Queens New York Promissory Note for Commercial Loan Secured by Real Property is a legal document that outlines the terms and conditions of a commercial loan issued by a lender in Queens, New York, and secured by real property. It serves as evidence of the borrower's promise to repay the loan amount, along with any applicable interest and fees, within a specified timeframe. Key elements included in a Queens New York Promissory Note for Commercial Loan Secured by Real Property may include: 1. Loan Details: The document will provide specific information about the loan, such as the loan amount, interest rate, repayment schedule, and any applicable late fees or penalties. 2. Borrower and Lender Information: The names, addresses, and contact details of both the borrower (the party receiving the loan) and the lender (the party providing the loan) will be stated. 3. Collateral Description: This note will highlight the real property that is being pledged as collateral for the loan. It will provide a detailed description of the property being used as security, including its address, legal description, and any necessary supporting documentation. 4. Repayment Terms: The note will clearly outline the repayment terms, including the repayment period, installment amounts, due dates, and any options for prepayment without penalty. 5. Interest Rate and Late Fees: The interest rate charged on the loan will be specified in the promissory note, along with any provisions for changes in interest rates. Additionally, any applicable late fees or penalties for missed or late payments will be included. 6. Default and Remedies: This section will outline the actions that can be taken by the lender in the event of a default by the borrower, such as acceleration of the loan (demanding full repayment), foreclosure on the real property, or suing for damages. Different types of Queens New York Promissory Notes for Commercial Loan Secured by Real Property may include variations based on the specific terms and conditions agreed upon by the parties involved. Some examples could include fixed-rate promissory notes, adjustable-rate promissory notes, or balloon payment promissory notes. Overall, a Queens New York Promissory Note for Commercial Loan Secured by Real Property plays a crucial role in documenting the terms of a commercial loan agreement, providing clarity and legal protection for all parties involved.

Queens New York Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out Queens New York Promissory Note For Commercial Loan Secured By Real Property?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Queens Promissory Note for Commercial Loan Secured by Real Property, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Queens Promissory Note for Commercial Loan Secured by Real Property from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Queens Promissory Note for Commercial Loan Secured by Real Property:

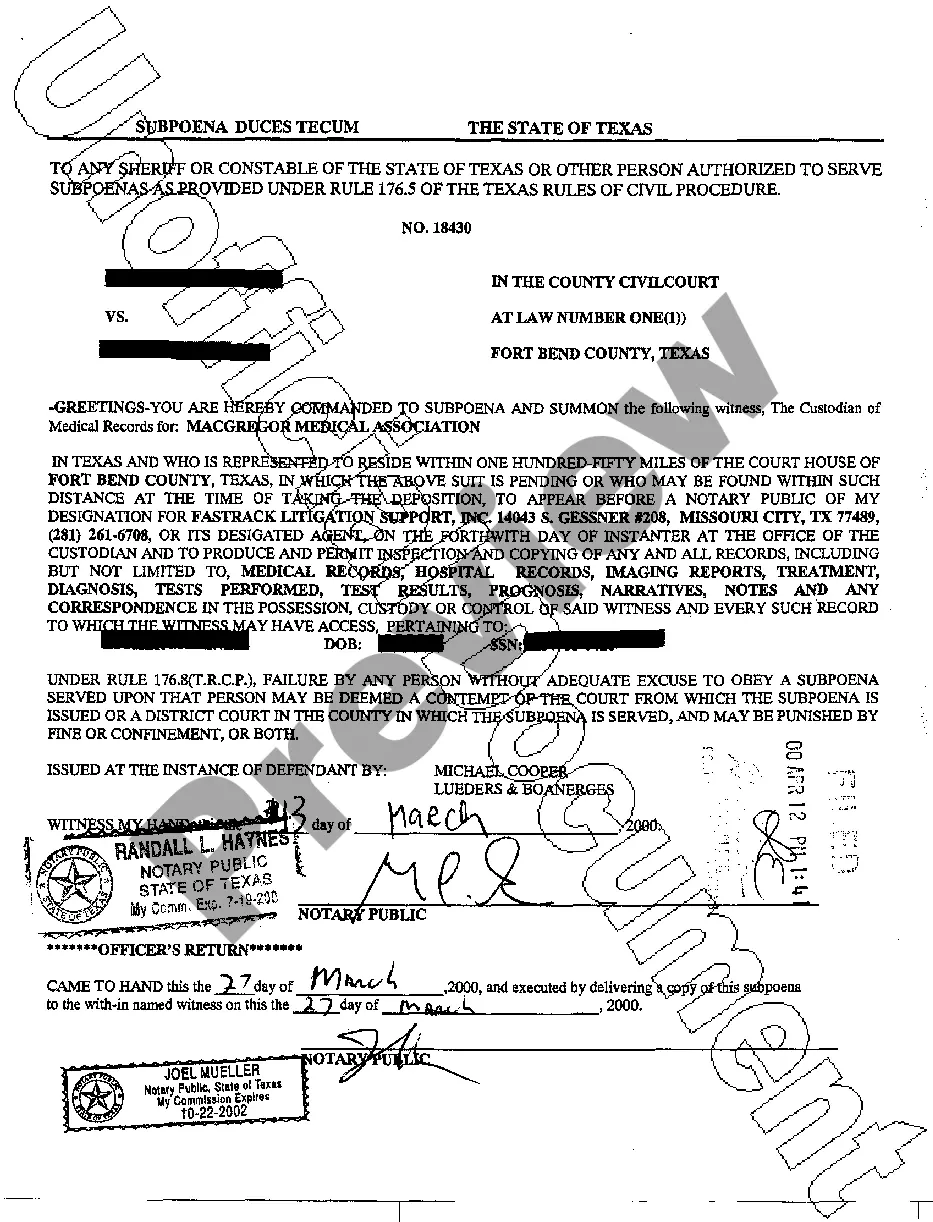

- Analyze the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!