Contra Costa California Certificate of Borrower is an official document related to commercial loans in Contra Costa County, California. It is designed to verify the eligibility and financial standings of a borrower seeking a commercial loan within the county. This certificate serves as a crucial piece of information for lenders to evaluate the creditworthiness of the borrower and assess the viability of approving a loan. The Contra Costa California Certificate of Borrower contains valuable information pertaining to the borrower's financial history, credit score, income, assets, liabilities, and repayment capacity. Lenders require this documentation to make informed decisions, minimize risk, and ensure responsible lending practices. Different types of Contra Costa California Certificates of Borrower regarding Commercial Loan may include: 1. Standard Certificate of Borrower: This is the most common type of certificate used for commercial loans in Contra Costa County, California. It provides a comprehensive overview of the borrower's financial profile, including credit history, income documentation, tax returns, and any existing debts or obligations. 2. Small Business Certificate: Specifically designed for small businesses, this certificate emphasizes the borrower's business performance, financial statements, cash flow projections, and potential for growth. Lenders often request additional documentation such as business bank statements and business plans to better evaluate the borrower's commercial viability. 3. Non-Resident Borrower Certificate: This certificate caters to borrowers who do not reside within Contra Costa County but seek commercial loans for properties or businesses located in the county. It ensures that out-of-town borrowers meet specific requirements and adhere to local regulations. 4. Construction Loan Certificate: For borrowers seeking loans related to construction projects, this certificate focuses on construction plans, permits, contractor agreements, and estimated project costs. It helps lenders assess whether the borrower has the necessary expertise and financial stability to complete the project successfully. 5. Multi-Property Certificate: This type of certificate applies to borrowers who own multiple investment properties in Contra Costa County and seek loans against their real estate portfolio. It highlights property details, rental income, and overall investment performance to assist lenders in evaluating the borrower's ability to manage multiple properties and repay the loan. In conclusion, the Contra Costa California Certificate of Borrower is a vital document for individuals and businesses seeking commercial loans within Contra Costa County. It ensures transparency, provides lenders with accurate financial information, and assists in making informed decisions regarding loan approvals.

Contra Costa California Certificate of Borrower regarding Commercial Loan

Description

How to fill out Contra Costa California Certificate Of Borrower Regarding Commercial Loan?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Contra Costa Certificate of Borrower regarding Commercial Loan, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Contra Costa Certificate of Borrower regarding Commercial Loan from the My Forms tab.

For new users, it's necessary to make several more steps to get the Contra Costa Certificate of Borrower regarding Commercial Loan:

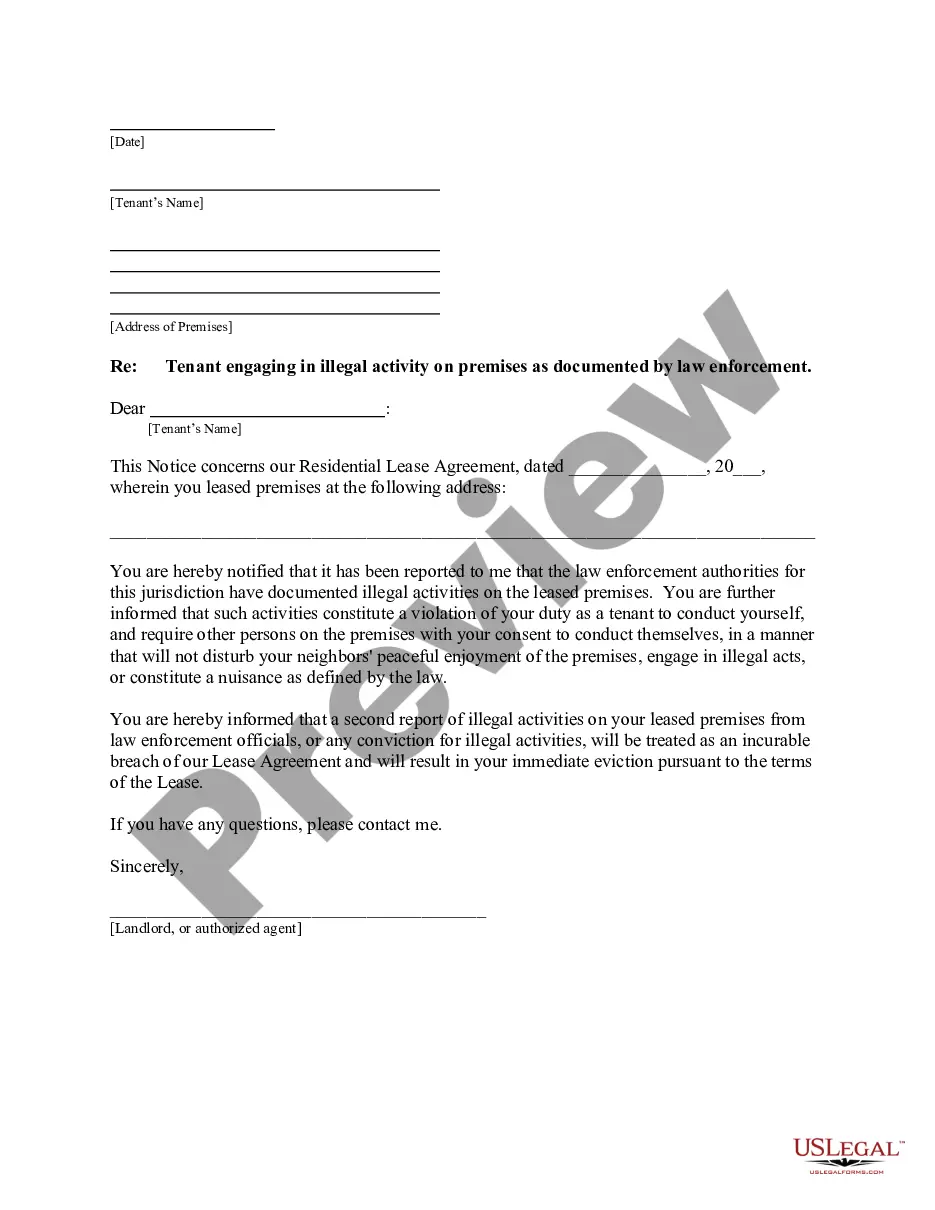

- Take a look at the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!