Chicago Illinois Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

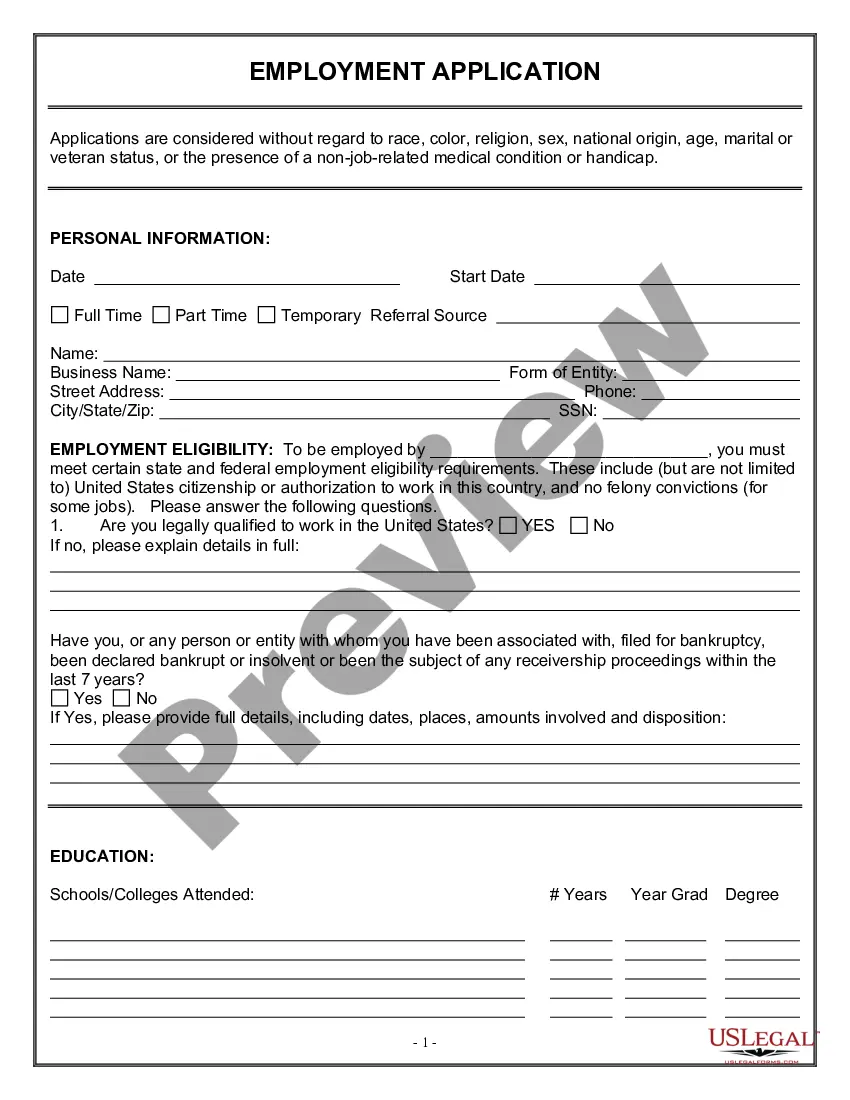

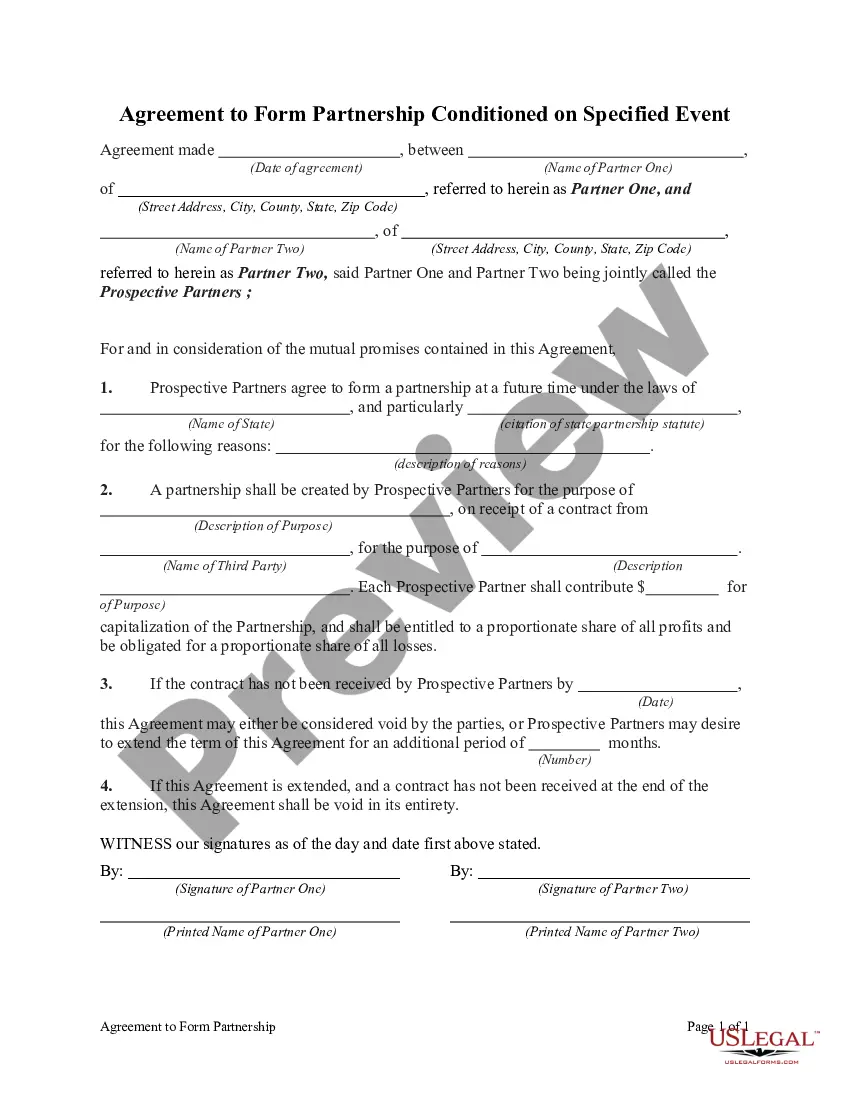

How to fill out Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

How long does it usually take you to create a legal document.

Considering that each state has its own laws and guidelines for various life situations, finding a Chicago Challenge to Credit Report of Experian, TransUnion, and/or Equifax that fulfills all local specifications can be daunting, and obtaining it from a qualified attorney can be expensive.

Several online platforms provide the most frequently needed state-specific documents for download, but utilizing the US Legal Forms library proves to be the most advantageous.

Select the subscription plan that best fits your needs. Sign up for an account on the platform or Log In to move forward to payment options. Complete the payment via PayPal or credit card. Change the file format if necessary. Click Download to keep the Chicago Challenge to Credit Report of Experian, TransUnion, and/or Equifax. Print the document or utilize any preferred online editor to fill it out digitally. Regardless of how often you need to use the obtained template, you can find all the files you’ve saved in your profile by selecting the My documents tab. Give it a try!

- US Legal Forms offers the most extensive online collection of templates, categorized by states and purposes.

- In addition to the Chicago Challenge to Credit Report of Experian, TransUnion, and/or Equifax, you can access any particular document necessary for managing your business or personal affairs, adhering to your county’s regulations.

- All templates have been validated by experts, ensuring that you prepare your documents correctly.

- Using the service is very straightforward.

- If you possess an account on the site and your subscription remains active, you simply need to Log In, select the desired template, and download it.

- The file will be available in your profile at any later time.

- If you are a newcomer to the site, there will be additional steps before obtaining your Chicago Challenge to Credit Report of Experian, TransUnion, and/or Equifax.

