Allegheny Pennsylvania Challenge to Credit Report: Allegheny County, located in Pennsylvania, presents individuals with the opportunity to challenge their credit reports with major credit reporting agencies such as Experian, TransUnion, and Equifax. Challenging a credit report allows individuals to question inaccurate or outdated information that may negatively impact their creditworthiness. There are various types of challenges that one can initiate against these credit reporting agencies. Some common challenges include: 1. Identity Verification Challenge: This type of challenge aims to rectify any inaccuracies resulting from identity theft or mistaken identity. If a person's credit report contains accounts or inquiries that they did not initiate or recognize, they can challenge these entries to prevent any further damage to their credit standing. 2. Inaccurate Reporting Challenge: In cases where credit reports contain incorrect or outdated information, individuals can submit an inaccurate reporting challenge. This may involve disputing incorrect personal details, payment history, account statuses, or duplicate entries. It is crucial to provide supporting documentation, such as billing statements or receipts, to strengthen the challenge. 3. Outdated or Expired Accounts Challenge: If an individual's credit report contains accounts that have surpassed the statute of limitations or are older than seven years (in most cases), they can file an outdated or expired accounts challenge. Removing such outdated information can significantly improve one's credit score. 4. Credit Inquiries Challenge: Individuals can challenge unauthorized credit inquiries appearing on their credit reports. This could involve inquiries made without their knowledge or consent, potentially indicating fraudulent activity. By disputing these inquiries, individuals can protect their credit standing and mitigate any potential harm. It is important to note that despite initiating a challenge, credit reporting agencies are legally obligated to conduct a thorough investigation within 30-45 days and provide a response. If the challenge is successful, the credit reporting agency must rectify the inaccuracies or remove the disputed information from the credit report, leading to an improved credit profile. To file an Allegheny Pennsylvania Challenge to a Credit Report with Experian, TransUnion, and/or Equifax, individuals can visit their respective websites or contact their customer service departments. It is advisable to gather all relevant documentation and maintain records of all correspondence for reference. Taking prompt action and actively monitoring credit reports can help individuals safeguard their financial future and maintain accurate creditworthiness.

