Maricopa Arizona Security Agreement in Personal Property Fixtures: A Comprehensive Overview In the process of securing a commercial loan in Maricopa, Arizona, one crucial aspect that borrowers must consider is the Maricopa Arizona Security Agreement in Personal Property Fixtures. This agreement plays a pivotal role in providing security to lenders by offering a legal framework for collateralizing personal property fixtures owned by the borrower. By understanding the various types of security agreements in personal property fixtures, borrowers can ensure compliance with local regulations and protect their interests. A security agreement is a legally binding contract between the borrower (debtor) and the lender (secured party) that outlines the terms and conditions regarding the collateral pledged to secure the loan amount. In the context of commercial loans, personal property fixtures refer to tangible assets that are attached or affixed to the property being financed, such as machinery, equipment, furniture, and other fixtures. Maricopa Arizona Security Agreement in Personal Property Fixtures encompasses different types, including: 1. Specific Collateral Security Agreement: This type of agreement specifies particular personal property fixtures as collateral for the loan. It provides detailed descriptions of the assets, their location, and any relevant distinguishing factors. 2. General Collateral Security Agreement: In contrast to the specific collateral security agreement, a general collateral security agreement covers a broader range of personal property fixtures. Instead of individually listing each item, it creates a blanket lien on all present and future personal property fixtures owned by the borrower within a specified scope. 3. Purchase Money Security Agreement (PSA): Under a PSA, the lender provides financing specifically for the acquisition of personal property fixtures. This type of security agreement gives the lender priority rights in case of default, ensuring repayment for the funded purchase. 4. Fixture Filing: A fixture filing is a crucial addition to the security agreement that allows lenders to perfect their interest in personal property fixtures affixed to the real property. It involves recording the financing statement with the Maricopa County Recorder's Office to provide public notice of the lender's claim to the fixtures. To ensure the effectiveness of the Maricopa Arizona Security Agreement in Personal Property Fixtures, borrowers must perform due diligence by conducting searches on existing liens or encumbrances on the assets. This step helps lenders assess the priority of their security interest and minimizes the risk associated with potential competing claims. In conclusion, the Maricopa Arizona Security Agreement in Personal Property Fixtures serves as a critical component in securing a commercial loan. By utilizing specific, general, or purchase money security agreements, borrowers can provide collateral while protecting their interests. Moreover, the inclusion of a fixture filing ensures the lender's claim is publicly known. Understanding these agreement types and complying with local regulations are paramount for borrowers seeking commercial loans in Maricopa, Arizona.

Maricopa Arizona Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan

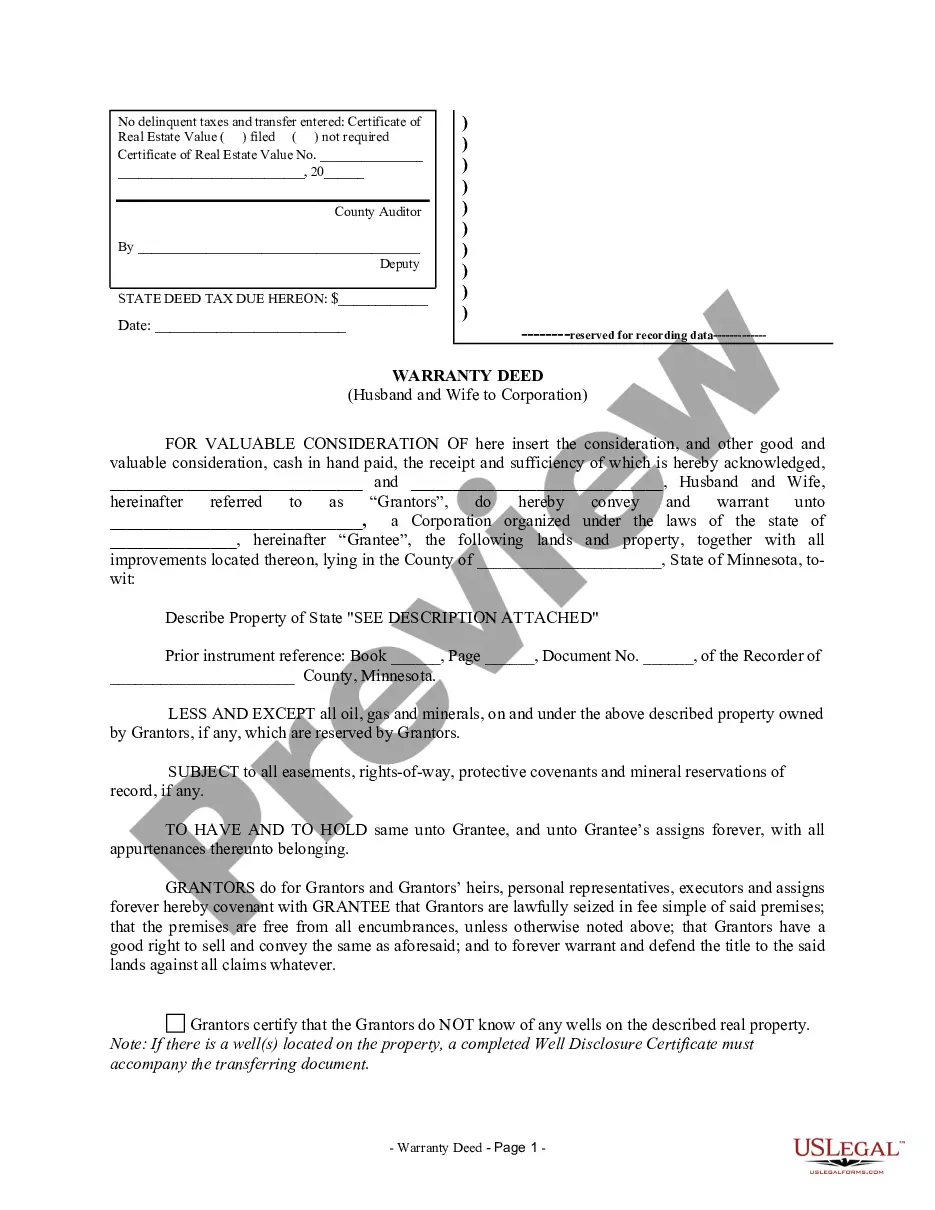

Description

How to fill out Maricopa Arizona Security Agreement In Personal Property Fixtures Regarding Securing A Commercial Loan?

Whether you plan to start your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business case. All files are grouped by state and area of use, so picking a copy like Maricopa Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Maricopa Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan. Follow the instructions below:

- Make certain the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!