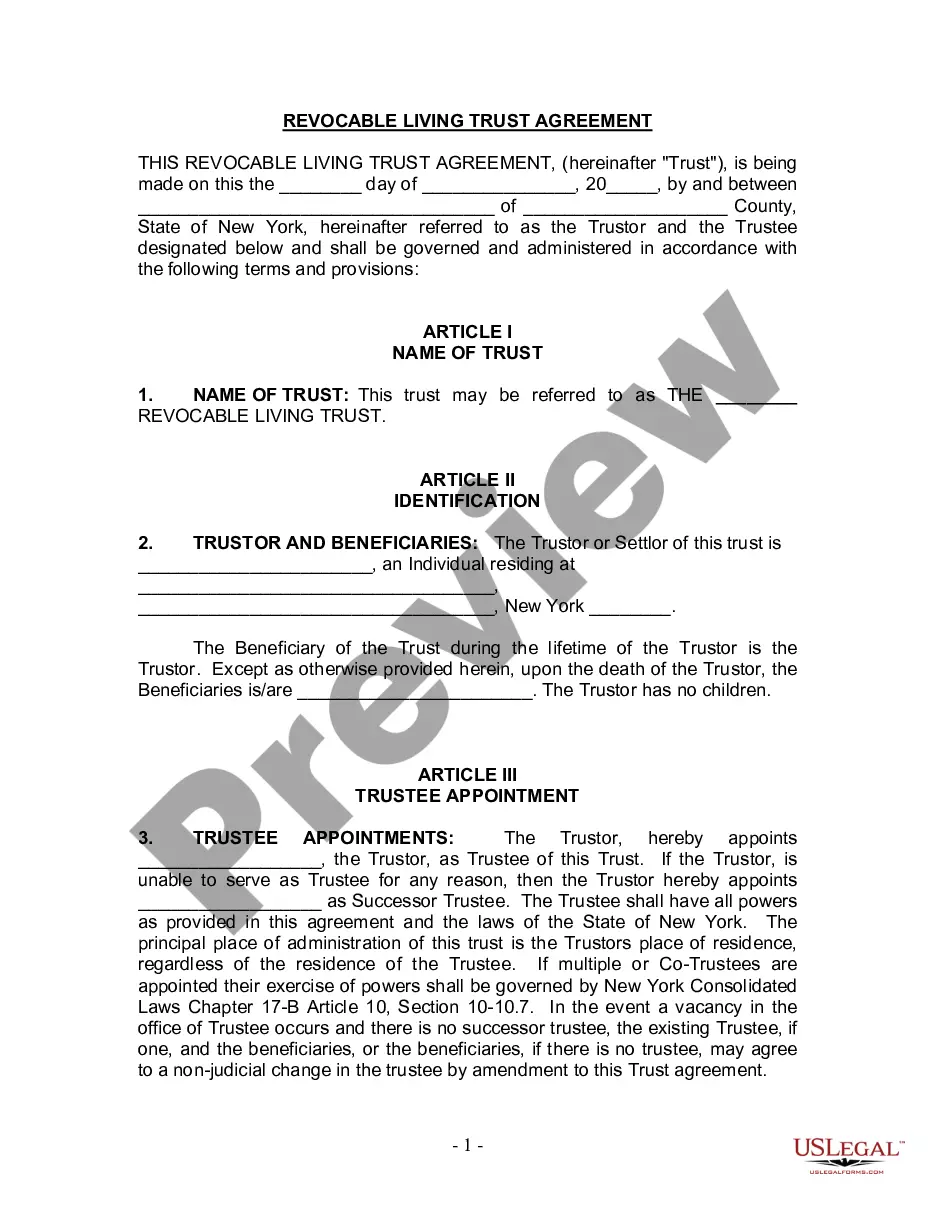

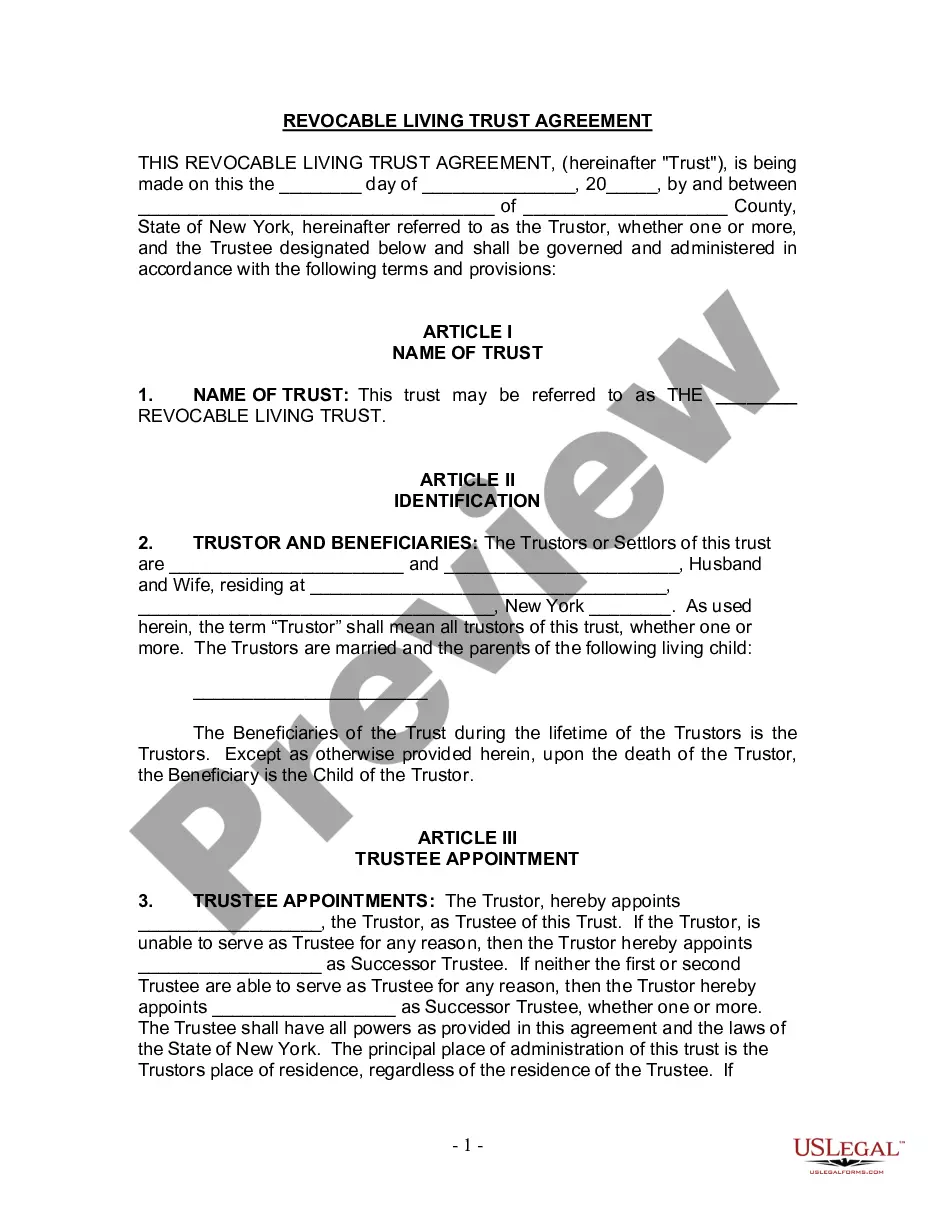

A Harris Texas Deed Conveying Property held by Spouses as Tenants in Common to Husband and Wife as Community Property is a legal document that transfers ownership of real estate from spouses who hold the property as tenants in common to their status as community property owners. This type of deed is commonly used in marriage situations, where the owners want to convert the property into community property, which affords certain advantages and rights. In Texas, community property laws govern the ownership and division of property acquired during marriage. When a married couple holds property as tenants in common, they each have an individual share in the property. However, by converting the property into community property, they create an equal, undivided interest in the entire property. The Harris Texas Deed Conveying Property held by Spouses as Tenants in Common to Husband and Wife as Community Property document should include specific keywords to clearly describe the process and details involved. These keywords may include: 1. Harris County, Texas: Since the deed pertains to property located within Harris County, Texas, it is crucial to mention this in the content. Harris County is the most populous county in Texas and the third-most populous county in the United States. 2. Deed Conveying: The purpose of the document is to transfer the property ownership from tenants in common to community property owners. Use keywords like "deed conveying" to highlight the legal transfer aspect. 3. Spouses or Married Couple: Emphasize that the deed applies to married couples who hold the property as tenants in common. Spouses have the intention of converting their ownership to community property. 4. Tenants in Common: Highlight the current ownership structure, where the spouses individually hold an ownership share in the property as tenants in common. 5. Community Property: Specify that the intent is to convert the property into community property, which will make both spouses equal, undivided owners of the entire property. Different types of Harris Texas Deed Conveying Property held by Spouses as Tenants in Common to Husband and Wife as Community Property may include variations based on specific circumstances. Some examples could be: 1. General Warranty Deed: A general warranty deed provides the highest level of protection for the new owners by guaranteeing against any claims or defects in the property's title. 