Allegheny Pennsylvania Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

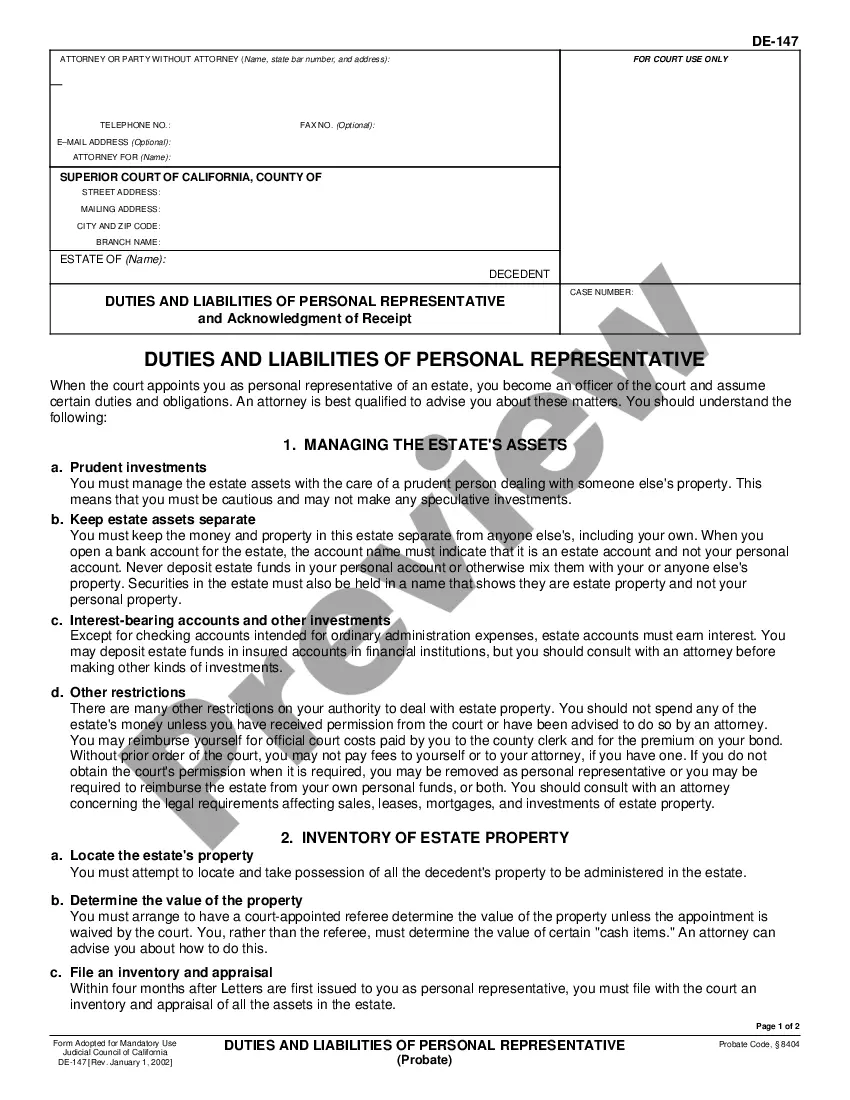

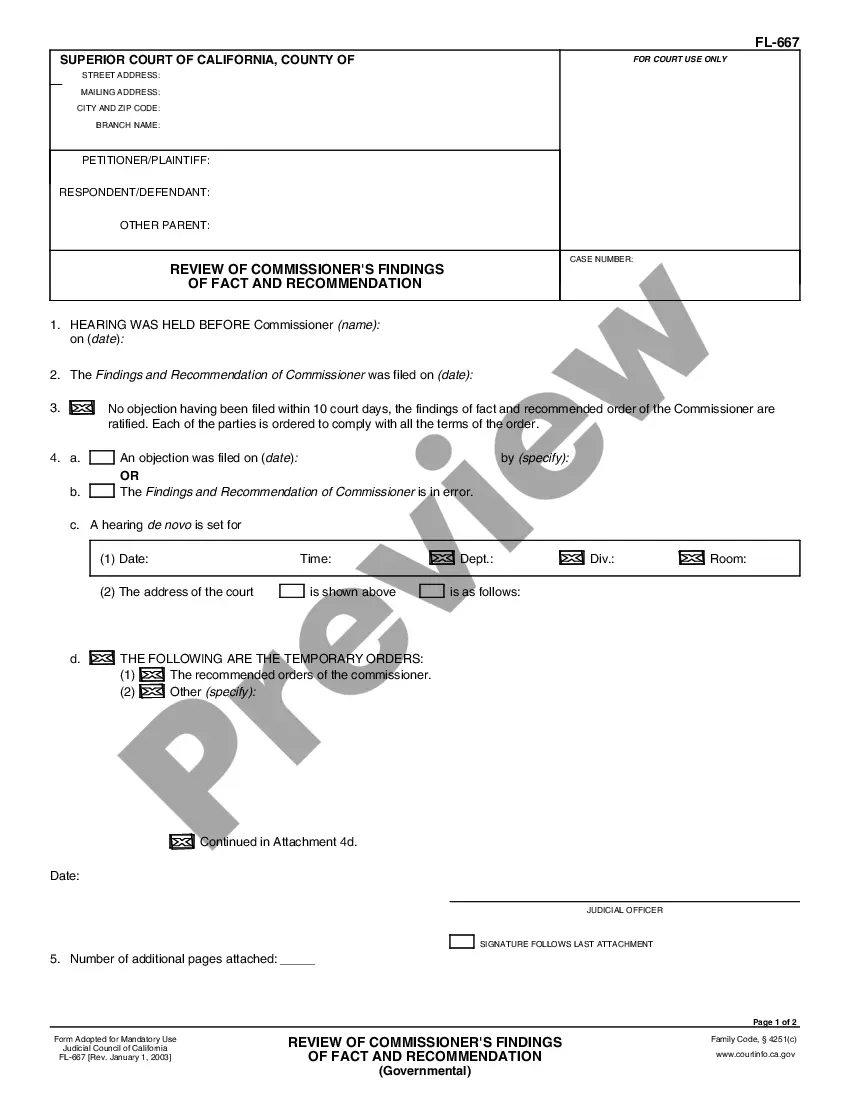

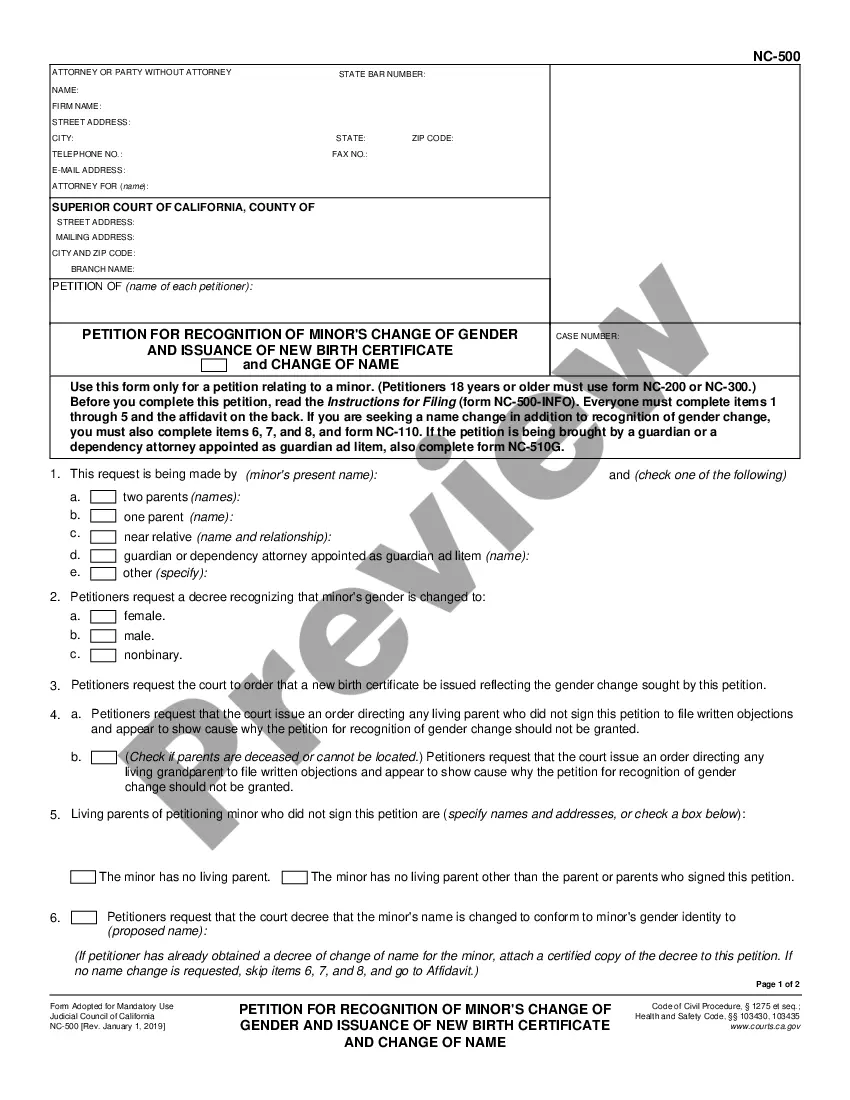

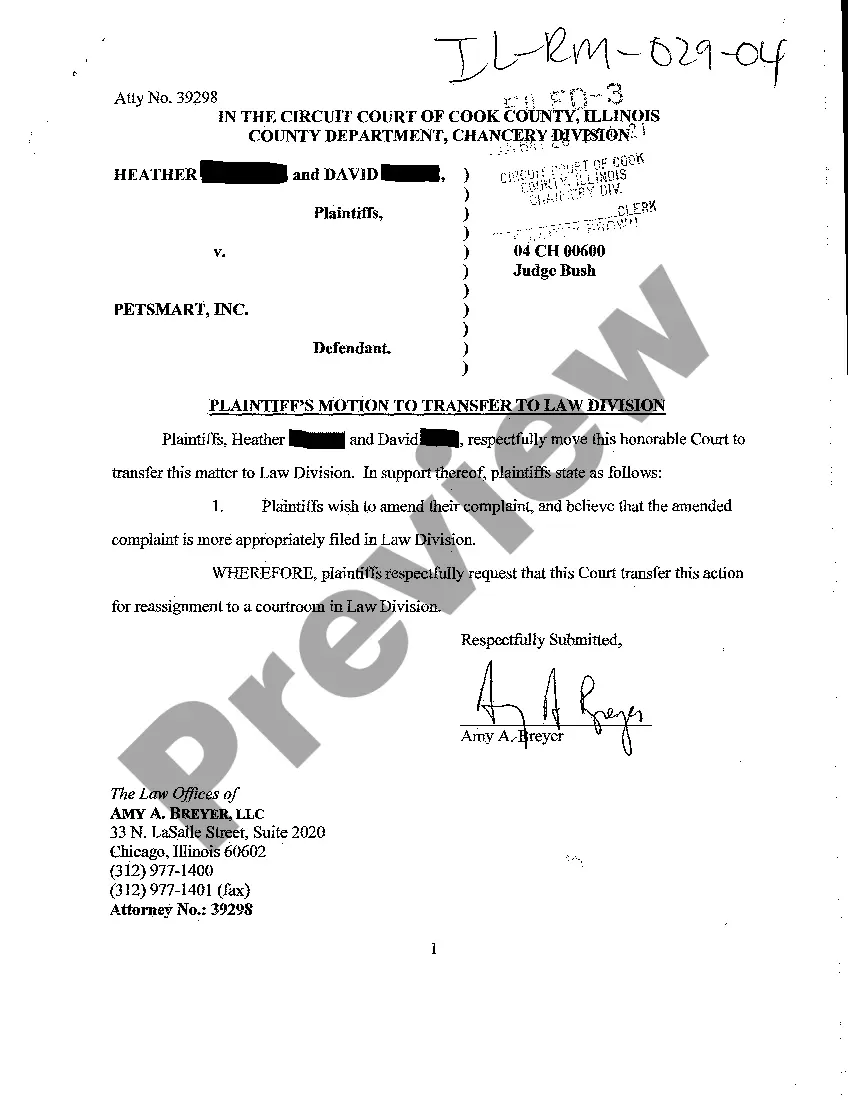

How to fill out Allegheny Pennsylvania Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

Do you need to quickly create a legally-binding Allegheny Challenge to Credit Report of Experian, TransUnion, and/or Equifax or maybe any other form to handle your own or business affairs? You can go with two options: contact a legal advisor to draft a valid document for you or draft it completely on your own. Thankfully, there's a third option - US Legal Forms. It will help you get neatly written legal documents without paying unreasonable fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-specific form templates, including Allegheny Challenge to Credit Report of Experian, TransUnion, and/or Equifax and form packages. We provide templates for an array of life circumstances: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, double-check if the Allegheny Challenge to Credit Report of Experian, TransUnion, and/or Equifax is adapted to your state's or county's laws.

