Cook Illinois Challenge to Credit Report is a legal process that allows individuals in Cook County, Illinois, to dispute and rectify incorrect or misleading information on their credit reports provided by Experian, TransUnion, and/or Equifax. The credit reporting agencies (Crash) are responsible for maintaining and generating credit reports, which are essential in determining an individual's creditworthiness. When inaccurate information such as incorrect personal details, erroneous account histories, or outdated data is present on a credit report, it can negatively impact one's credit score and financial future. Recognizing the significance of accurate credit reporting, Cook Illinois allows residents to challenge and request corrections on their credit reports. The Cook Illinois Challenge necessitates individuals to thoroughly review their credit reports, identifying any discrepancies, inconsistencies, or fraudulent activities. Upon identifying errors, individuals can gather relevant supporting documents, such as payment receipts, bank statements, or communication records, to substantiate their claims. There are several types of Cook Illinois Challenges that individuals can pursue: 1. Incorrect Personal Information: This type of challenge addresses errors in personal details, including name, address, Social Security number, or employment history. Providing accurate documentation, such as government-issued identification, utility bills, or employment records, can help rectify these inaccuracies. 2. Inaccurate Account Histories: This challenge focuses on disputing incorrect account information, such as unfamiliar accounts, closed accounts being reported as open, or incorrect payment histories. Providing account statements, cancellation letters, or other relevant documents can be beneficial in proving these discrepancies. 3. Identity Theft: In cases of identity theft, individuals can challenge fraudulent or unauthorized accounts, inquiries, or transactions that appear on their credit report. Providing police reports, identity theft affidavits, or dispute letters can aid in resolving these issues promptly. 4. Outdated Information: This type of challenge addresses outdated credit information, such as paid-off debts that continue to be reported as outstanding or negative information that should no longer be present as per legal time limits. Supplying proof of payment, release-of-lien documents, or court orders may help expedite the removal of outdated information. Once the necessary supporting documentation is gathered, individuals can initiate the Cook Illinois Challenge by submitting a dispute to one or more of the Crash: Experian, TransUnion, and Equifax. The Crash are required to investigate the disputed items within 30 days and provide a written response. If the disputed information is found to be incorrect or unverifiable, the Crash must correct or remove it from the credit report, ensuring accuracy and fairness. In conclusion, the Cook Illinois Challenge to Credit Report empowers individuals to rectify inaccurate or misleading information on their credit reports. By addressing errors and discrepancies, Cook Illinois aims to promote fair and reliable credit reporting processes, facilitating individuals in their pursuit of financial stability and opportunities.

Cook Illinois Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

How to fill out Cook Illinois Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Cook Challenge to Credit Report of Experian, TransUnion, and/or Equifax, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case accumulated all in one place. Consequently, if you need the recent version of the Cook Challenge to Credit Report of Experian, TransUnion, and/or Equifax, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Cook Challenge to Credit Report of Experian, TransUnion, and/or Equifax:

- Look through the page and verify there is a sample for your region.

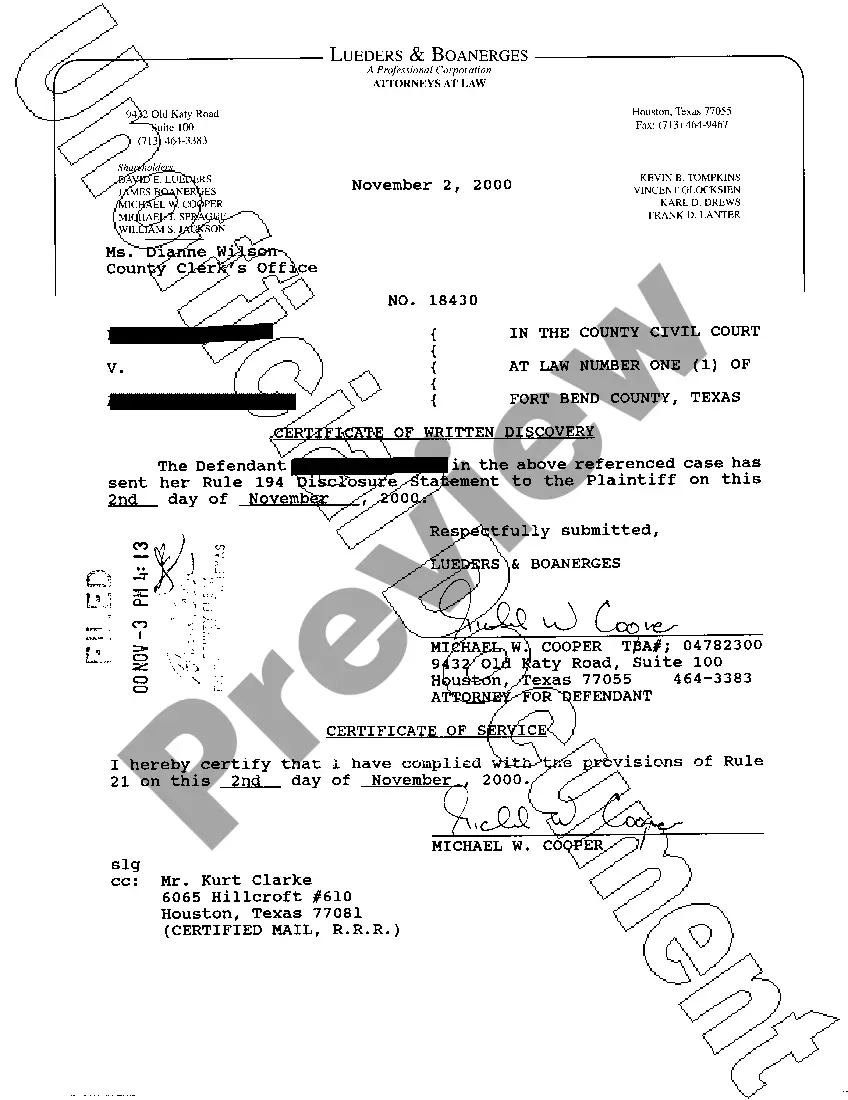

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Cook Challenge to Credit Report of Experian, TransUnion, and/or Equifax and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!