Harris Texas Challenge to Credit Report of Experian, TransUnion, and/or Equifax: Understanding Your Rights and Steps to Take If you are a resident of Harris, Texas, and believe that there are inaccuracies or errors in your credit report held by Experian, TransUnion, and/or Equifax, it is crucial to understand your rights and take necessary actions to rectify the situation. By challenging your credit report, you can potentially improve your credit score, access better loan terms, or ensure that your financial history is accurately represented. Types of Harris Texas Challenges crediting Report: 1. Experian Credit Report Challenge: Experian is one of the three major credit reporting agencies. If you have identified discrepancies, outdated information, or potential errors on your Experian credit report within Harris, Texas, it is vital to take prompt action to correct these discrepancies. 2. TransUnion Credit Report Challenge: TransUnion, another leading credit reporting agency, may also hold your credit data in Harris, Texas. By challenging your TransUnion credit report, you have the opportunity to correct any inaccuracies or inconsistencies that might negatively impact your creditworthiness. 3. Equifax Credit Report Challenge: Equifax is the third major credit reporting agency that collects and maintains credit data of Harris, Texas residents. Ensuring the accuracy of your Equifax credit report is crucial to safeguard your financial reputation, as it is often utilized by lenders, landlords, and potential employers. Steps to Challenge Credit Reports in Harris, Texas: 1. Obtain and Review Your Credit Reports: To identify potential errors or inaccuracies, request your free annual credit reports from Experian, TransUnion, and Equifax. Analyze each report thoroughly and take note of any questionable information. 2. Document Discrepancies: Compile evidence supporting your claim of inaccuracies or errors on your credit report. This may include bank statements, payment receipts, or any relevant correspondence. 3. Initiate a Dispute: Contact the credit reporting agency (i.e., Experian, TransUnion, or Equifax) in writing, clearly outlining the specific information you believe to be incorrect and providing supporting documentation. Ensure that you include your personal information and specify the Harris, Texas address associated with your credit report. 4. Wait for Investigation: The credit reporting agency is required to investigate your dispute within 30 days of receipt. They will reach out to the data furnishes (e.g., lenders, creditors) responsible for the information you disputed. If the data furnishes determine your claim to be valid, they must correct the information and inform all three credit reporting agencies. 5. Review the Updated Credit Report: Once the investigation concludes, you should receive an updated credit report reflecting any necessary corrections or removal of disputed items. Analyze the updated report to verify that the changes have been accurately implemented. 6. Monitor Your Credit: Regularly monitor your credit reports from Experian, TransUnion, and Equifax to ensure that the corrections have been made and that there are no new errors or discrepancies. By taking these steps, you can assert your rights as a resident of Harris, Texas, and challenge any inaccuracies or errors present in your credit reports from Experian, TransUnion, and Equifax. Stay proactive and vigilant about your credit, as it plays a significant role in your financial health and future opportunities.

Harris Texas Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

How to fill out Harris Texas Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

Whether you plan to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Harris Challenge to Credit Report of Experian, TransUnion, and/or Equifax is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Harris Challenge to Credit Report of Experian, TransUnion, and/or Equifax. Adhere to the guide below:

- Make certain the sample meets your personal needs and state law requirements.

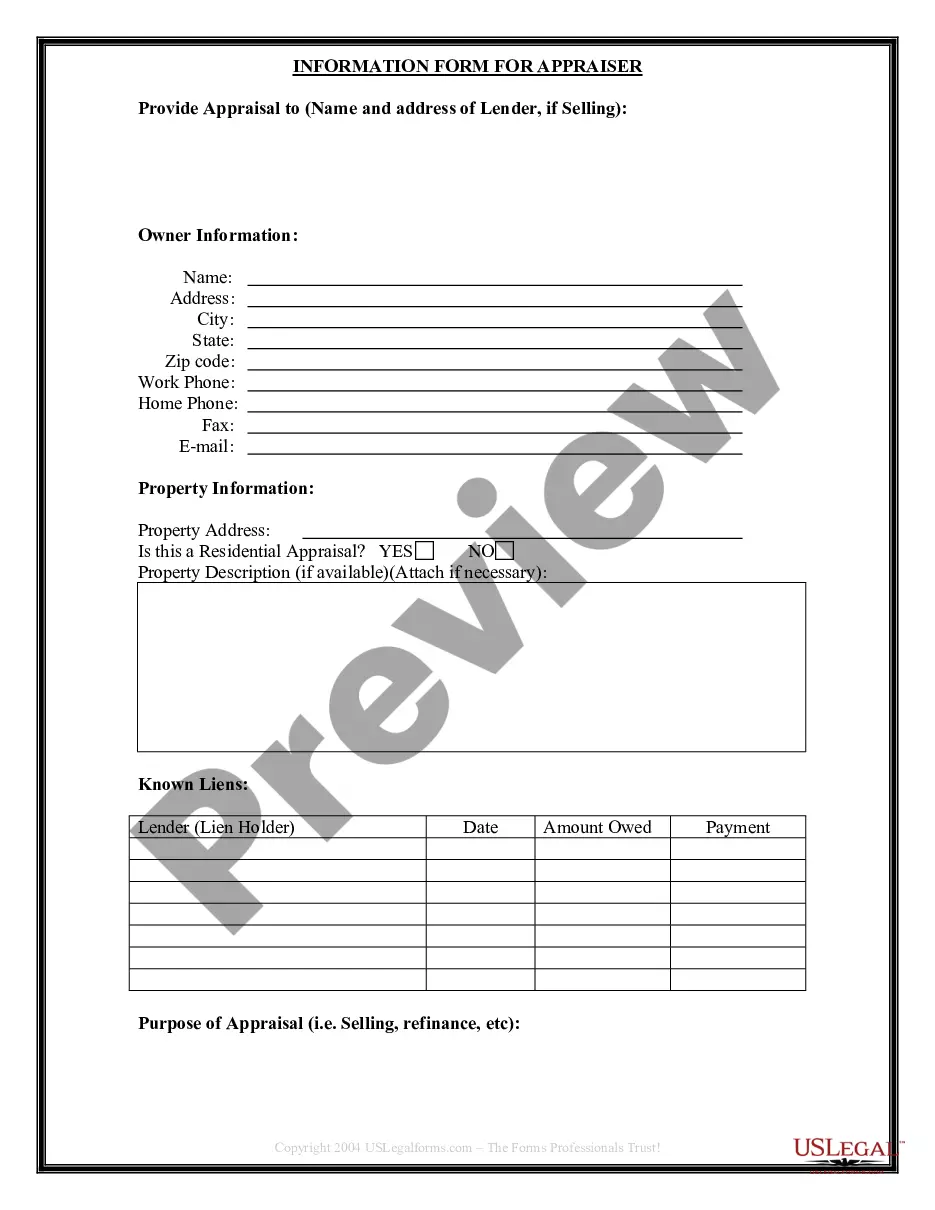

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Harris Challenge to Credit Report of Experian, TransUnion, and/or Equifax in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!