A Harris Texas Security Agreement in Personal Property Fixtures is a legal document that serves as collateral for securing a commercial loan. It outlines the rights and obligations of the lender and the borrower regarding the personal property fixtures involved in the loan transaction. This agreement provides security to the lender in case the borrower defaults on the loan. This type of security agreement is crucial for lenders as it helps protect their investment by establishing a valid claim on the borrower's personal property fixtures. These fixtures typically include any items that are affixed to the property and have become a part of it, such as machinery, equipment, signage, and fixtures within a commercial building. The Harris Texas Security Agreement in Personal Property Fixtures details the specific personal property fixtures being used as collateral, specifying their location, description, and any identifying information. It also outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any additional fees or charges associated with the loan. There can be several types of Harris Texas Security Agreements in Personal Property Fixtures regarding securing a commercial loan. Some common variations include: 1. Fixed Security Agreement: This type of agreement involves personal property fixtures that are permanently attached to the property, such as a built-in ventilation system or a custom-made display case. 2. Floating Security Agreement: This agreement covers personal property fixtures that are not permanently affixed to the property but can be easily moved or transferred, such as office furniture, appliances, or temporary display stands. 3. Purchase Money Security Agreement: In this scenario, the security agreement is used when the loan is specifically taken out to finance the purchase of personal property fixtures. The lender's claim on the property will take priority over other creditors in case of default. 4. Leasehold Security Agreement: This type of agreement applies when the borrower is leasing the property rather than owning it. It allows the lender to claim the personal property fixtures if the borrower defaults on the loan, even though the fixtures are attached to the leased property. By carefully drafting and executing a Harris Texas Security Agreement in Personal Property Fixtures, both the lender and the borrower can have a clear understanding of their rights and responsibilities within the commercial loan transaction. Lenders benefit from having additional security for their investment, while borrowers can secure the necessary financing they need for their business operations.

Harris Texas Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan

Description

How to fill out Harris Texas Security Agreement In Personal Property Fixtures Regarding Securing A Commercial Loan?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Harris Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you purchase a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Harris Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Harris Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan:

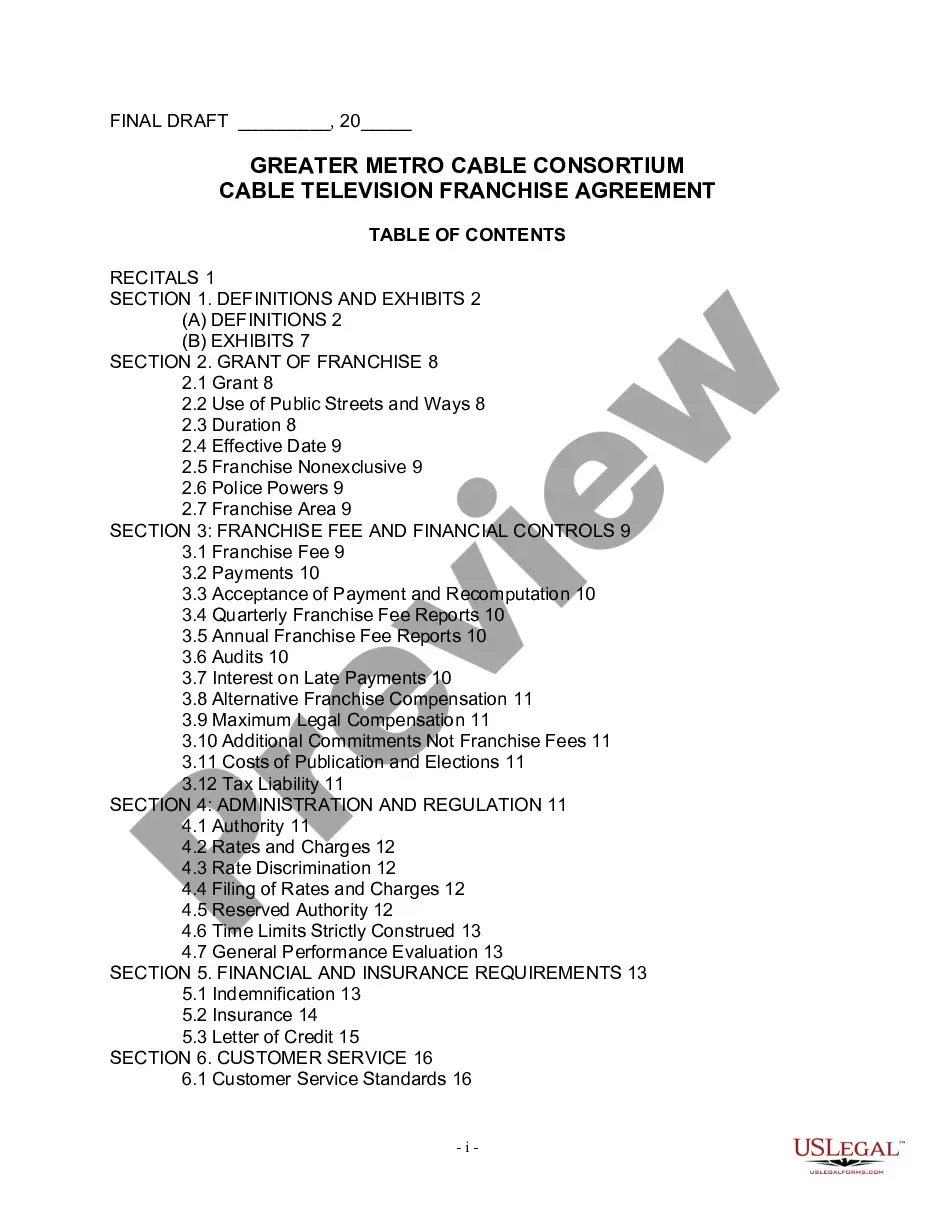

- Analyze the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document once you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!