- In case the document includes a desciption, make sure to verify what it's suitable for.

- Start the search again if the template isn’t what you were hoping to find by using the search box in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Allegheny Challenge to Credit Report of Experian, TransUnion, and/or Equifax template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Moreover, the documents we provide are updated by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

The most accurate credit scores are the latest versions of the FICO Score and VantageScore credit-scoring models: FICO Score 8 and VantageScore 3.0.

If you simply want more control over your credit report and credit score, Experian offers the most bang for your buck in terms of personal credit monitoring and identity protection. However, TransUnion offers the most business-related products.

Two of the biggest companies when it comes to credit scoring models are Fair Isaac Corporation (FICO) and VantageScore. VantageScore is the result of a collaboration between the three nationwide credit bureaus: Equifax, Experian, and TransUnion.

Is TransUnion more important than Equifax? The short answer is no. Both TransUnion and Equifax are reliable credit reporting agencies that compile reports and calculate your credit scores using different scoring models.

A: As a general matter, no one credit bureau report is more important than the others. In today's economic environment, they are all vitally critical to your personal finances.

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a fair score from TransUnion is typically fair across the board.

Experian is the largest credit bureau in the United States. Still, it's not the only entity that houses consumer financial data. Equifax and TransUnion are the other major credit reporting agencies lenders, and creditors turn to for credit reports and scores used to make lending decisions.

The most accurate credit scores are the latest versions of the FICO Score and VantageScore credit-scoring models: FICO Score 8 and VantageScore 3.0.

Dispute mistakes with the credit bureaus. You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureau's dispute form (if they have one), copies of documents that support your dispute, and keep records of everything you send.

Our Verdict: Credit Karma has better credit monitoring and more features, but Experian actually gives you your real credit score. Plus it offers the wonderful Experian Boost tool. Since they're both free, it's worth it to get both of them.