Sacramento California Challenge to Credit Report of Experian, TransUnion, and/or Equifax: In Sacramento, California, individuals have the right to challenge inaccuracies or discrepancies on their credit reports as provided by the Fair Credit Reporting Act (FCRA). The three main credit bureaus, Experian, TransUnion, and Equifax, are responsible for compiling and maintaining credit information. If you believe there are errors in your credit report that may be negatively impacting your financial standing, it is essential to take appropriate steps to address the issue and ensure accurate reporting. There are different types of challenges that individuals in Sacramento can initiate against these credit bureaus. Some common challenges include: 1. Identity Theft Related Challenges: If you suspect that you have been a victim of identity theft and believe that unauthorized accounts or fraudulent information are present on your credit report, you can challenge these inaccuracies. By submitting a dispute to the credit bureaus, you can request the removal of any fraudulent accounts and restore the accuracy of your report. 2. Inaccurate Personal Information: It is important to ensure that your personal information, such as your name, address, social security number, and date of birth, is correctly represented on your credit report. If you find any discrepancies in this information, it is recommended to challenge them and provide updated and accurate details to the credit bureaus. 3. Erroneous Payment History: Your payment history is a crucial factor impacting your credit score. If you notice incorrect information regarding late payments, missed payments, or accounts marked as delinquent when they were not, you can dispute these inaccuracies. Accurate reporting of your payment history is vital in determining your creditworthiness, so correcting any errors can potentially enhance your credit score. 4. Outdated Negative Information: Negative information, such as bankruptcies, foreclosures, or tax liens, should be removed from your credit report after a specific period. If you find that outdated negative information is still being reported, you have the right to challenge the inaccuracies and request its removal to ensure an updated and fair representation of your creditworthiness. To challenge any inaccuracies on your credit report, it is crucial to follow the correct procedure. Start by obtaining free copies of your credit reports from Experian, TransUnion, and Equifax. Carefully review each report, highlighting any discrepancies you believe are inaccurate. Then, you can file a dispute online, by mail, or by phone with the respective credit bureau(s). Ensure to provide supporting documentation and a clear explanation of the errors while requesting an investigation. In Sacramento, California, taking on the challenge to correct errors on your credit report is a critical step towards maintaining and improving your financial health. By effectively utilizing your rights under the FCRA, you can ensure accurate credit reporting, potentially improving your creditworthiness and gaining access to better financial opportunities.

Sacramento California Challenge to Credit Report of Experian, TransUnion, and/or Equifax

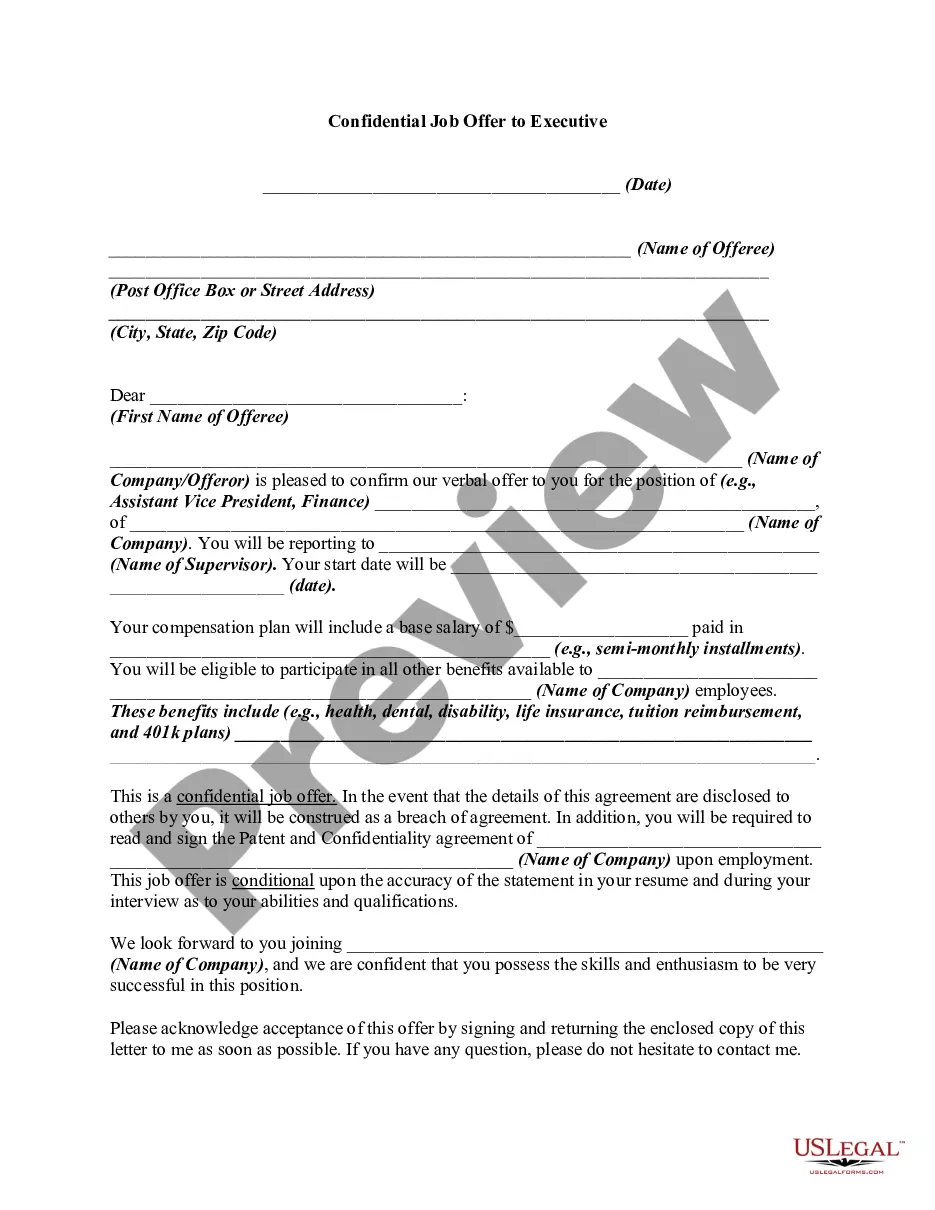

Description

How to fill out Sacramento California Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

If you need to get a trustworthy legal document provider to find the Sacramento Challenge to Credit Report of Experian, TransUnion, and/or Equifax, consider US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support make it easy to locate and execute various papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply select to search or browse Sacramento Challenge to Credit Report of Experian, TransUnion, and/or Equifax, either by a keyword or by the state/county the document is intended for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Sacramento Challenge to Credit Report of Experian, TransUnion, and/or Equifax template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less pricey and more reasonably priced. Set up your first company, arrange your advance care planning, create a real estate contract, or complete the Sacramento Challenge to Credit Report of Experian, TransUnion, and/or Equifax - all from the convenience of your home.

Sign up for US Legal Forms now!