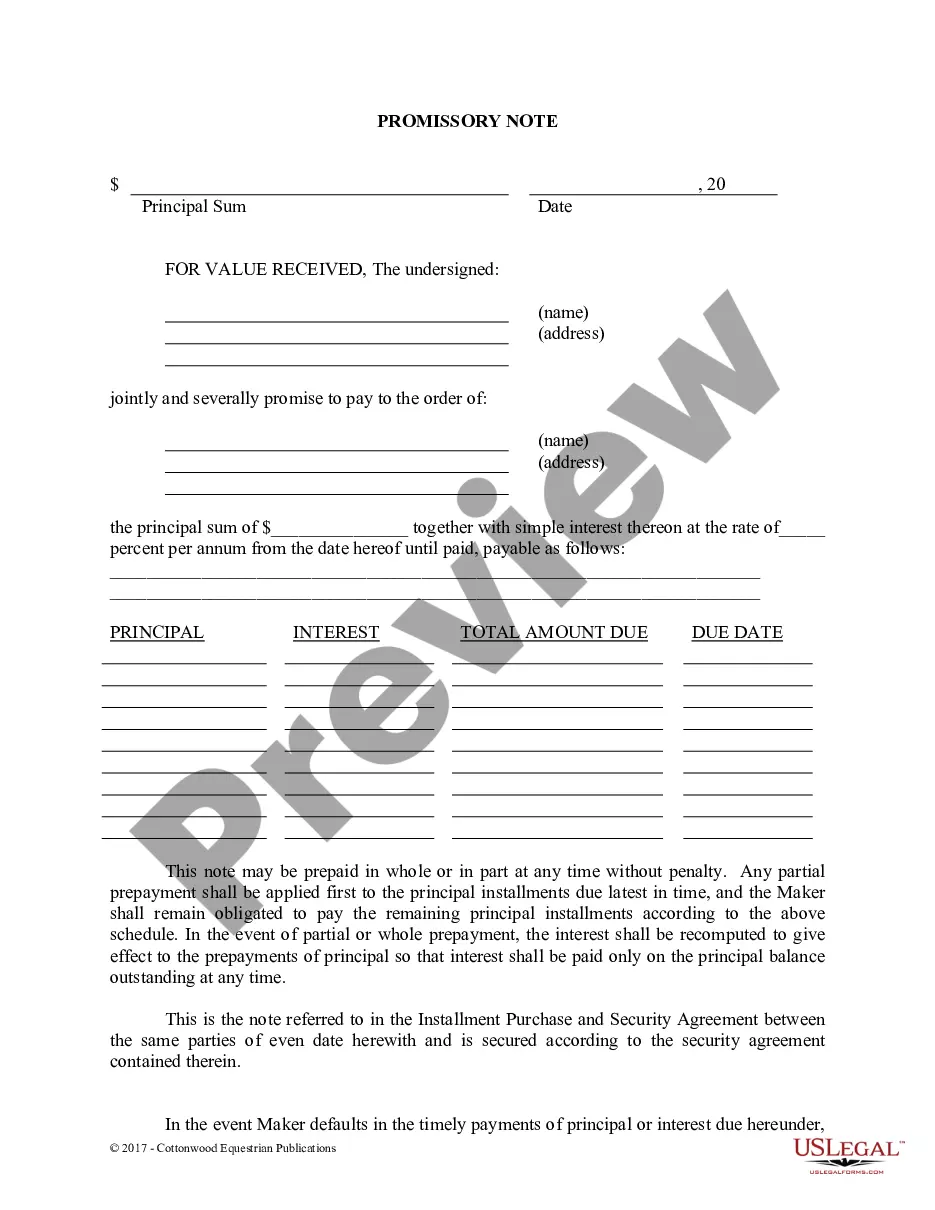

The Suffolk New York Certificate of Secretary of Corporation as to Commercial Loan is an important legal document that verifies the actions and authority of a corporation in relation to obtaining a commercial loan. This certificate is typically required by lenders or financial institutions when a corporation is applying for a loan to ensure that the loan transaction is valid and authorized by the corporation's board of directors. The Suffolk New York Certificate of Secretary of Corporation as to Commercial Loan includes detailed information regarding the corporation, the loan, and the individuals or entities involved. It serves as evidence of the corporation's compliance with all relevant laws, regulations, and internal procedures. Below are some relevant keywords associated with this certificate: 1. Suffolk New York: Refers to the specific jurisdiction where the corporation is located and where the certificate is issued. 2. Certificate of Secretary of Corporation: Highlights the individual responsible for preparing and signing the certificate, typically the corporate secretary. 3. Commercial Loan: Specifies that the loan in question is for commercial purposes, such as business expansion, working capital, or equipment financing. 4. Corporate Authority: Demonstrates that the corporation has the necessary legal authority to borrow money and enter into a loan agreement. 5. Board of Directors: Establishes that the corporation's highest governing body has granted approval for the loan, often through a board resolution or meeting minutes. 6. Loan Details: Includes crucial information about the loan, such as the loan amount, interest rate, repayment terms, and any collateral or guarantees provided. 7. Corporation Information: Provides essential details about the corporation, including its legal name, registered address, federal tax identification number, and state of incorporation. 8. Financial Institution: Identifies the lender or financial institution involved in the loan transaction, including its name, contact information, and any additional requirements or documentation they may need. Different types of Suffolk New York Certificate of Secretary of Corporation as to Commercial Loan may vary based on the specific lending institution's requirements or the complexity of the loan transaction. However, these variations generally revolve around the level of detail included, the formatting of the certificate, and any specific additional clauses or legal language required by the lender. It's crucial to consult legal professionals or experienced corporate secretaries to ensure compliance with all relevant laws and regulations when preparing the Suffolk New York Certificate of Secretary of Corporation as to Commercial Loan. Keeping accurate and up-to-date records is essential for corporations seeking financing and maintaining legal credibility.

