Wake North Carolina is a state-level initiative that provides individuals residing in Wake County with the opportunity to challenge their credit reports from major credit reporting agencies such as Experian, TransUnion, and Equifax. This program aims to empower residents by enabling them to take control of their credit profiles and rectify any inaccuracies or discrepancies that may be adversely impacting their creditworthiness. One type of Wake North Carolina Challenge to Credit Report involves individuals disputing erroneous information provided by Experian. Experian is one of the three major credit reporting bureaus and plays a significant role in assessing individuals' creditworthiness. By participating in this challenge, residents can thoroughly review their Experian credit reports and initiate disputes for any incorrect or misleading data. Common inaccuracies that individuals may challenge include incorrect personal information, fraudulent accounts, inaccurate payment history, or improperly reported delinquencies. Another type of challenge targets TransUnion credit reports. Similar to Experian, TransUnion is one of the primary credit reporting agencies used by lenders and creditors. Participants in this Wake North Carolina Challenge have the opportunity to review their TransUnion credit reports in detail, identify any discrepancies, and request investigations to rectify the reported inaccuracies. It is crucial to ensure accurate credit information on TransUnion reports as they heavily influence credit decisions, such as loan approvals and interest rates. Equifax credit reports can also be the focal point of a Wake North Carolina Challenge. As one of the main credit bureaus, Equifax holds significant responsibility in accurately reflecting individuals' credit histories. Participants in this challenge can scrutinize their Equifax credit reports, spot any erroneous entries, and initiate formal disputes with the agency to have the inaccuracies corrected. This process can involve verifying inaccurate personal information, disputing incorrect account balances, or challenging inaccurate reporting of late payments or defaults. By engaging in a Wake North Carolina Challenge to Credit Report of Experian, TransUnion, and/or Equifax, individuals can proactively manage their credit profiles and ensure the information being reported accurately reflects their financial responsibility. It is vital to regularly monitor credit reports and take appropriate actions to address any inaccuracies, as these reports directly impact credit scores and influence lending decisions by financial institutions.

Wake North Carolina Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

How to fill out Wake North Carolina Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

Drafting papers for the business or individual needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Wake Challenge to Credit Report of Experian, TransUnion, and/or Equifax without expert assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Wake Challenge to Credit Report of Experian, TransUnion, and/or Equifax on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Wake Challenge to Credit Report of Experian, TransUnion, and/or Equifax:

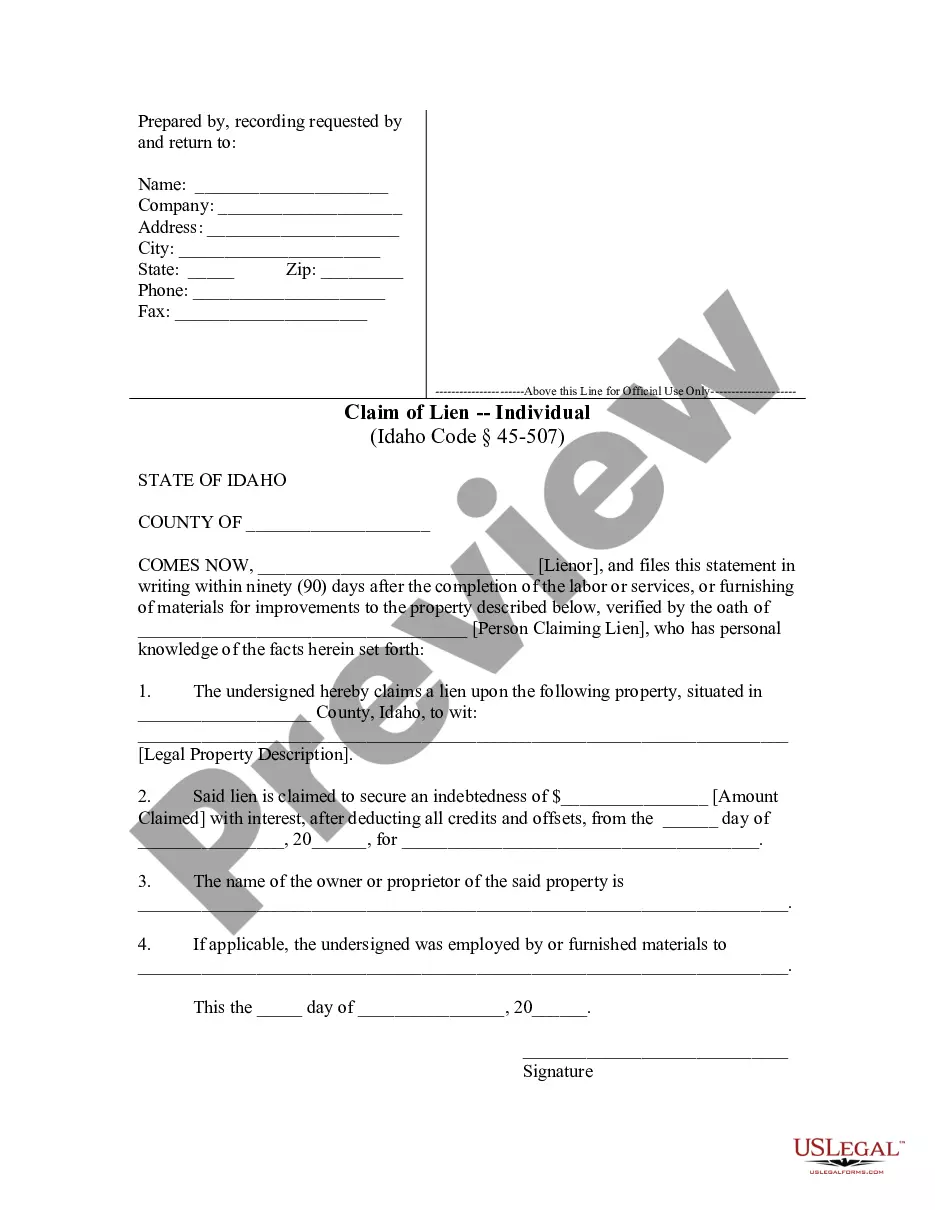

- Look through the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any use case with just a couple of clicks!