2. Special Warranty Deed: A special warranty deed provides a limited guarantee against any claims or defects in the property's title but only during the time the current owners held the property. 3. Quitclaim Deed: A quitclaim deed transfers the property ownership without providing any warranty or guarantee. It only transfers the ownership interest that the granter (spouses as tenants in common) may have in the property. In conclusion, a Harris Texas Deed Conveying Property held by Spouses as Tenants in Common to Husband and Wife as Community Property is a legally significant document that transfers ownership rights from tenants in common to community property owners for married couples in Harris County, Texas. These deeds can take various forms, such as general warranty deeds, special warranty deeds, or quitclaim deeds, depending on the intended level of protection and guarantee.

Harris Texas Deed Conveying Property held by Spouses as Tenants in Common to Husband and Wife as Community Property

Description

How to fill out Harris Texas Deed Conveying Property Held By Spouses As Tenants In Common To Husband And Wife As Community Property?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Harris Deed Conveying Property held by Spouses as Tenants in Common to Husband and Wife as Community Property, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you purchase a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Harris Deed Conveying Property held by Spouses as Tenants in Common to Husband and Wife as Community Property from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Harris Deed Conveying Property held by Spouses as Tenants in Common to Husband and Wife as Community Property:

- Take a look at the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Probate is usually needed if the estate of the person who died is worth more than £10,000. You can read our guide on what is probate for more information. If most of the assets in the estate were jointly owned such as a joint mortgage or bank account probate may not be needed.