Suffolk New York Certificate of Secretary of Corporation as to Commercial Loan

Description

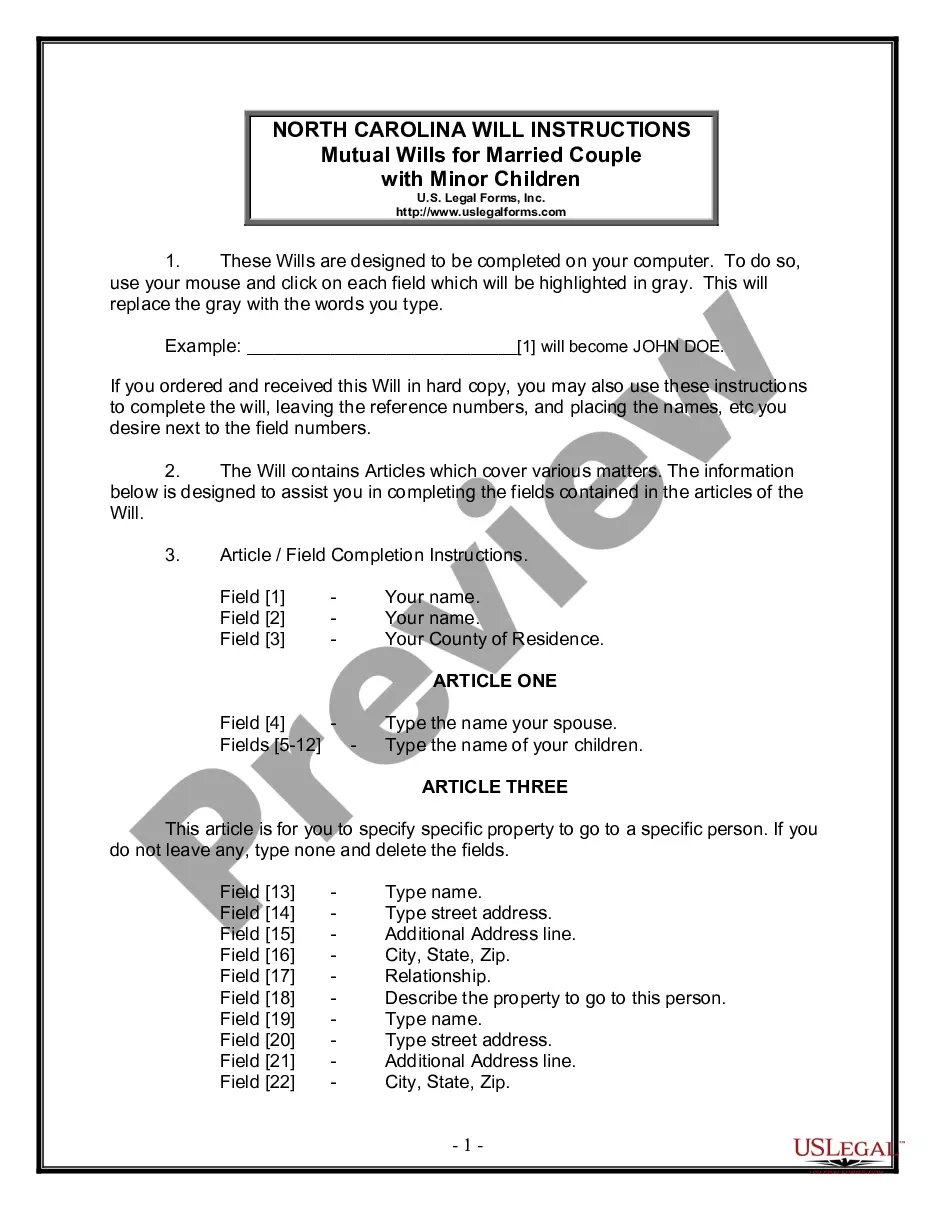

How to fill out Suffolk New York Certificate Of Secretary Of Corporation As To Commercial Loan?

If you need to find a trustworthy legal document supplier to obtain the Suffolk Certificate of Secretary of Corporation as to Commercial Loan, consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can select from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning resources, and dedicated support make it easy to locate and execute various paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply select to look for or browse Suffolk Certificate of Secretary of Corporation as to Commercial Loan, either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Suffolk Certificate of Secretary of Corporation as to Commercial Loan template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and select a subscription option. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less expensive and more affordable. Create your first company, arrange your advance care planning, create a real estate agreement, or complete the Suffolk Certificate of Secretary of Corporation as to Commercial Loan - all from the comfort of your sofa.

Sign up for US Legal Forms now!