- Review the content on the page you’re visiting.

- Examine the description of the template or Preview it (if an option is present).

- Search for another document using the related option in the header.

- Click Buy Now when you are confident in the chosen file.

Form popularity

FAQ

Illinois, like other states, recognizes all three major credit bureaus: Equifax, TransUnion, and Experian. The Chicago Illinois Challenge to Credit Report of Experian, TransUnion, and/or Equifax reinforces that these bureaus provide essential credit information throughout the state. Understanding how each bureau operates can help Illinois residents better manage their credit. Utilizing platforms like UsLegalForms can assist you in navigating issues related to credit reporting effectively.

Yes, it's wise to check your credit report from all three major credit bureaus. The Chicago Illinois Challenge to Credit Report of Experian, TransUnion, and/or Equifax emphasizes that variations in your reports can reveal errors that impact your score. Regularly reviewing all three reports helps you catch discrepancies early on. This proactive approach fosters better credit management and ensures you maintain a healthy credit profile.

You should send your dispute letter to Experian's dispute processing address. The Chicago Illinois Challenge to Credit Report of Experian, TransUnion, and/or Equifax provides guidance on properly formatting and submitting your dispute. Ensure that you include all necessary details and documentation to support your claim. Sending your dispute through certified mail can also confirm receipt and support your case.

The accuracy of information can vary between Equifax, TransUnion, and Experian. The Chicago Illinois Challenge to Credit Report of Experian, TransUnion, and/or Equifax underscores the fact that no single bureau is definitively more accurate than the others. Instead, they maintain different data sources, leading to variations in your credit report. Regularly checking all three can help you spot inconsistencies and enhance your overall credit profile.

It's beneficial to obtain your credit report from all three bureaus: Equifax, TransUnion, and Experian. The Chicago Illinois Challenge to Credit Report of Experian, TransUnion, and/or Equifax highlights the importance of comparing reports to identify any discrepancies. Each bureau may have different information, so reviewing all three gives you a complete view of your credit health. This practice helps you ensure accuracy and address any potential issues.

Yes, you can file a complaint against Experian if you believe they have mishandled your credit report. The Chicago Illinois Challenge to Credit Report of Experian, TransUnion, and/or Equifax emphasizes your right to dispute inaccuracies. You should gather any relevant documentation and submit your complaint directly to Experian through their official channels for a resolution. This process ensures your voice is heard and can lead to corrective action.

Your Experian dispute letter should be mailed to the designated address provided by Experian for dispute resolution. A successful Chicago Illinois Challenge to Credit Report of Experian, TransUnion, and/or Equifax relies on delivering your letter to the correct location. Verify the mailing address on Experian's official site to ensure accuracy. Utilizing solutions such as uslegalforms can help streamline this process and improve your likelihood of a successful dispute.

To mail your dispute letters to Experian, use the address provided specifically for disputes. For a Chicago Illinois Challenge to Credit Report of Experian, TransUnion, and/or Equifax, it’s vital to include your personal information and the relevant details of the item in question. Check Experian’s website for any updates on their mailing address and follow their instructions carefully. Platforms like uslegalforms can help you craft a compelling letter that meets all necessary requirements.

When sending your documents to Experian, ensure to direct them to the appropriate address specified for disputes. This step is crucial for a successful Chicago Illinois Challenge to Credit Report of Experian, TransUnion, and/or Equifax. You can typically find the correct address on Experian's official website or their dispute resolution page. Remember, providing clear and concise documentation strengthens your case.

To submit a dispute letter, you may send it directly to the respective credit bureau. For a Chicago Illinois Challenge to Credit Report of Experian, TransUnion, and/or Equifax, ensure your dispute letter includes all necessary details and documentation. Each bureau has specific guidelines for disputes, so it's essential to follow them closely. You can enhance your chances of a favorable outcome by using platforms like uslegalforms to draft your letter accurately.