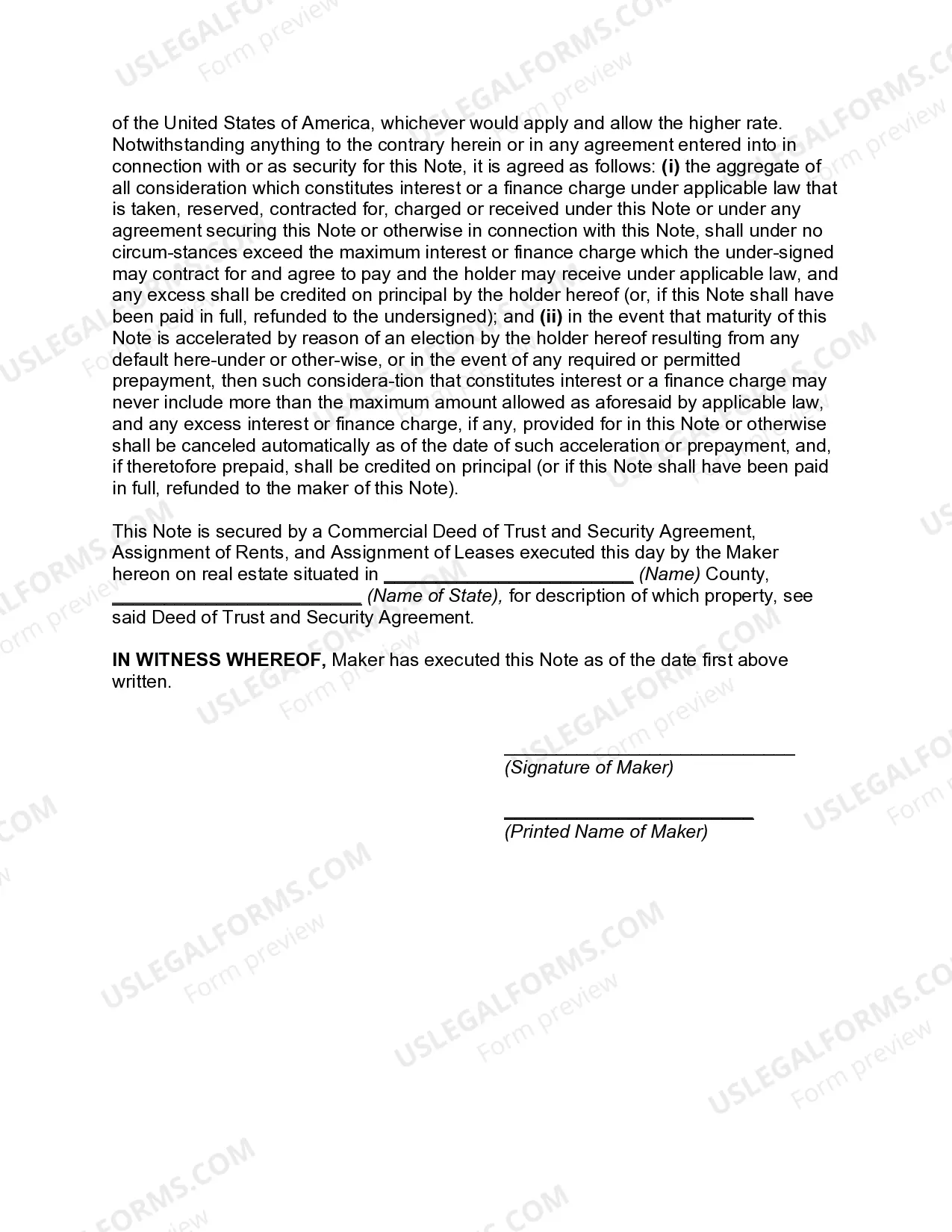

A Dallas Texas Promissory Note for Commercial Loan Secured by Real Property refers to a legally binding document that outlines the terms and conditions of a commercial loan secured by real estate in the city of Dallas, Texas. This note acts as evidence of the borrower's promise to repay the loan, including the principal amount borrowed, interest rate, repayment schedule, and any additional fees or charges associated with the loan. In Dallas, there are several types of Promissory Notes for Commercial Loans Secured by Real Property, including: 1. Fixed-rate Promissory Note: This type of note establishes a predetermined fixed interest rate for the loan, ensuring that the borrower's monthly repayment amount remains consistent throughout the loan term. This provides stability and predictability for both parties involved. 2. Adjustable-rate Promissory Note: Unlike a fixed-rate note, an adjustable-rate note allows for changes in the interest rate over time. The interest rate on this note is typically tied to a financial index or market conditions, and periodic adjustments may occur. These adjustments can impact the borrower's monthly payment amount. 3. Balloon Promissory Note: A balloon note allows the borrower to make smaller monthly payments for a certain period, typically with a lower interest rate. However, at the end of the agreed-upon period, the borrower is required to make a large "balloon" payment, which accounts for the remaining principal balance. This type of note can be beneficial for borrowers who anticipate having additional funds available at the end of the term or plan to refinance. 4. Interest-only Promissory Note: With an interest-only note, the borrower is only responsible for making interest payments for a specific period, typically ranging from a few months to several years. This type of note does not require the borrower to pay down the principal balance during this period. After the interest-only period ends, the borrower must begin repaying both the principal and the interest. When considering a Promissory Note for a Commercial Loan Secured by Real Property in Dallas, Texas, it is important to consult with a qualified attorney or financial professional to ensure compliance with local laws and regulations. Additionally, borrowers should carefully review the terms and conditions of the note, including any provisions related to defaults, prepayment penalties, and the consequences of failing to fulfill the loan obligations.

Dallas Texas Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out Dallas Texas Promissory Note For Commercial Loan Secured By Real Property?

Creating legal forms is a necessity in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Dallas Promissory Note for Commercial Loan Secured by Real Property, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different categories ranging from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching process less overwhelming. You can also find information resources and guides on the website to make any activities associated with document completion straightforward.

Here's how you can find and download Dallas Promissory Note for Commercial Loan Secured by Real Property.

- Go over the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is specific to your state/county/area since state laws can impact the validity of some documents.

- Check the related document templates or start the search over to locate the correct document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment gateway, and purchase Dallas Promissory Note for Commercial Loan Secured by Real Property.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Dallas Promissory Note for Commercial Loan Secured by Real Property, log in to your account, and download it. Of course, our website can’t replace an attorney entirely. If you have to cope with an exceptionally complicated situation, we recommend getting an attorney to check your form before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and get your state-specific paperwork effortlessly!