Married couples are permitted to own real estate as tenants-in-common. Each person will own half the share of the property if they are the only owners. If you marry someone involved in a TIC agreement, you don't automatically become joint investors.

When you die, the property automatically passes to the surviving joint tenant under the Right of Survivorship. A property owned as Joint Tenants cannot be passed under the terms of your Will.

Tenants in common normally record their shares of the property in a deed of trust. A deed of trust is a legal document which records the shares of the joint owners. For tenants in common, if one owner dies, then that owner's share of the property will not automatically pass to the other owner.

If the other joint tenants feel the same way, all of you can execute a quick and easy form of deed called a quitclaim. If you are alone in your wish to transfer, that works too. A transfer by one co-owner terminates the joint tenancy. In many states, you can even transfer to yourself to terminate the joint tenancy.

The deceased tenant's property, debt, and contracts will transfer to the estate or next of kin. This means, that the lease agreement does not automatically end when a tenant dies. In most states a landlord can hold an estate accountable for any unpaid rent for the remainder of the lease terms.

One benefit of buying a home with a tenants in common agreement is that it may make it easier for you to get a home. Dividing up the necessary deposits and payments while splitting the cost of maintaining the property can make it more cost effective than just buying property alone.

Tenants in common normally record their shares of the property in a deed of trust. A deed of trust is a legal document which records the shares of the joint owners. For tenants in common, if one owner dies, then that owner's share of the property will not automatically pass to the other owner.

Do Tenants in Common have to go through Probate? Yes, you'll still need to go through Probate after a tenant in common dies. This is because their share of the property is part of their Estate, so someone will still need to apply for the legal right to deal with the Estate and all its assets.

Joint tenants or tenants in common relates to the equity in the property. The legal title (the right to transfer or mortgage the property) can only be held as joint tenants.