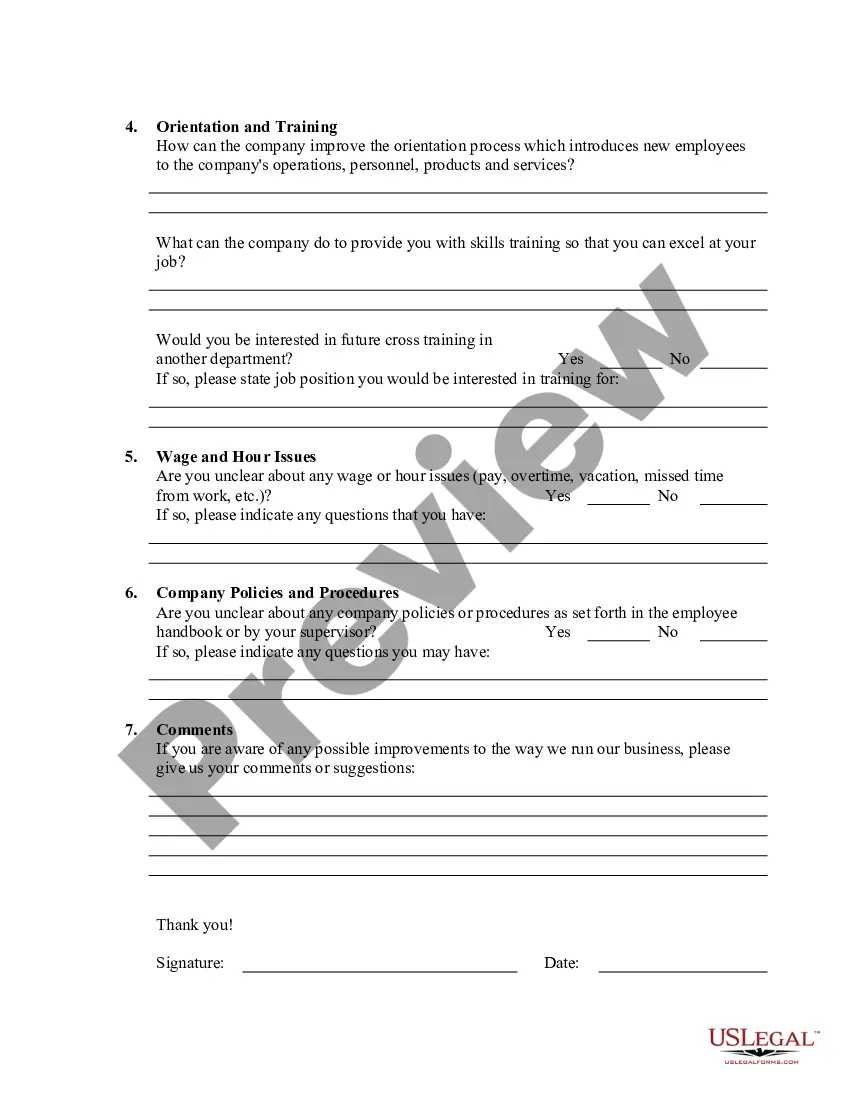

Santa Clara California Sixty Day New Hire Survey

Description

How to fill out Santa Clara California Sixty Day New Hire Survey?

Preparing paperwork for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Santa Clara Sixty Day New Hire Survey without expert help.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Santa Clara Sixty Day New Hire Survey on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Santa Clara Sixty Day New Hire Survey:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any situation with just a few clicks!

Form popularity

FAQ

Both a W-2 and a W-4 tax form. These forms will come in handy for both you and your new hire when it's time to file income taxes with the IRS. A DE 4 California Payroll tax form. Issued by the Employment Development Department, this form helps employees calculate the correct state tax withholding from their paycheck.

Gavin Newsom signed new state legislation, Assembly Bill 5 (AB5), into law. Effective January 1, 2020, AB5 affects independent contractors throughout California, radically changing 30 years of worker classification and reclassifying millions as employees.

Online. Use e-Services for Business to submit a Report of New Employee(s) (DE 34). Submit a paper report of new employees by mail or fax using one of the following options:Mail. Mail or fax your paper DE 34 to: Employment Development Department.Fax. Fax your form to 1-916-319-4400. Additional Resources.

Free. Federal law requires all employers to report to EDD within 20 days of start of work all employees who are newly hired or rehired. This information is used to assist state and county agencies in locating parents who are delinquent in their child support obligations.

California employers must provide the following documents for example: I-9 Employment Eligibility Verification completed. W-4 federal and state tax withholding forms completed. Workers' Compensation Time of Hire Pamphlet: Personal Chiropractor or Acupuncturist Designation Form and Personal Physician Designation Form.

Provide required forms and pamphlets. I-9 Employment Eligibility Verification completed. W-4 federal and state tax withholding forms completed. Workers' Compensation Time of Hire Pamphlet: Personal Chiropractor or Acupuncturist Designation Form and Personal Physician Designation Form.

The federal requirement was implemented by California effective July 1, 1998. California employers are required to report information on newly hired or rehired employees who work in California to the EDD's New Employee Registry (NER).

It is even possible that a worker can be considered an independent contractor for purposes of IRS tax filing, but they are considered an employee under California's wage and hours laws.

All California employers must report all of their new or rehired employees who work in California to the New Employee Registry within 20 days of their start-of-work date, which is the first day of work. Any employee who is rehired after a separation of at least 60 consecutive days must also be reported within 20 days.

Online. Use e-Services for Business to submit a Report of New Employee(s) (DE 34). Submit a paper report of new employees by mail or fax using one of the following options:Mail. Mail or fax your paper DE 34 to: Employment Development Department.Fax. Fax your form to 1-916-319-4400. Additional Resources.