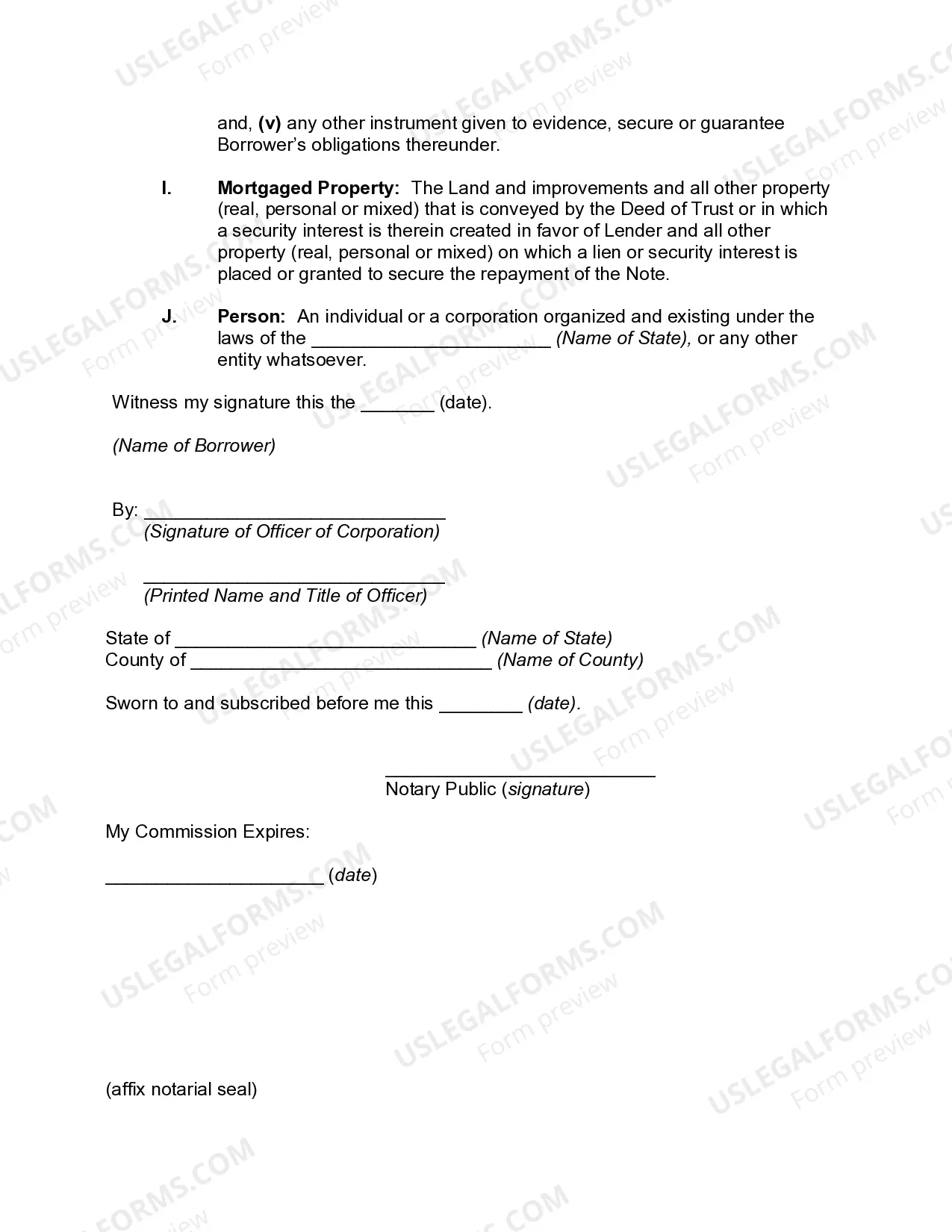

How to fill out Bronx New York Certificate Of Borrower Regarding Commercial Loan?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare official paperwork that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any individual or business purpose utilized in your county, including the Bronx Certificate of Borrower regarding Commercial Loan.

Locating samples on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Bronx Certificate of Borrower regarding Commercial Loan will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to get the Bronx Certificate of Borrower regarding Commercial Loan:

- Make sure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Bronx Certificate of Borrower regarding Commercial Loan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!