The Suffolk New York Security Agreement in Personal Property Fixtures plays a crucial role in securing a commercial loan. It is a legal document that establishes a security interest in certain personal property fixtures owned by a borrower, which will serve as collateral for the loan. This agreement allows the lender to have a priority claim on the specified assets in case of default or non-payment. These fixtures typically include equipment, machinery, furnishings, and other items attached to the commercial property. By executing this security agreement, the borrower grants the lender a security interest in these fixtures, ensuring that the lender can claim ownership or sell them to recover the outstanding loan amount if the borrower fails to meet the loan obligations. The Suffolk New York Security Agreement in Personal Property Fixtures includes several key provisions to protect both parties involved. These provisions may include detailed descriptions of the fixtures being used as collateral, provisions for default and remedies, priority rights and lien provisions, and requirements related to insurance and maintenance of the fixtures. There are different types or variations of the Suffolk New York Security Agreement in Personal Property Fixtures that lenders may use. Some common types include: 1. Specific Equipment Security Agreement: This type focuses on specific equipment or machinery being used as collateral. 2. General Personal Property Security Agreement: This agreement covers a broader range of personal property fixtures, including equipment, inventory, and other assets necessary for the operation of the commercial enterprise. 3. Floating Lien Agreement: This agreement allows the borrower to use personal property fixtures acquired after the execution of the security agreement as collateral, providing flexibility for the borrower and increased security for the lender. When obtaining a commercial loan in Suffolk New York, it is crucial for both borrowers and lenders to carefully review and negotiate the terms outlined in the Security Agreement in Personal Property Fixtures. It ensures that the lender's interests are protected and provides a clear understanding of what assets are being used as collateral and how they will be treated in case of default.

Suffolk New York Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan

Description

How to fill out Suffolk New York Security Agreement In Personal Property Fixtures Regarding Securing A Commercial Loan?

Preparing paperwork for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Suffolk Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan without expert assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Suffolk Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Suffolk Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan:

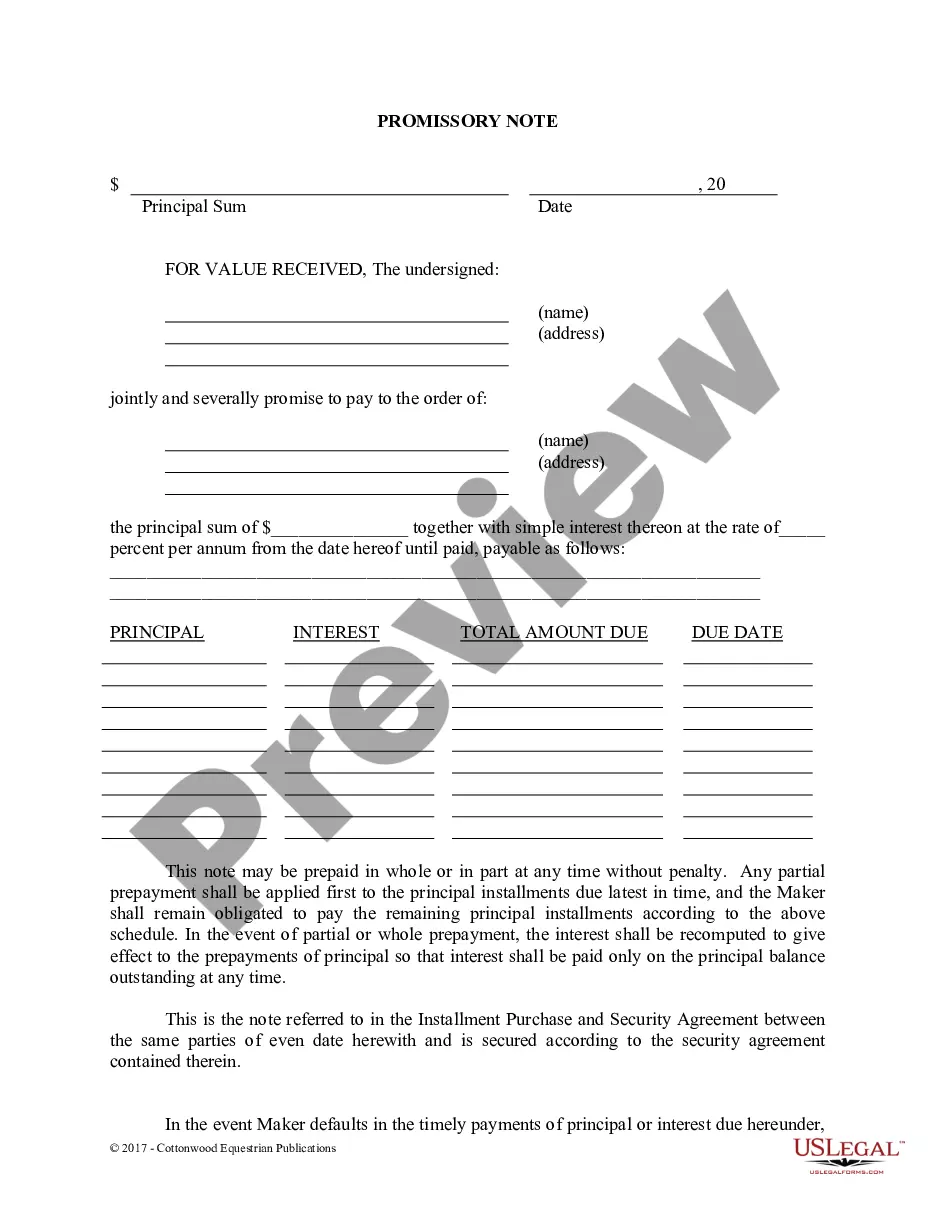

- Look through the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that suits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any use case with just a few clicks!