Wayne Michigan Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan is an important legal document that outlines the terms and conditions of securing a commercial loan with the collateral of personal property fixtures in Wayne, Michigan. This agreement ensures that the lender has a legal claim over the fixtures in case of default by the borrower. In Wayne, Michigan, there are two main types of Security Agreements relating to personal property fixtures when securing a commercial loan: 1. General Security Agreement: A general security agreement is a comprehensive document that covers all the personal property fixtures owned by the borrower. It provides the lender with a broad and all-encompassing security interest on all current and future personal property fixtures that belong to the borrower. This type of agreement offers maximum protection to the lender as it covers a wide range of assets. 2. Specific Security Agreement: A specific security agreement is a more targeted document where the lender and borrower identify and describe specific personal property fixtures that will serve as collateral for the commercial loan. This agreement is used when the borrower has specific assets that they want to pledge as security. It delineates particular fixtures, such as machinery, equipment, or inventory, providing a more narrow focus while still offering legal protection to the lender. The Wayne Michigan Security Agreement in Personal Property Fixtures outlines various essential components. These components include the identification of the borrower and lender, a detailed description of the collateral, the loan amount, the interest rate, maturity date, repayment terms, and default provisions. It also often includes provisions for the lender's right to inspect the fixtures, insurance requirements, and the borrower's obligation to maintain and preserve the fixtures. This agreement functions as a legal contract that safeguards the lender's interests in the event of loan default or bankruptcy by the borrower. By securing personal property fixtures in Wayne, Michigan, the lender ensures their ability to recover the loan through the sale or disposition of the collateral. The agreement is enforceable under the laws of Wayne, Michigan, providing a legal framework for both parties involved. In conclusion, the Wayne Michigan Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan serves as a crucial document that protects the interests of lenders and the borrower. By defining the terms and conditions of securing a loan with personal property fixtures, this agreement helps create a fair and transparent lending process, ensuring the stability of commercial transactions in Wayne, Michigan.

