The Hillsborough Florida Security Agreement in Personal Property Fixtures is a legal contract that serves as a means to secure a commercial loan in Hillsborough County, Florida. This agreement aims to protect the lender's interests by establishing a claim on certain personal property fixtures collateralized against the loan. Personal property fixtures, in this context, refer to movable assets that have become affixed or attached to the real property, such as machinery, equipment, furniture, or fixtures present on the premises of a business. This security agreement is crucial for lenders as it ensures that they have a priority claim or lien on the specified collateral in the event of default by the borrower. By entering into this agreement, the borrower acknowledges that they are granting the lender a security interest in their personal property fixtures, essentially using these assets as collateral for the loan. The Hillsborough Florida Security Agreement in Personal Property Fixtures includes various essential components to protect the lender's interests. These may include details about the borrower, lender, and the loan itself, as well as a comprehensive description of the personal property fixtures being utilized as collateral. These details will typically include in-depth information about the fixtures, such as make, model, serial numbers, location, and any relevant identifying characteristics. Different types or variations of the Hillsborough Florida Security Agreement in Personal Property Fixtures may arise based on individual circumstances, agreements, or preferences. For example, there may be specific security agreements tailored for different industries, such as manufacturing, retail, or healthcare. Each contract may have its unique terms, conditions, and specifications customized to meet the needs of both the borrower and the lender. In conclusion, the Hillsborough Florida Security Agreement in Personal Property Fixtures is an essential legal document designed to secure a commercial loan. It provides protection to lenders by establishing a claim on specific personal property fixtures that serve as collateral for the loan. Customized variations of this security agreement may exist depending on the industry or specific terms negotiated between the borrower and the lender. It is crucial for both parties to thoroughly review and understand the terms outlined in the agreement to ensure a secure and fair financial transaction.

Hillsborough Florida Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan

Description

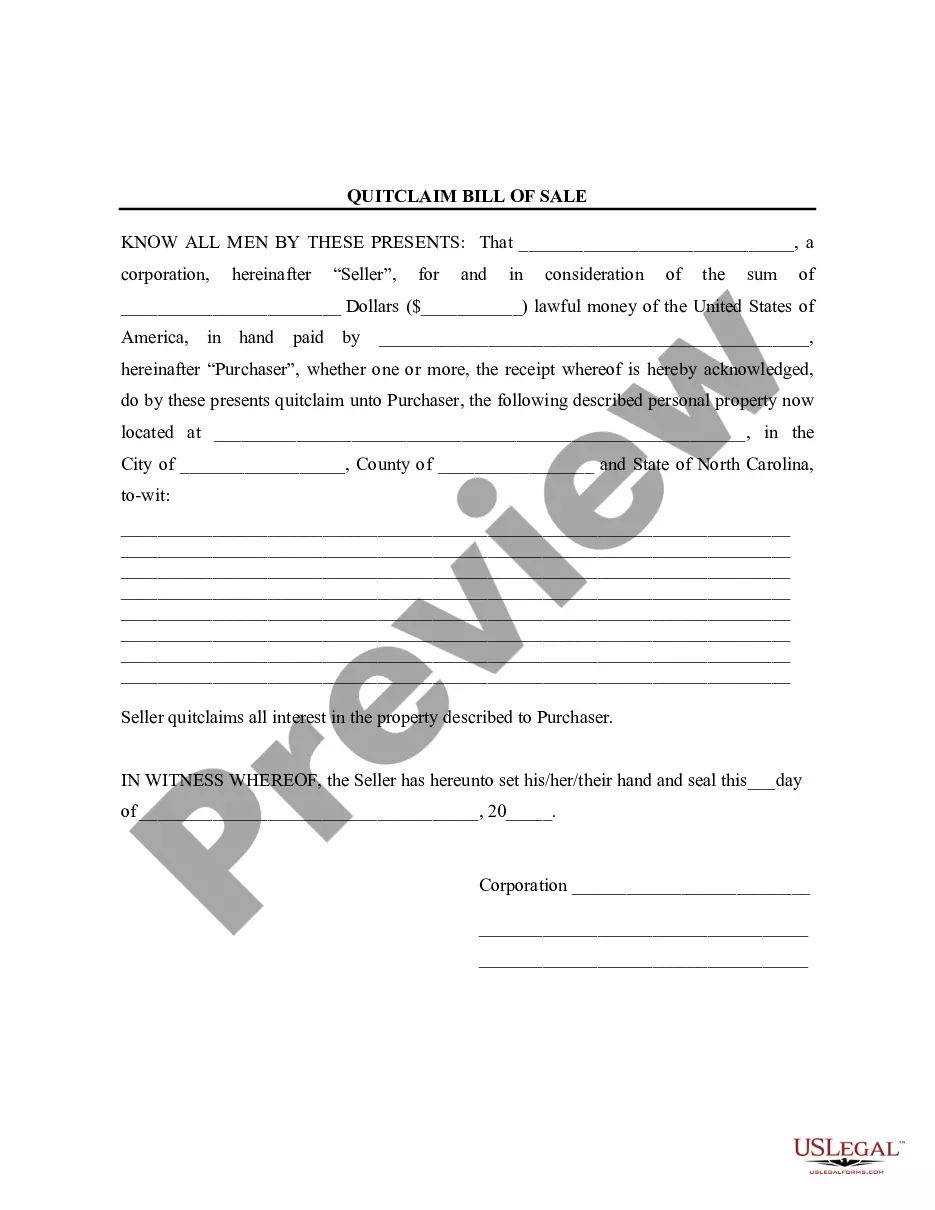

How to fill out Hillsborough Florida Security Agreement In Personal Property Fixtures Regarding Securing A Commercial Loan?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Hillsborough Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Hillsborough Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Hillsborough Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan:

- Take a look at the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Loan against Property (LAP) is a secured form of loan borrowed from a loan provider. As the name itself reveals, it is a loan given against property, which should be physical and immovable (residential/ commercial). A loan provider or lender can be a bank, NBFC or HFC (Housing Finance Company).

Mortgage. A security agreement provides a legal title transfer from the borrower to the lender in while leaving equitable rights of the property with the debtor. The lender then provides the loan.

Protection; assurance; indemnification.

What Is Collateral? The term collateral refers to an asset that a lender accepts as security for a loan. Collateral may take the form of real estate or other kinds of assets, depending on the purpose of the loan. The collateral acts as a form of protection for the lender.

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

Collateral is any asset or personal property that you pledge to a lender for a secured loan. As mentioned above, homes, vehicles, stocks, bonds, jewelry, future paychecks, fine art, life insurance policies, and cash in a savings account can be offered as collateral.

Types of Collateral You Can Use Cash in a savings account. Cash in a certificate of deposit (CD) account. Car. Boat. Home. Stocks. Bonds. Insurance policy.

Security agreements and financing statements are often confused with one another. The primary difference is that the financing statement largely serves as notice that a creditor possesses security interest in the debtor's assets or property. The financing statement is not a contract.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

As a noun, collateral means something provided to a lender as a guarantee of repayment. So if you take out a loan or mortgage to buy a car or house, the loan agreement usually states that the car or house is collateral that goes to the lender if the sum isn't paid.