Wayne Michigan Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan

Description

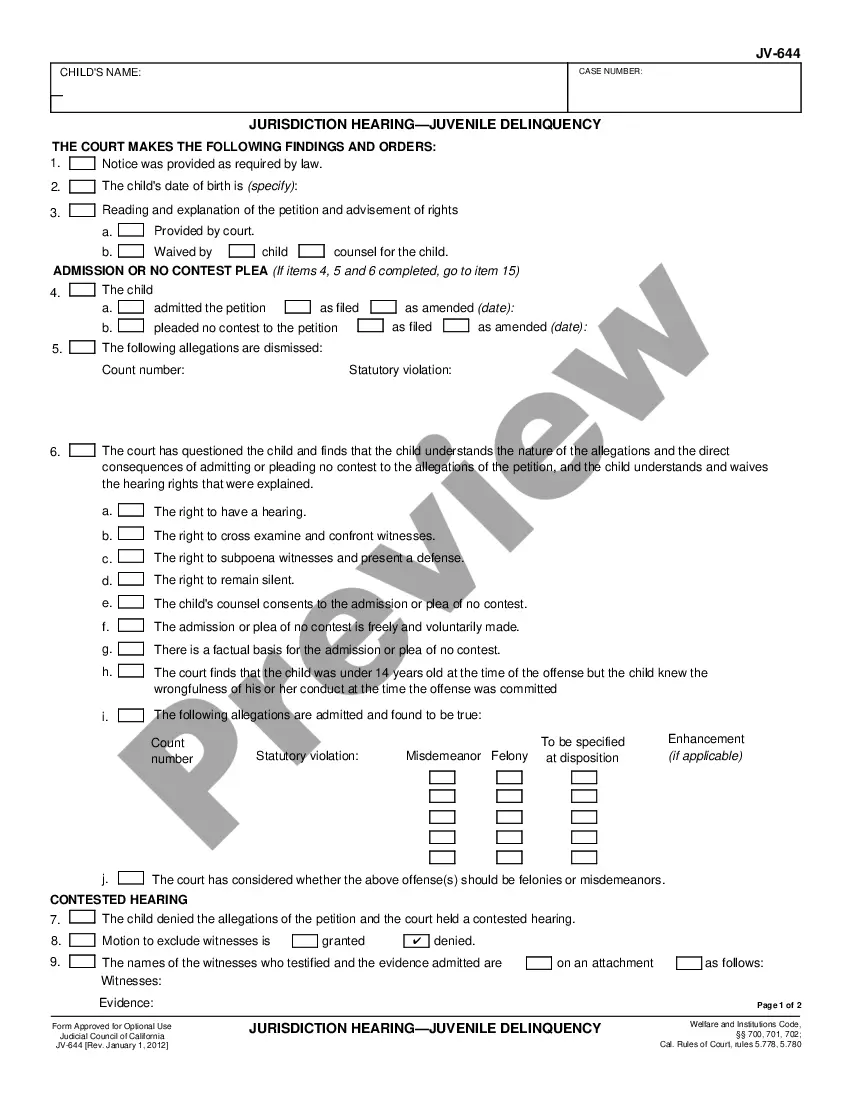

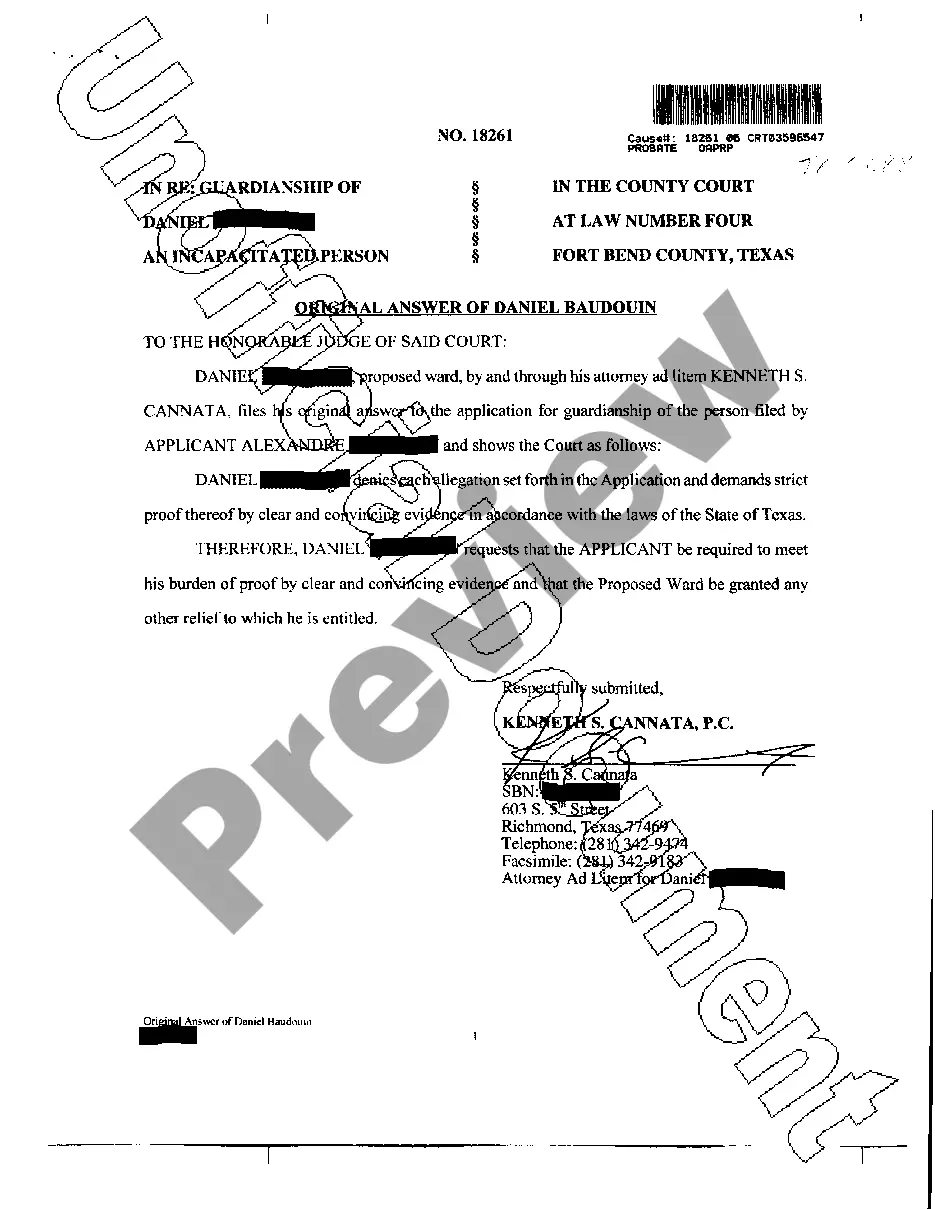

How to fill out Wayne Michigan Security Agreement In Personal Property Fixtures Regarding Securing A Commercial Loan?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare official documentation that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business objective utilized in your county, including the Wayne Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Wayne Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to obtain the Wayne Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan:

- Make sure you have opened the correct page with your regional form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Wayne Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

At a minimum, a valid security agreement consists of a description of the collateral, a statement of the intention of providing security interest, and signatures from all parties involved.

However, generally speaking, the primary ways for a secured party to perfect a security interest are: by filing a financing statement with the appropriate public office. by possessing the collateral. by "controlling" the collateral; or. it's done automatically upon attachment of the security interest.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

A security agreement, in the law of the United States, is a contract that governs the relationship between the parties to a kind of financial transaction known as a secured transaction.

Mortgage. A security agreement provides a legal title transfer from the borrower to the lender in while leaving equitable rights of the property with the debtor. The lender then provides the loan.

Key Takeaways. A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

The law of secured transactions in the United States covers the creation and enforcement of a security interest. Usually, a secured transaction happens when a person or business borrows money for the purpose of acquiring property, including real estate, vehicles or business equipment.

A general security agreement creates a security interest in all present and future assets of the borrower. This means the lender would have access to all assets your business owns now and any future assets your business purchases as collateral for the loan issued.

Certain specific requirements are required for the security agreement to form the foundation for a valid security interest, namely 1) it must be signed, 2) it must clearly state that a security interest is intended, and 3) it must contain a sufficient description of the collateral subject to the security interest.